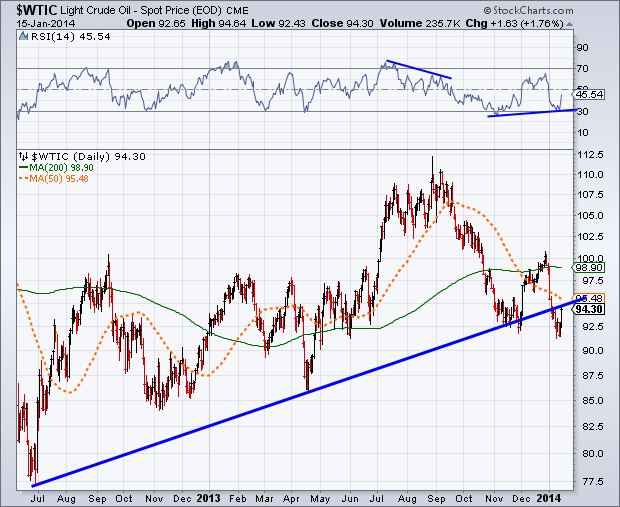

Last Friday I posted on StockTwits a chart of a potential false break in crude oil (CL) and that it might be hinting at higher oil prices. We then saw price begin to consolidate for a few days before pushing higher by nearly 2% yesterday. This bullish move on Wednesday has sent oil to test previous support which has now become resistance.

I last mentioned this level back in December when we were seeing a small positive divergence in momentum which ultimately propelled CL to test $100/barrel. However, crude was unable to maintain its strength and quickly fell back down to the low $90′s. Once again there is a slight positive divergence taking place in the Relative Strength Index (top panel of the chart) as it makes a higher low off an ‘oversold’ level while price tested the November low. At the time of this writing, crude prices are in the red for today and may take time to work through the supply brought about from this multi-year trend line.

I’ll be watching to see if price once again drops back to the January low or if the commodity can break the trend line as well as the 50-day moving average and fight its way back to $100. We’ll see what happens.

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in the blog. Please see my Disclosure page for full disclaimer. Connect with Andrew on Google+, Twitter, and StockTwits.