Gold made a low for the day exactly at the only support for this week at 1830/25 - another great call in Gold! Longs worked perfectly on the bounce to minor resistance at 1838/42, reversing from 1845.

Silver made a high for the day at resistance at 2180/85, with shorts offering 45 easy points profit.

Perfect again as silver hits my target for our shorts at 2135/30, with a low for the day exactly here.

Crude Oil WTI Futures MAY hold a range from 7300/7270 up to 8320/50.

Today's Analysis

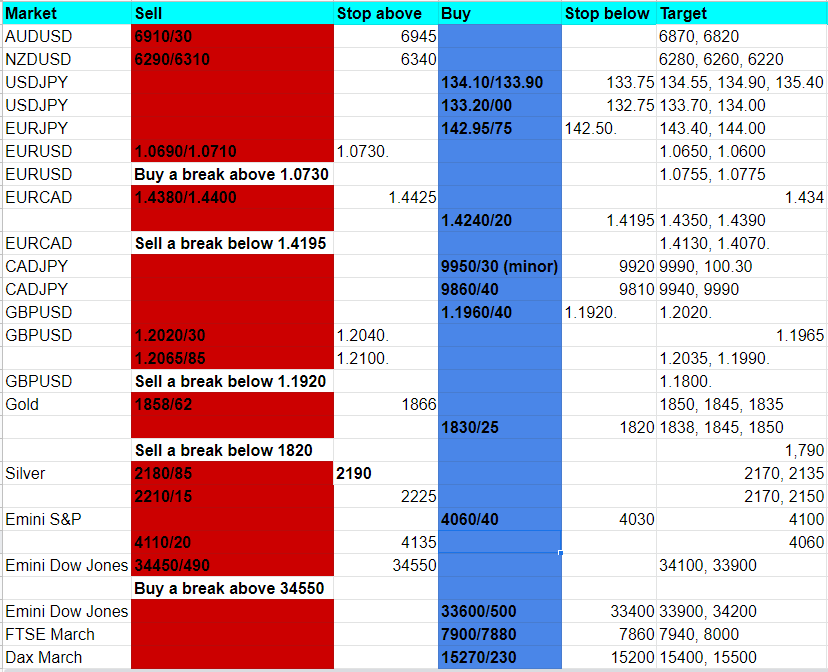

Gold made low for the day exactly at the only support for this week at 1830/25 as predicted! We are retesting this level as I write overnight to try a long again at 1830/25 with a stop below 1820. Just be aware that a weekly close below 1825 means we could fall as far as 1790/80 early next week (or today!).

Longs at 1830/25 can re-target minor resistance at 1838/42. Too risky to try shorts here I think (although it would have worked yesterday in fact) as we would have a double-bottom buy signal if we hold the support at 1830/25 today. A break above 1842 can target 1850, perhaps as far as a selling opportunity at 1858/62. Shorts need stops above 1866.

Silver shorts at resistance at 2180/85 worked perfectly with a high for the day exactly here before a retest of my target of 2135/30 for a 45-tick profit. The same levels apply today. A break below 2125 today can target the 200-day moving average at 2100/2095.

Gains are likely to be limited in the bear trend with minor resistance at 2180/85. Above 2190 however, can target strong resistance at 2210/15. Shorts need stops above 2225.

WTI Crude May - first resistance at 7900/7950. Shorts need stops above 8000. A break higher can target the February high at 8060/90. Above 8100 looks for 8250/8290.

Shorts at 7900/7950 can target 7800/7750. If we continue lower look for 7600/7550.