One of the reasons for the failure of the so-called "cap and trade" program in the US (other than political), has to do with the fact that carbon emissions have declined on their own - without any caps. And why would a company pay for an emissions "allowance" if it can stay under the cap without it? Of course, politically it made no sense to force companies to pay at the time when they were emitting materially less carbon on their own.

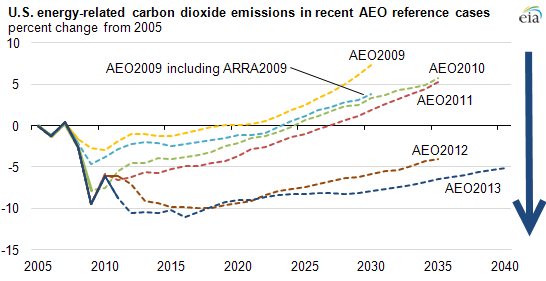

Furthermore, there was no incentive for investors to hold these contracts because each year the long-term projections for carbon emissions in the US have declined. Carbon emissions in 2040 US are now projected by the EIA to be below that of 2005.

The sharp declines first took place during the financial crisis, as companies simply produced less and therefore emitted less. Two major factors driving lower emission projections have to do with slower economic growth and increasing usage of natural gas. Other factors are at play as well.

EIA: From 2009 to 2013, key changes in the AEO include:

- "Downward revisions in the economic growth outlook, which dampens energy demand growth

- Lower transportation sector consumption of conventional fuels based on updated fuel economy standards, increased penetration of alternative fuels, and more modest growth in light-duty vehicle miles traveled

- Generally higher energy prices, with the notable exception of natural gas, where recent and projected prices reflect the development of shale gas resources

- Slower growth in electricity demand and increased use of low-carbon fuels for generation

- Increased use of natural gas"

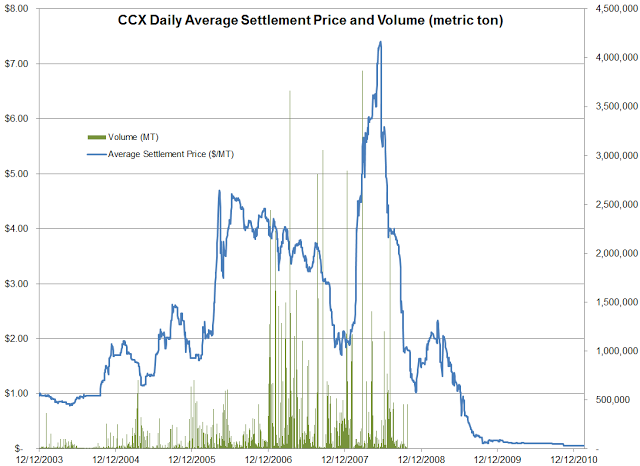

And once "cap and trade" became known as a "tax scheme," while some idiotic media stories linked it to Goldman, it was all over for the program. The experimental "voluntary" program called CCX (Chicago Climate Exchange) died in '09, as Obama's proposed legislation was killed in Congress (rejected with 219-212 vote in the House.) The CCX contract and the trading volume effectively went to zero (see discussion).

Even in Europe, where "cap and trade" has been in place for some time, carbon allowance contracts aren't doing much better. Europe's economic growth prospects are worse than those of the US, resulting in lower emissions. The ECX CER unit now trades below €1.

There has been talk of bringing the program back and some projects in North America (Québec and California for example) have been implemented on a small scale (these are mostly symbolic in nature.) It is certainly positive that the US and Europe emit far less carbon than expected. But the saddest part of this story however is in the bigger picture.

Both the US and Europe have effectively "exported" a great deal of their carbon-heavy industries to emerging nations, particularly to China. However countries like China are actually far less "carbon efficient" than factories in the developed world. Making a gadget in China pumps much more carbon into the atmosphere than producing the same gadget in Europe.

Therefore, global emissions increased even as the developed world cut them. And unfortunately carbon is one of those global pollutants - it makes no difference where it is produced, the impact is world-wide. Which means that even if the US had a full fledged "cap and trade" program, the impact on total carbon in the atmosphere would not be dramatically different without the commitment from emerging markets nations.