Charter Communications Inc (NASDAQ:CHTR). (NYSE:T) reported impressive financial results for fourth-quarter 2017, wherein both the top and the bottom line outpaced the Zacks Consensus Estimate.

GAAP net income in the reported quarter was $9,553 million or $34.56 per share compared with net income of $454 million or $1.67 in the year-ago quarter. However, adjusted earnings per share of 86 cents were a penny above the Zacks Consensus Estimate.

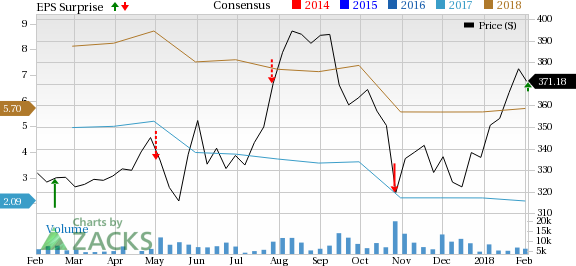

Charter Communications, Inc. Price, Consensus and EPS Surprise

Fourth-quarter 2017 total revenues of $10,602 million increased 3.2% year over year surpassing the Zacks Consensus Estimate of approximately $10,583 million.

Residential segment revenues came in at $8,450 million compared with $8,129 million in the year-ago quarter. Within the Residential segment, Video revenues totaled $4,225 million, up 3.1% year over year. Internet revenues came in at $3,638 million, up 9.8% from the prior-year quarter, while Voice revenues were $587 million, down 18.3% year over year.

Commercial revenues totaled $1,501 million, reflecting an increase of 6% year over year. Within the Commercial segment, small and medium business revenues were $931 million, up 4.5% year over year. Enterprise revenues came in at $570 million, increasing 8.3% on a year-over-year basis.

Advertising revenues were $419 million, down 17.3% year over year. Other revenues came in at $232 million, reflecting an increase of 4.1% year over year.

Quarterly operating costs and expenses were $6,621 million compared with $6,422 million in the year-ago quarter. Fourth-quarter adjusted EBITDA was $3,981 million compared with $3,853 million in the year-ago quarter. EBITDA margin came in at 37.5%, flat year over year.

In the fourth quarter of 2017, Charter Communications generated $3,258 million of cash from operations compared with $3,226 million a year ago. Free cash flow was $1,217 million compared with $1,855 million in the year-ago quarter.

At the end of 2017, Charter Communications had $621 million of cash and cash equivalents and $70,231 million of outstanding debt compared with $1,535 million and $62,464 million, respectively, at the end of 2016. The debt-to-capitalization ratio at the end of 2017 was 0.59 compared with 0.54 at the end of 2016.

Charter Communications currently carries a Zacks Rank #4 (Sell). The company competes with AT&T Inc. (NYSE:T) , DISH Network Corp. (NASDAQ:DISH) and Comcast Corp. (NASDAQ:CMCSA) in the intensely competitive pay-TV industry. Each of these stocks carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Subscriber Statistics

Residential Segment: As of Dec 31, 2017, Charter Communications’ residential high-speed Internet subscribers increased 263,000 to 22.545 million. Voice subscribers grew 22,000 to 10.427 million. Importantly, video subscribers also increased 2,000 to 16.544 million.

Monthly residential revenues per customer were $110.21 compared with $109.77 in the prior-year quarter. Single Play penetration was 40.8%, Double Play penetration was 25.3% and Triple Play penetration was 33.9%.

Commercial Segment: As of Dec 31, 2017, Charter Communications had 453,000 video, 1,358,000 high-speed Internet and 912,000 voice subscribers. During the reported quarter, the company added 13,000 video customers, 37,000 high-speed Internet and 31,000 voice customers.

Monthly small and medium business revenues per customer were $201.37 compared with $214.25 in the prior-year quarter. Enterprise customers came in at 0.114 million, increasing 17.5% year over year.

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley (NYSE:MS), Goldman Sachs (NYSE:GS) and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks >>

AT&T Inc. (T): Free Stock Analysis Report

DISH Network Corporation (DISH): Free Stock Analysis Report

Comcast Corporation (CMCSA): Free Stock Analysis Report

Charter Communications, Inc. (CHTR): Free Stock Analysis Report

Original post

Zacks Investment Research