Inflation is going down, but the Fed will have to traverse more volatile waters to keep it that way.

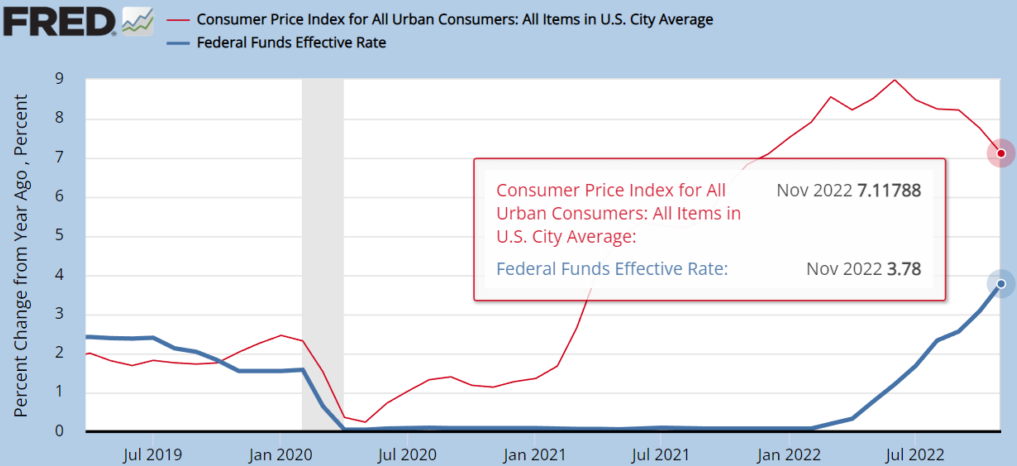

The Consumer Price Index has been lower than forecasted for three consecutive months. November’s latest CPI at 7.1% vs. forecasted 7.3% added to the downward inflation trend. At this rate, is the Federal Reserve likely to reach its target inflation goal in 2023?

The Fed’s Rate Hikes are Working

The Federal Reserve pincered the economy between two extremes since March 2020. Having bloated its balance sheet by ~$5 trillion, the overflowing money liquidity propelled the stock and crypto markets to their all-time highs. By mid-2022, the cost of central banking’s “free money” began to manifest itself in the highest inflation rate since the early 1980s.

Given its dual mandate – employment and price stability – the Federal Reserve responded with the fastest rate hiking cycle in over 40 years. As the third consecutive month that positively exceeded expectations, November CPI at 7.1% vs. forecast 7.3% shows that the Fed got on top of inflation.

The Federal Reserve considers both inflation metrics, CPI and core inflation. The latter disregards volatile food and energy prices, making it a more useful indicator that is less prone to lag. The Fed’s core inflation target is still at 2%. For November, core inflation also beat estimates at 6.0% vs. 6.1%, which is 3x above the Fed’s target.

The world’s central bank is now increasingly in a more favorable position to avoid a deep recession.

Did the Fed Suppress Assets Enough?

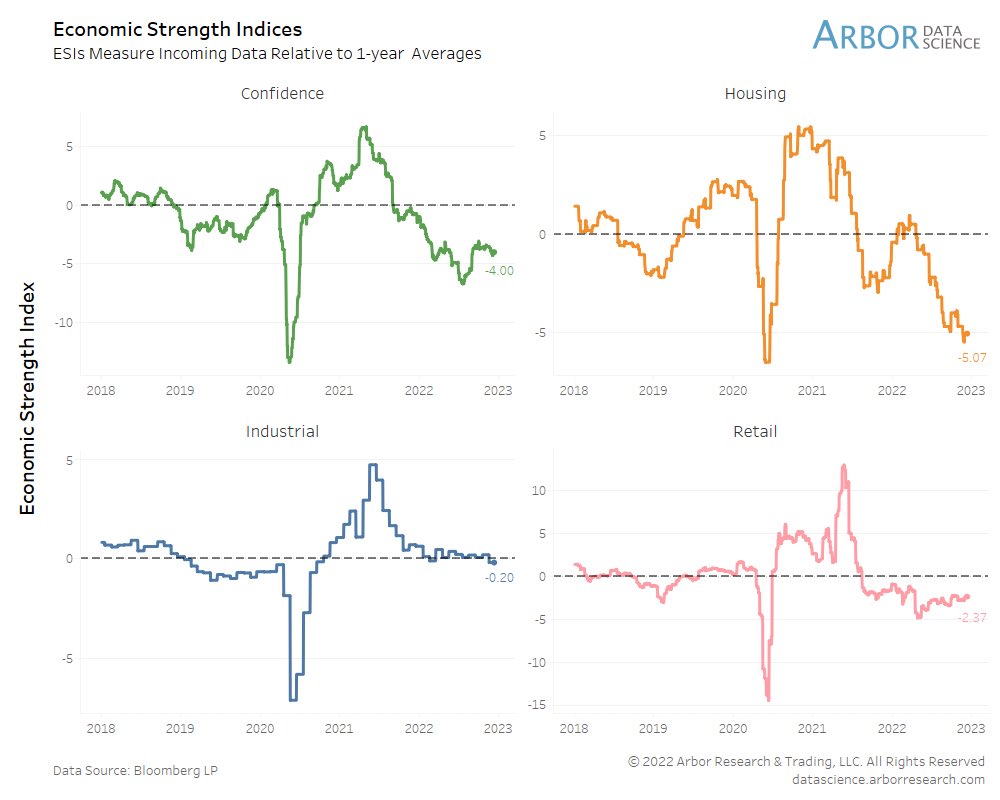

The Fed’s loose monetary policy led to a hot economy, manifested as price instability – inflation. The Fed started to cool the economy by increasing the cost of capital using higher interest rates. The cooling manifested as asset price suppression across the board.

In other words, the Fed could cool down the economy into a recession as consumer demand is suppressed. At $75 per barrel, the West Texas Intermediate (WTI) crude oil benchmark has already dropped to the year’s lowest point, indicating significant demand reduction.

BlackRock, the money manager with $9 trillion AuM that the Fed hired in 2020, also warned that 2023 would be a historic cooldown year.

“Recession is foretold as central banks race to try to tame inflation. It’s the opposite of past recessions: Loose policy is not on the way to help support risk assets, in our view.”

Why Further Inflation-Combating Hikes May Not Be on the Table

For the Fed’s next meeting on Dec. 14, the market expects (80% probability) the central bank to increase the rate by 50 bps into the 4.25% – 4.5% range. This will break the four-consecutive 75 bps streak, with a potential hike pause afterward. This seems more likely, given another critical indicator.

The Fed’s asset suppression has also reduced tax revenue, which dropped 10% in November, or $29 billion from a year prior.

Lower federal revenue means less ability to pay government debt (treasuries). For this reason, the Fed has historically avoided raising interest rates beyond the level of 2-year treasury yields, according to 3Fourteen Research.

The expected December 50 bps hike aligns the Fed Funds rate in that range. In other words, the Fed will likely have to count on the already achieved inflation downward trend to resume its momentum. Otherwise, the Fed is entering uncharted waters, historically speaking.

After all, if lower tax revenue leads to a higher deficit, it leads to a higher supply of treasuries. The Fed would then have to rely on foreign countries to buy them. If the demand is not there, treasury yields would have to go up. This would lead to a stronger dollar, hurting international US companies and decreasing federal tax receipts.

We may end up in the rate-cutting phase to avoid uncharted waters. In turn, the inflation’s downward trend would only be temporarily halted in 2023.