Crude oil ended at its highest level of the year on the NYMEX on Wednesday, with fears of tighter global oil supply and slowing US inflation outweighing a slight swelling of crude inventories in the United States.

Today, let’s analyse the various price drivers!

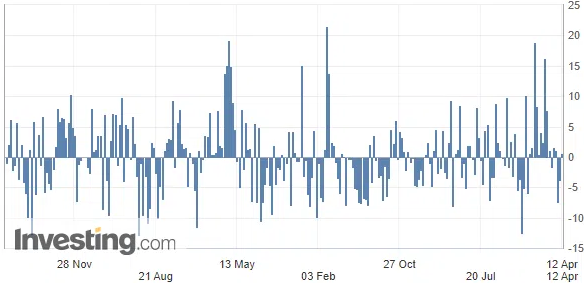

United States Crude Oil Inventories

The market seems to have ignored the weekly U.S. Crude Oil Inventories report as it was mixed.

Admittedly, it showed a small, unexpected increase in crude oil stocks (over half a million barrels) in the country due to a drop in exports, a slight increase in production, a small decline in refinery activity and the sale of 1.6 million barrels of strategic petroleum reserves (SPR).

SPRs are currently at their lowest level since the early 1980s.

However, the report also highlighted a decline in oil demand.

Market players are instead focusing on global crude supply, in particular continuing to digest the announcement by the Organization of the Petroleum Exporting Countries and their allies (OPEC+) of further cuts in their oil production.

At the same time, various sources show that Russian exports have fallen significantly while exports from northern Iraq to Turkey remain stuck in a legal battle.

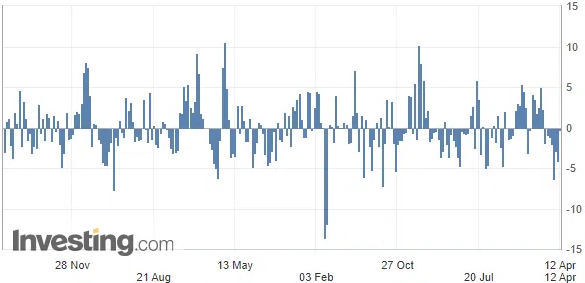

United States Gasoline Inventories

U.S. gasoline inventories were following the same trend as crude oil stocks:

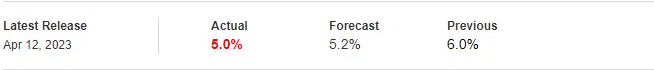

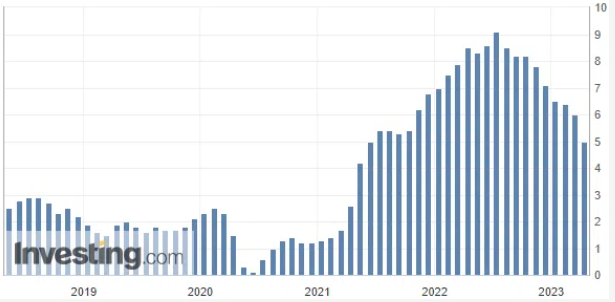

In addition, U.S. inflation (CPI) figures – which indeed slowed to 5% year on year in March, thus settling at their lowest level in almost two years – also play a role.

United States Consumer Price Index (CPI) Year-on-Year (YoY)

This announcement on Wednesday could therefore lead some investors to believe that the US central bank is at the end of its rate hike cycle.

Thus, lower interest rate expectations – reducing fears of recession and at the same time helping to support the prices of dollar-denominated assets, such as crude oil – also ward off fears of a recession, which could weigh on energy demand.

In conclusion, this outlook supports crude oil prices, which benefit from a weaker dollar. The depreciation of the greenback indeed encourages purchases of oil, denominated in USD, making them more attractive for investors using other currencies.

However, the possibility of a recession in the United States later this year has not yet been ruled out. What do you think about this? Do you believe that if signs of slowing growth appear, oil prices are likely to suffer?

Technical Charts

U.S. Dollar Currency Index (DXY/USDX) CFD (daily chart w/ linear regression channel)

WTI Crude Oil (Continuous) Futures (weekly bar chart)

WTI Crude Oil (CLM2023) Futures (June contract, daily chart)

WTI Crude Oil (CLM2023) Futures (June contract, 4H chart)