On Monday 28 March, Brent is trading downwards, near $116.25. However, even considering the current correction, the instrument looks too expensive. Today’s decline is the result of investors’ response to the Chinese lockdown.

It became known that local authorities re-introduced a distant work mode for many companies and their employees in Shanghai, there is strict quarantine in some areas. The reason is pretty straightforward – a new coronavirus outbreak.

One may assume that the oil price decline in response to this news might be temporary because China usually quickly reacts to such things. In addition to that, the global energy supply shortage is a substantial factor in favour of bulls.

The Baker Hughes report showed that the Oil Rig Count in the US added 7 units last week, up to 531. This week, there will be another OPEC+ meeting. The agenda is focused on the cartel’s policy for the next month. The daily output is expected to remain unchanged, +400K barrels per day. At the same time, the actual production might be a bit behind the schedule.

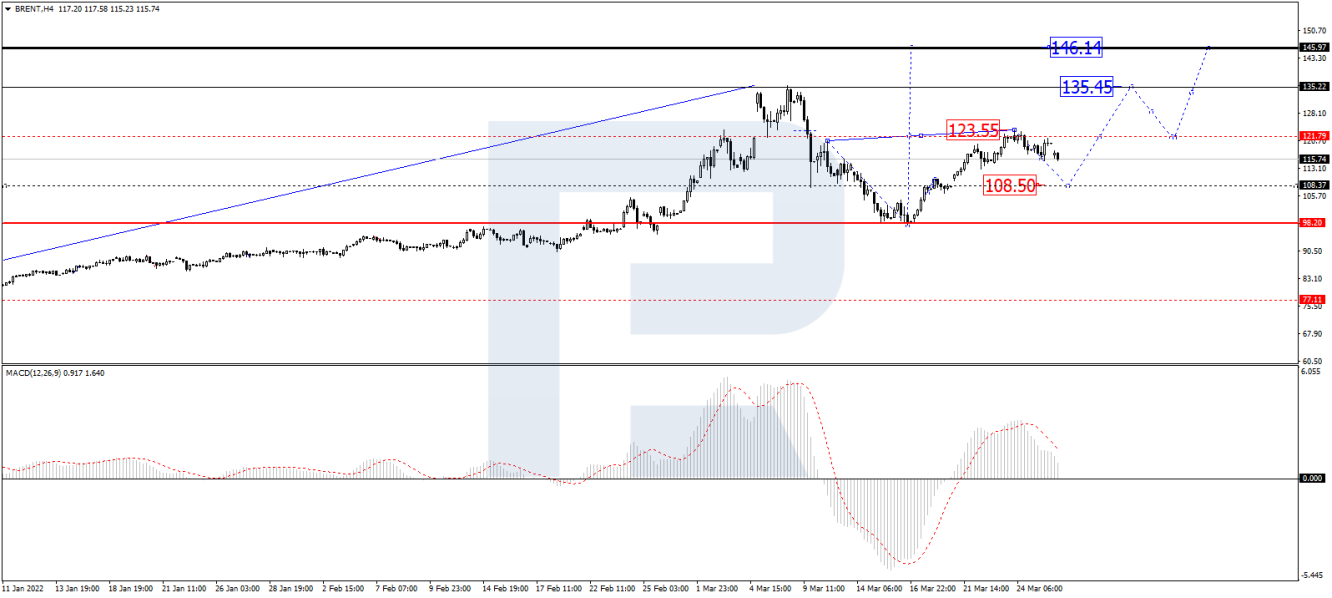

In the H4 chart, having completed the correctional structure at $115.50, Brent is consolidating above this level. If the asset breaks this range to the downside later, the market may continue the correction down to $108.50.

After that, the instrument may resume trading upwards to break $123.60 and then continue growing with the short-term target at $135.45. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is falling towards 0 and may rebound from it soon. If it happens, the line may continue growing towards new highs.

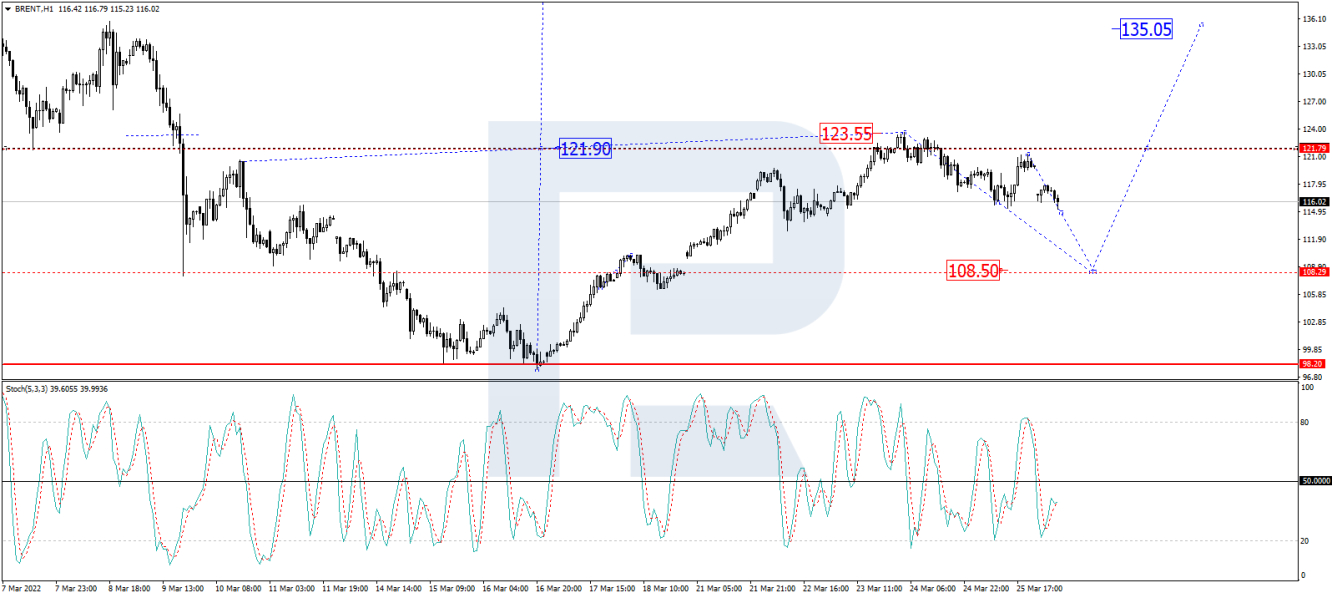

As we can see in the H1 chart, after finishing another descending impulse at $115.50 and forming a new consolidation range above this level, Brent is expected to break it to the downside and continue the correction to #110.60.

Later, the market may start another growth to reach 116.00 and then complete the correction at 108.50. After that, the instrument may resume trading within the uptrend with the target at 123.50.

From the technical point of view, this idea is confirmed by the Stochastic Oscillator: after returning to 50, its signal line is expected to continue falling towards 20 and then grow to return to 80.

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.