France was in a bind.

In the early 1700s, the country had run up astronomical debts from endless wars with the British. They needed money… desperately.

So, John Law — the first central banker in France — turned the Mississippi territory France had just acquired into a stock company.

Stocks were a new trend. People weren’t prepared for the crash that comes when stocks teeter too high. So, they went all in… and what resulted was one of the fastest, most exponential bubbles to build and just as quickly burst that the world has ever seen.

It took just two years for this venture to became a popular get-rich-quick scheme. Shares or parcels of land were sold to the public and financed by the government at lower-than-market rates.

Little did buyers know, the land was basically a swamp, far away so no one could see what they were getting.

Thus, the Mississippi Land Bubble peaked in 1720… then crashed over 90% in just over a year.

It’s one of the classic examples of political manipulation, and the first major financial bubble in modern history. And yes, it was engineered by a central bank.

England had a similar bubble when it turned its monopoly on trade with the South Seas Trading Company into a public stock — to pay off its debts from the same war France had with them.

These governments didn’t concern themselves with paying their debts in a more sound, responsible way. They manipulated the market to create an artificial bubble for their own advantage.

The U.S. government had its own land scheme in the early 1800s. In an effort to get people to populate the newly acquired Midwest following the Louisiana Purchase, they offered raw land at bargain rates and — you guessed it — low cost government financing.

It was the greatest real estate bubble in U.S. history. And it burst just as quickly.

By the early 1840s, Chicago real estate fell over 90%, along with most of the Midwest.

It got so bad that it turned into the worst depression the country had seen, between 1836 and 1843.

Then came the U.S. Federal Reserve… created to offset the extreme volatility in the economy and interest rates created by that very depression and more to follow into 1896.

A near-century later, after years of stimulus and lower interest rate policies, an even greater depression happened — the Great one, itself.

This was no accident…

When these political entities constantly stimulate the economy in every correction, it never has a chance to rebalance. All we get are greater bubbles, greater bursts, and greater financial crises as we scramble to rebalance the debt and the financial bubbles that resulted.

But until recently, these bubbles were never orchestrated on a global scale.

Now, the greatest market manipulation in all of history has been globally coordinated by the world’s central banks, who have gone wild with endless money printing to keep the bubble that started in the mid-1990s from bursting.

What’s more, that bubble was already out of control due to decades of manipulation prior.

How do you think we got the Great Recession of 2008 and 2009? It resulted from endless debt growth, and central banks fostering financial bubbles through unprecedented liberal lending policies.

To make it worse, our own Fed decided to ignore the consequences and stop the bubble from fully bursting. Why delay the recovery when we can get it right now?

I don’t know about you, but I lose sleep at night knowing that’s the logic of people charged with controlling our economy… because it shows they obviously don’t have a clue what the economy is all about.

We have stock markets at much higher highs, despite feeble economic growth. We have sovereign bond markets at zero short-term and zero-to-negative long-term rates adjusted for inflation.

It’s political manipulation at its finest… and it takes a government buying massive amounts of debt with money created from thin air.

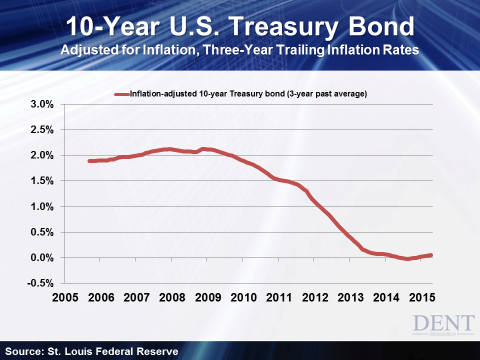

You know what the effect is on bond holders, but here’s a chart just to drive it home a little further. It’s the U.S. 10-Year Treasury bond, adjusted for an average of 3-year inflation rates.

Central banks can always set short term rates, and they have set them at near zero since late 2008. But the unique policy this time around is endless QE to buy government bonds and push them to zero, adjusted for inflation.

Prior to QE, investors got 2% yield on these “risk free” longer term bonds. Now, they get zero. Mission accomplished!

When money — both short and long term — is “free,” we abuse it through speculation, thanks to these preposterously low rates. Our stock market is the shining pillar of that.

But over time, long-term rates at zero are far more dangerous.

In the short term, 0% interest rates encourage people to invest at low costs, and institutional investors and hedge funds at much higher leverage. This creates more money chasing more financial assets, from stocks to bonds to real estate.

When they’re zero long term, that sort of speculation becomes the new normal. Since all financial assets are priced relative to longer term risk-free Treasury rates, those other asset classes seem much more valuable… but of course, none of it due to their own merits.

In fact, stocks are valued by projecting the earnings growth of the next 10 years, and then discounting the 10-year Treasury rate back to present value.

Real estate is financed largely by mortgages, and mortgage rates are priced with a risk premium higher than the risk-free long-term Treasury yield.

Then there’s investment grade and junk corporate rates, which are also priced with a risk premium above the risk-free rate.

As a result, each of these asset classes climb higher in value. Lower rates, higher stock prices and higher values for other bond classes. Lower mortgages, more buying power and hence, higher real estate values.

This is what central banks do. They manipulate interest rates to make borrowing more attractive and financial assets more bubbly.

Ultimately, they only create bubbles that burst: 1720, 1835, 1929, and now 2015.

Think twice before playing the central banks’ game. Find proven trading systems from experts that can deal with such a challenging and unusually opportune environment.

We have a great variety of trading systems to play the increasing volatility ahead — such as Adam O’Dell’s Max Profit Alert, which we’re running at a 60% discount through tonight.

This is the most globally synchronized bubble in all of modern history, and the most volatile markets since the 1930s. Buy and hold is dead for at least several years ahead… mark my words on this! It’s better to be safe and/or flexible than sorry… so if you think you can keep holding for the long term, think again!