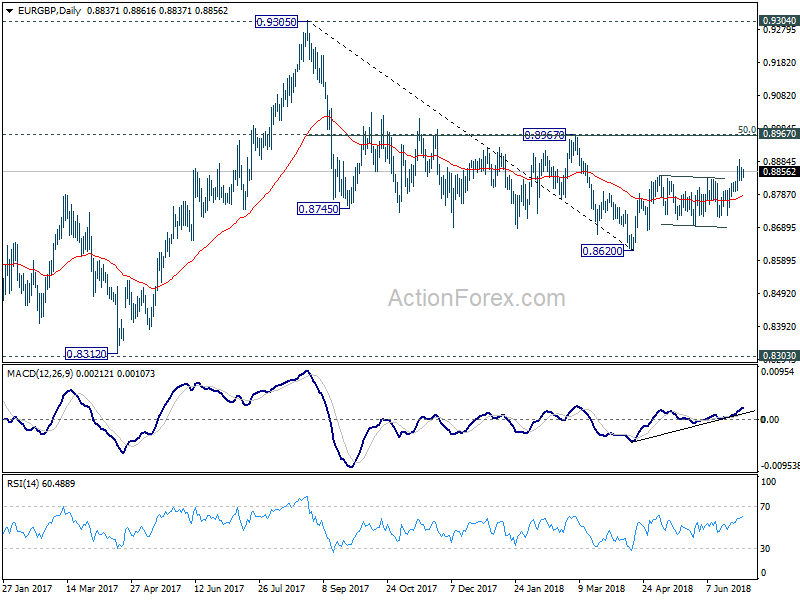

EUR/GBP Daily Outlook

Daily Pivots: (S1) 0.8833; (P) 0.8852; (R1) 0.8876;

EUR/GBP is staying in consolidation below 0.8890 temporary top and intraday bias remains neutral. In case of deeper retreat, downside should by contained by 0.8796 minor support to bring rally resumption. On the upside break of 0.8890 will resume the rebound from 0.8620 and target 0.8967 cluster resistance (50% retracement of 0.9305 to 0.8620 at 0.8963).

In the bigger picture, EUR/GBP is staying in long term consolidation pattern from 0.9304 (2016 high). Such consolidation pattern could extend further. Hence, in case of strong rally, we’d be cautious on strong resistance by 0.9304/5 to limit upside. Meanwhile, in another decline attempt, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside.

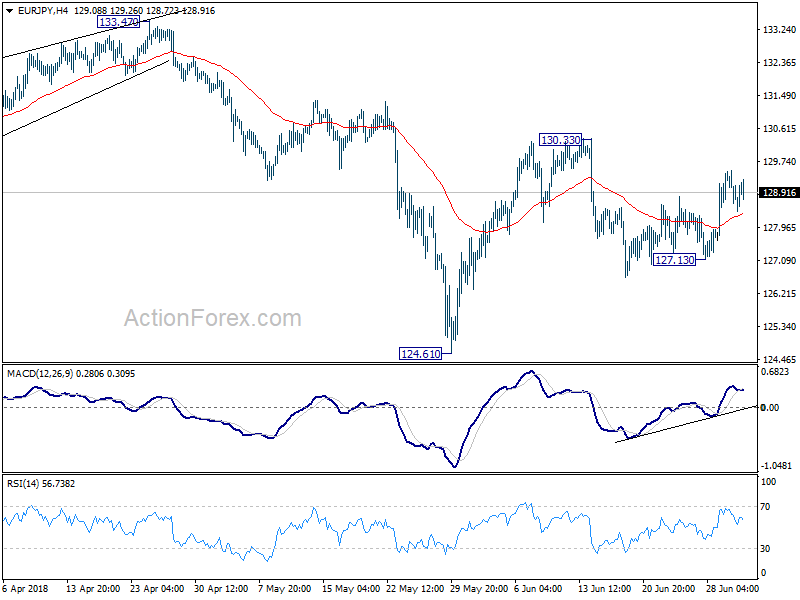

EUR/JPY Daily Outlook

Daily Pivots: (S1) 128.47; (P) 128.99; (R1) 129.57;

Intraday bias in EUR/JPY stays neutral at this point. On the upside, break of 130.33 will resume the rebound from 124.61. And by then, EUR/JPY should have also taken out near term falling channel decisively. That would be a strong sign of trend reversal. In that case, further rise should be seen to 133.47 resistance for confirmation. On the downside, break of 127.13 will bring retest of 124.61 low instead.

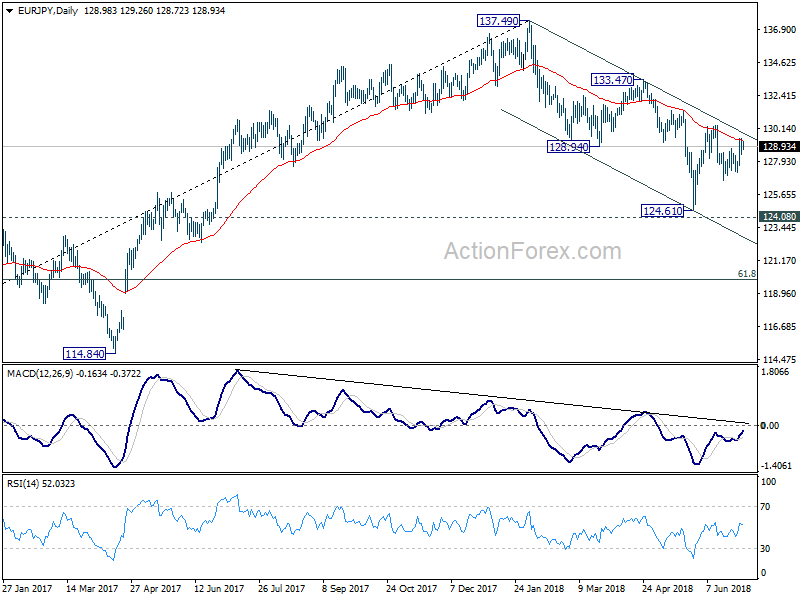

In the bigger picture, for now, EUR/JPY is holding above 124.08 key resistance turned support. Fall from 137.49 could be proven to be a correction. Decisive break of 133.47 resistance will confirm its completion and should extend the rise from 109.03 (2016 low) through 137.49 high. However, firm break of 124.08 will confirm trend reversal. That is, whole rise from 109.03 (2016 low) has completed at 137.49 already. In that case, deeper fall should be seen back to 61.8% retracement of 109.03 to 137.49 at 119.90 and below.