The release of China’s Q3 GDP last week revealed growth of 6.8%, which will likely put full-year annual growth in the range of 6.8-6.9%. This is well above the 6.5% annual target set by the Chinese authorities at the start of the year and a pickup from 6.7% growth last year. After six years of decelerating growth and heightened fears of a so-called “hard landing”, an acceleration was scarcely expected. However, this is not cause for celebration about sustained higher growth. Cyclical factors are largely responsible for the recent uptick and their impact has already started to fade.Adding to this,a gradual corporate deleveraging is underway, which should have a negative impact on growth going forward.

Chinese export growth

(% year on year; value terms)Sources: China’s State Administration of Foreign Exchange, Haver Analytics, QNB Economics

There have been three main cyclical factors behind the pickup in 2017. First is the synchronised improvement in global growth across emerging markets and advanced economies. China’s exports have surged this year to grow by an estimated 14% through three quarters in 2017, compared to a contraction of 1.6% over the same period last year. Underpinning the recovery has been a broad-based resurgence in demand from China’s main trade partners. Healing labour markets and firming investment in advanced economies have bolstered China's exports of consumer goods and machinery and equipment. Meanwhile, emerging market demand for Chinese goods and services is also up, reflecting higher commodity prices and positive feedbacks from higher growth in advanced economies.

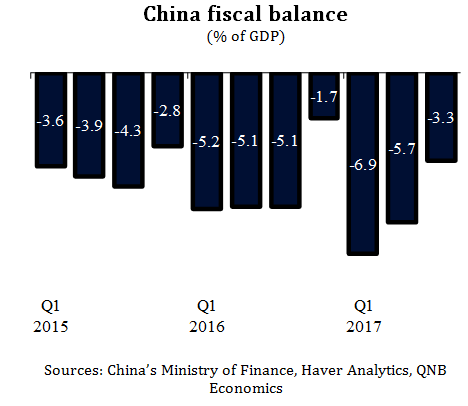

China fiscal balance (% of GDP)

Sources: China’s Ministry of Finance, Haver Analytics, QNB Economics

Second, fiscal policy has become more expansionary in 2017, particularly early in the year. China’s budgetary deficit reached a post-crisis high of 6.5% inH1. The authorities used additional spending and tax cuts to stimulate demand and boost employment in regions affected by output curbs on overcapacity sectors, such as steel and coal. Additionally, the central government has increased investment in public-private partnerships in transportation and other infrastructure, which peaked at over 60% growth in value terms in Q1 2017.

Third, financial conditions have improved as net capital outflows have ceased. . . In 2015-16, China witnessed major outflows, depleting its international reserves by over USD1tn. Tighter capital controls and foreign exchange restrictions brought an end to net outflows and reserves have modestly increased by around USD100bn since the start of 2017. This has alleviated downward pressure on the renminbi (RMB)and returned net foreign direct investment to positive territory as well.

However, the lift from these three tailwinds appears to have peaked and should fade going into 2018. Chinese exports moderated in Q3 on reduced advanced economy demand;the fiscal stimulus was heavily concentrated at the start of the year and the deficit has consolidated each year quarter since Q1; and progressively higher capital inflows seem unlikely as the authorities seek to limit the flow of hot money in their desire for greater RMB stability.

More importantly however, as these tailwinds fade, growth will be more exposed to the gradual deleveraging taking place in the corporate sector.Chinese corporate debt declined from 167% of GDP in Q1 to 166% in Q2– marginal but symbolically important because it was the first decline since 2011. The authorities appear firmly committed to reigning in excessive credit growth,which suggests deleveraging is likely to be sustained in 2018, pushing growth lower.