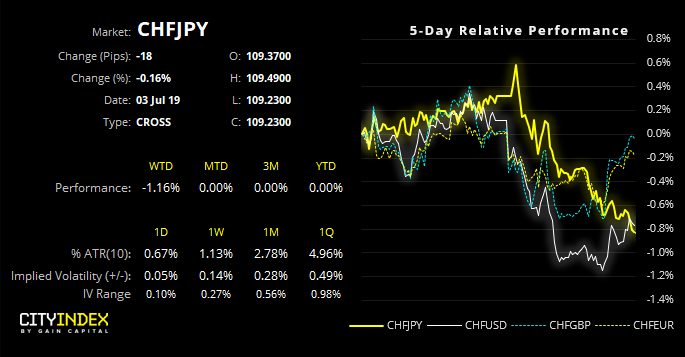

When we last covered CHF/JPY as G20 talks were underway, we’d been looking for the 109.70-109.80 support area to hold and trade within a new range. Well, it clearly had other plans and instead provided a momentum shift back within rang. Ultimately this now appears to have been a bull-trap/fakeout but sharp reversals can act as just that – a reversal.

Monday’s candle has formed a distinctive swing high which has respected the 200-day eMA. It was its most volatile session in a month and most bearish since late March, which adds weight to its potential as an inflection point.

Moreover, a pattern is now emerging since crashing from its 2019 high, in that this could be the third time we have seen an oscillating correction between impulsive, bearish leg low. Admittedly the oscillations aren’t identical yet, a nuance is present and the momentum shift back within range is worthy of monitoring in our view.

- We remain bearish below 110.81

- However, fading into moves below 109.78-91 may provide a better reward to risk entry

- The initial target is 108.22 support and the 2017 lows.

- If this is the beginning of a bearish move then it should break below the 107.60 area. As a conservative example, the prior leg lower was -3.9% which, if repeated could take the cross to 106.50 (just above the flash-crash low).