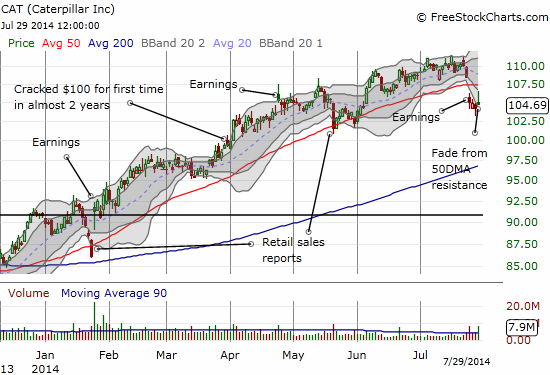

Last week, Caterpillar (NYSE:CAT) reported earnings that sent the stock gapping below its 50-day moving average (DMA) with a 3.1% loss. The stock followed its lower-Bollinger Bands ® (BB) until today (July 29, 2014). The stock rallied earlier in relative out-performance to the market before fading to flatline.

All this might be rather unremarkable EXCEPT this is the fourth time this year CAT has closed below its rising 50DMA. The last two were in quick succession. This trading action suggests CAT’s primary uptrend at the 50DMA is in trouble. A retest of 200DMA support is likely on the near horizon at this rate. CAT broke out above tis 200DMA back in December, 2013 and has not looked back ever since, so a 200DMA retest will be a must-watch.

Caterpillar breaks down again – is the fourth time a charm?

After the post-earnings breakdown, I thought I lost a chance for a good entry point to get put options on CAT. So, I rushed to fade CAT as it approached its 50DMA today. I purchased the Sept 105/100 put spread figuring $100 is a good downside target for even a modest sell-off in the market. As a reminder, I find bearish bets on CAT to be a good hedge against the potential for a market sell-off. Since August and September tend to be the weakest months of the year, I think now is a great time to put on this hedge.

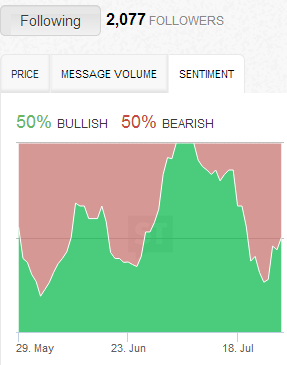

The good folks at StockTwits are evenly split on CAT, but sentiment is notably down from a month ago. That seems to me a large enough non-confirmation of CAT’s recent highs given how well StockTwits folks seem to crowdsource opinion on stocks (that’s an informal/anecdotal observation that I would LOVE to study with hard data – Howard Lindzon, are you listening?).

Be careful out there!

Full disclosure: long CAT shares and put spread