Watching the trends in S&P 500 EPS and revenue growth for the 2nd and 3rd quarters of 2021 will be key as we roll into the new year (which is just 6 weeks away). In simple terms, it will be the “work-from-home” trade that was mega-cap Tech for most of the year, versus the cyclical sectors that were crushed from March through the present that includes Financials, Energy, Casinos, and the Travel trade.

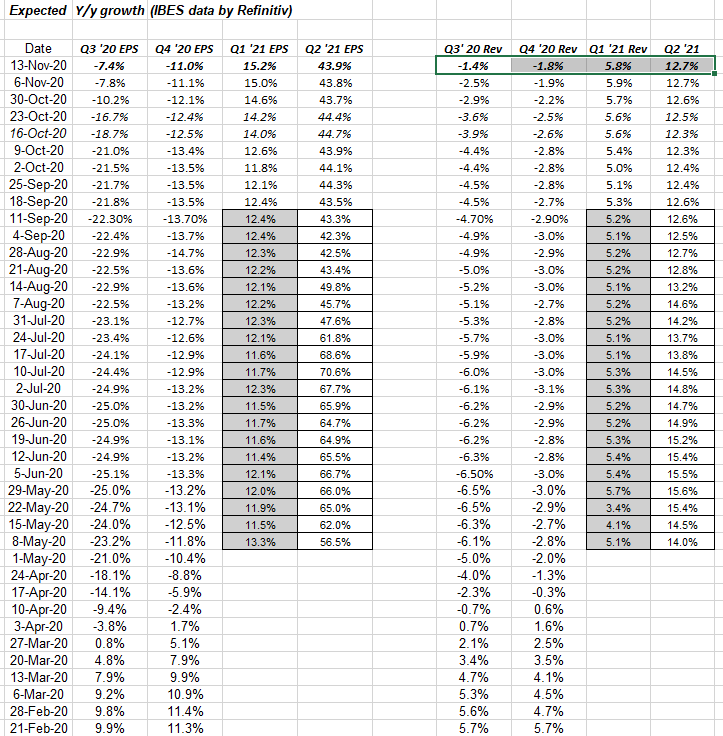

The S&P 500 earnings data as of Friday, 11/13/20:

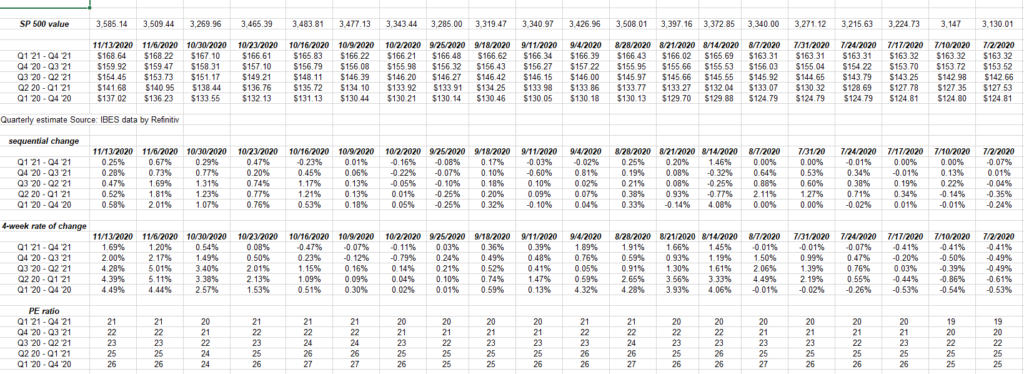

- The “forward 4-qtr estimate” rose to $159.92 this week, from last week’s $159.47. In what is a most unusual pattern, the forward estimate has only declined once sequentially – in the middle of August – in the last 21 weeks or since the end of the June 30 ’20 quarter.

- The forward PE is 22.4 vs last week’s 22x

- The S&P 500 earnings yield is 4.46% and has declined for the last two weeks, probably because the S&P 500 was up 7% last week and another 2% this week.

- The “average” expected S&P 500 EPS growth rate for 2020 and 2021 is still 4%. That has been remarkably consistent since late April ’20.

- The forward 4-quarter period covers Q4 ’20 through Q3 ’21 so investors are getting a good read into late 2021 EPS levels.

- Source data from IBES from Refinitiv (all calculations are my own)

Table 1: Looking at the next four quarter’s expected growth rates:

The expected growth rates are still improving for Q3 ’20 through Q2 ’21.

Last week it was noted that this was one of the more informative tables every week since it gives investors a look at forward quarters, which the mainstream media rarely covers. While the forward 4-quarter estimate is very informative, this table gives investors a chronological look, at how revisions are trending for this current quarter and through Q2 ’21 and the trend is telling.

Trends can change for many reasons but for now, both “expected” S&P 500 EPS and revenue growth are improving.

Computing Covid-19 impact in 2021:

- Q1 ’20 S&P 500 actual EPS revenue growth: EPS -12.8%, revenue growth -1.3%

- Q2 ’20 S&P 500 actual EPS revenue growth: EPS fell 30.8%, revenue fell 8.7%

- Q3 ’20 S&P 500 (est) EPS revenue growth: EPS -7.4%, revenue growth fell 1.4%

Look at the two EPS and revenue columns for Q1 ’21 and Q2 ’21 above in Table 1, and note how the expected growth rates remain above the actual declines we saw in Q1 and Q2 ’20. That comparison should be watched as we finish 2020 and roll into 2021.

Back in April and May ’20, this blog noted that if the 2021 S&P 500 EPS estimate remained above the 2019 actual EPS of $162.93, that would be a plus. Friday the full-year 2021 EPS estimate was $168.64.

Forward S&P 500 EPS curve:

This week EPS watchers saw a sequential slowing in the growth rates, but if readers look at the month of September and the sequential rate of change, particularly the last two weeks of September and the first week of October, analysts tend to get a little “gator-armed” (that’s the expression defensive backs use for wide receivers who come across the middle a little apprehensively) and usually get reluctant to raise numbers in front of a quarter.

It’s a little early for that in the middle of the quarter, but let’s see how the next few weeks develop.

The one thing this blog is missing is sector data revisions, but a template is being worked on now. It just takes time, which is what I usually have the least of. (Excuse the dangling participle.)

Summary / conclusion:

Big retail reports next week, with two of the biggest – Walmart (NYSE:WMT) and Home Depot (NYSE:HD) – on Tuesday morning. Kohl's (NYSE:KSS) also reports Tuesday and Macy’s reports on Wednesday.

According to the fiscal year estimates, Amazon (NASDAQ:AMZN) is on track to surpass Walmart’s annual revenue in 2023: $605 billion versus Walmart’s $573 billion, but only if the current trajectories remain intact.

That will be a remarkable accomplishment for Amazon.

But it also shows how big Walmart (NYSE:WMT) is and what a true American giant they have been in the last 40 years.

To conclude, S&P 500 earnings still look good. The S&P 500 closed this week at an all-time closing high, but needs to trade above 3,588 to break this 10 -11 week trading range for the large-cap index.

Biden appointments to Treasury and Commerce will likely get a lot of scrutiny by investors.

Take everything you read here with skepticism. Earnings and revenue estimates can change quickly.