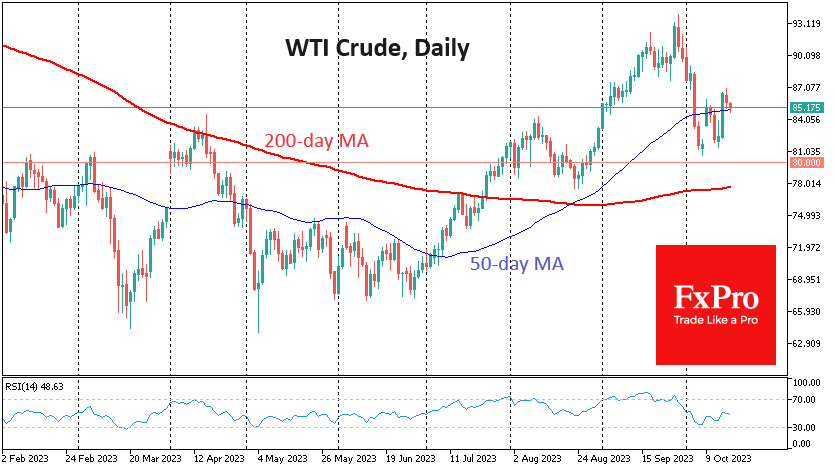

Oil made curious movements last week. After opening last week with a gap of 2.3% and quickly rising to 5.2%, the price stabilized and turned downwards. On Thursday, the gap at the week's opening was closed entirely. Given the current geopolitics, it is unlikely that many people at the beginning of the week could have expected such a quick closing of the gap.

Anyway, the closing of the gestalt technically cleared the space for oil to rise. Fundamentally, oil was actively bought on fears that other Islamic countries would get involved in the conflict. The markets are paying the most attention to statements regarding Iran, which produces over 3.1M BPD. Since the end of last week, Iran has been toughening its rhetoric, which was played back by the markets on Friday in the form of a 5% rise in quotations and a rise in price at the start of the new week.

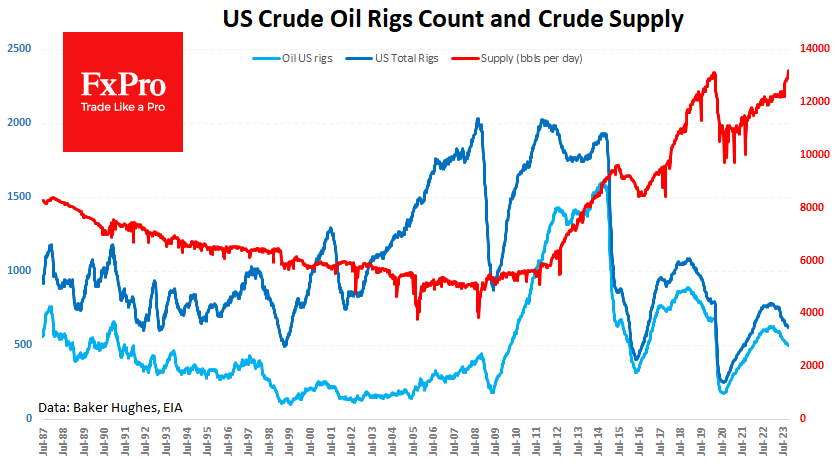

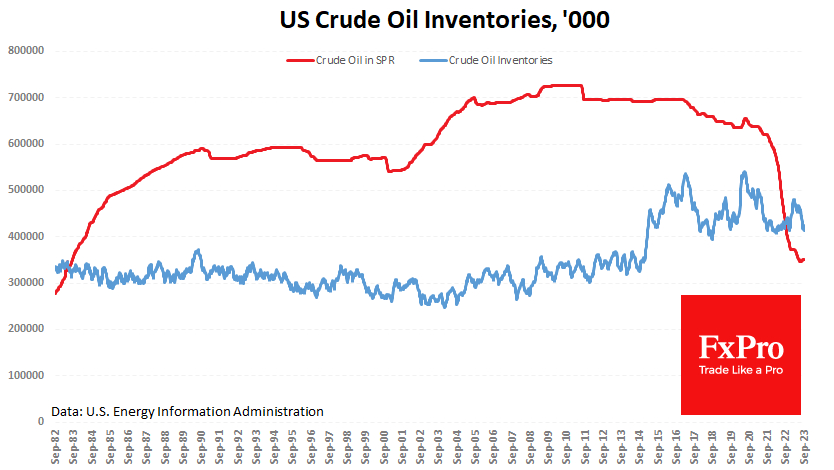

However, geopolitics is not the only fundamental driver of oil prices. Last week, the US ramped production to a record 13.2 million barrels. These reports, as well as a 10.2-million-barrel jump in commercial inventories, pressured quotes midweek.

Towards the end of the week, the Middle East again drew attention to the risks of geographic expansion of the conflict, which increased the risks of a decline in supplies.

However, one should not underestimate the factor of production growth in the US. Producers there have increased average daily production by 1 million barrels since August.

It seems that US oil producers, after the August OPEC+ assurances, have finally joined the fight for a share of global oil supplies. This comes after another round of assurances from Russia and Saudi Arabia that quotas and voluntary cuts on top of those quotas will remain in place for the foreseeable future.

It is also possible that the trigger was the price, which exceeded $80 per barrel of WTI in August and has been trading above $90 since the second half of September.

That said, oil prices may already be too high for consumers, and we may see a reduction in supply. In addition, the risks of supply cuts from Iran and other Middle Eastern countries are real but still risks. But at the same time, supply from the US is increasing while demand is giving up.

All this is a good enough reason to test the support at $80 per barrel WTI once again.

The FxPro Analyst Team