Is the top 10% up to the task of borrowing and blowing enough money to prop up a debt and bubble-dependent economy?

Since the entire economy depends on consumption for its "growth," and discretionary consumption is financed with either cash or debt, that leads to two questions: 1) who has cash to spend on non-essentials and 2) who is credit-worthy enough to borrow money for non-essentials?

What makes a household credit-worthy? A) disposable income, i.e. cash left over after servicing debt and paying for essentials, and B) assets that can act as collateral for loans.

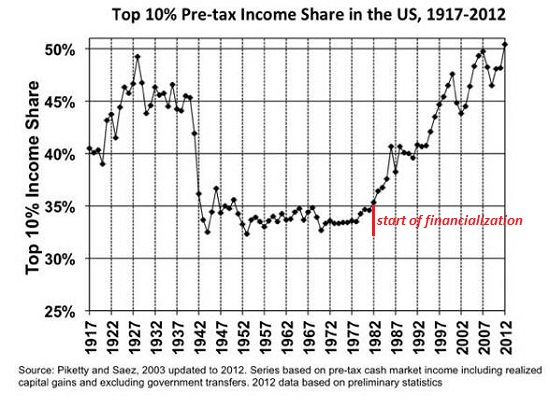

Since the top 10% take home 50% of all household income, it follows that this top slice has most of the discretionary cash:

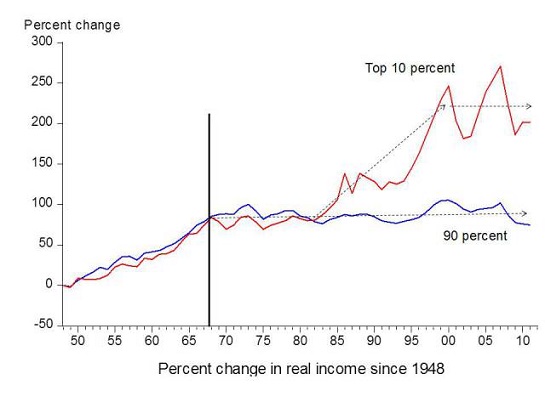

The top 10% is also the only slice whose income has exceeded inflation over the past four decades:

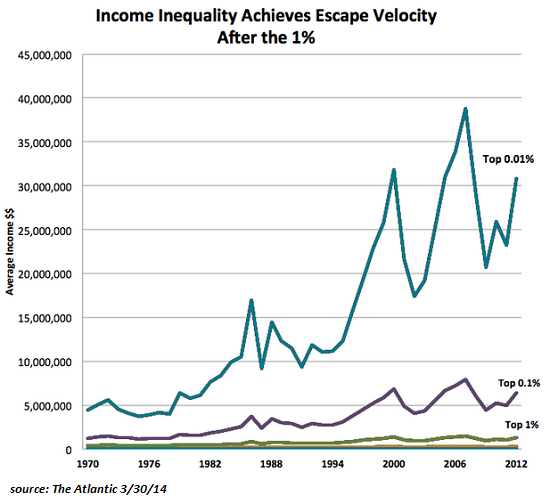

In terms of assets that can serve as collateral, the top 5% own most of the nation's household wealth. So not only do the top 10% earn most of the income, they also own most of the assets that can serve as collateral for loans:

Much has been written recently about the extreme concentration of wealth in the top .1%. The point here is that the top 9.9% may be doing OK, but much of the wealth owned by the top 10% is concentrated in the top .1%.

Since real income for all wage earners has declined since 2007 when adjusted for inflation, we have to ask just how well the top 9.9% is doing in terms of purchasing power.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Can the top .1% prop up the economy with their spending? Yes, they can prop up Maserati sales and buy $10 million vacation condos, but there simply aren't enough super-wealthy to do the job. As for the top 1%, they can prop up the local Porsche dealership and pay dock fees at the yacht club, but there aren't enough of them, either: around 1.5 million qualify as top 1%.

The top 5% households number around 6 million out of 121 million households, but that's not a big enough number to fill every high-end bistro and private school in the nation. So that leaves the top 10%, the 12 million households with half the income and roughly 80% of the assets, with the task of spending enough free cash or credit-money to prop up an economy that depends on serial asset bubbles for massive injections of unearned income.

Is the top 10% up to the task of borrowing and blowing enough money to prop up a debt and bubble-dependent economy? Right now, we're one stock-market-and-housing bubble pop away from finding out if the top 10% will be able and willing to spend, spend, spend once their bubblicious assets are evaporating like mist in Death Valley.