- Dollar and stocks drift sideways as August payrolls awaited for direction

- Asian equities outperform after China boosts support but aussie fails to catch fire

- Oil extends rebound amid tightening market, gold holds near highs

All eyes on August NFP report

It’s been a week of ‘bad news is good news’ for the markets as investors ramped up their bets that rates in the US have peaked following a slew of soft data suggesting that Fed tightening is starting to put the brakes on the economy. With signs that there’s been a significant slowdown in hiring in recent weeks and inflationary pressures continuing to ease, Treasury yields have suffered a major pullback, giving way for a rebound on Wall Street.

Thursday’s data included the core PCE price index, which ticked up to 4.2% y/y in July. But given the recent moderation in the month-on-month rate, it’s likely to resume its decline in September.

Nevertheless, a Fed pause has not been completely priced out as investors still see about a 48% probability of a 25-basis-point rate hike by November. That not only indicates that not all traders carry such a strong conviction about the Fed being done raising rates, but it also leaves markets exposed to some volatility should today’s jobs report be hotter than expected.

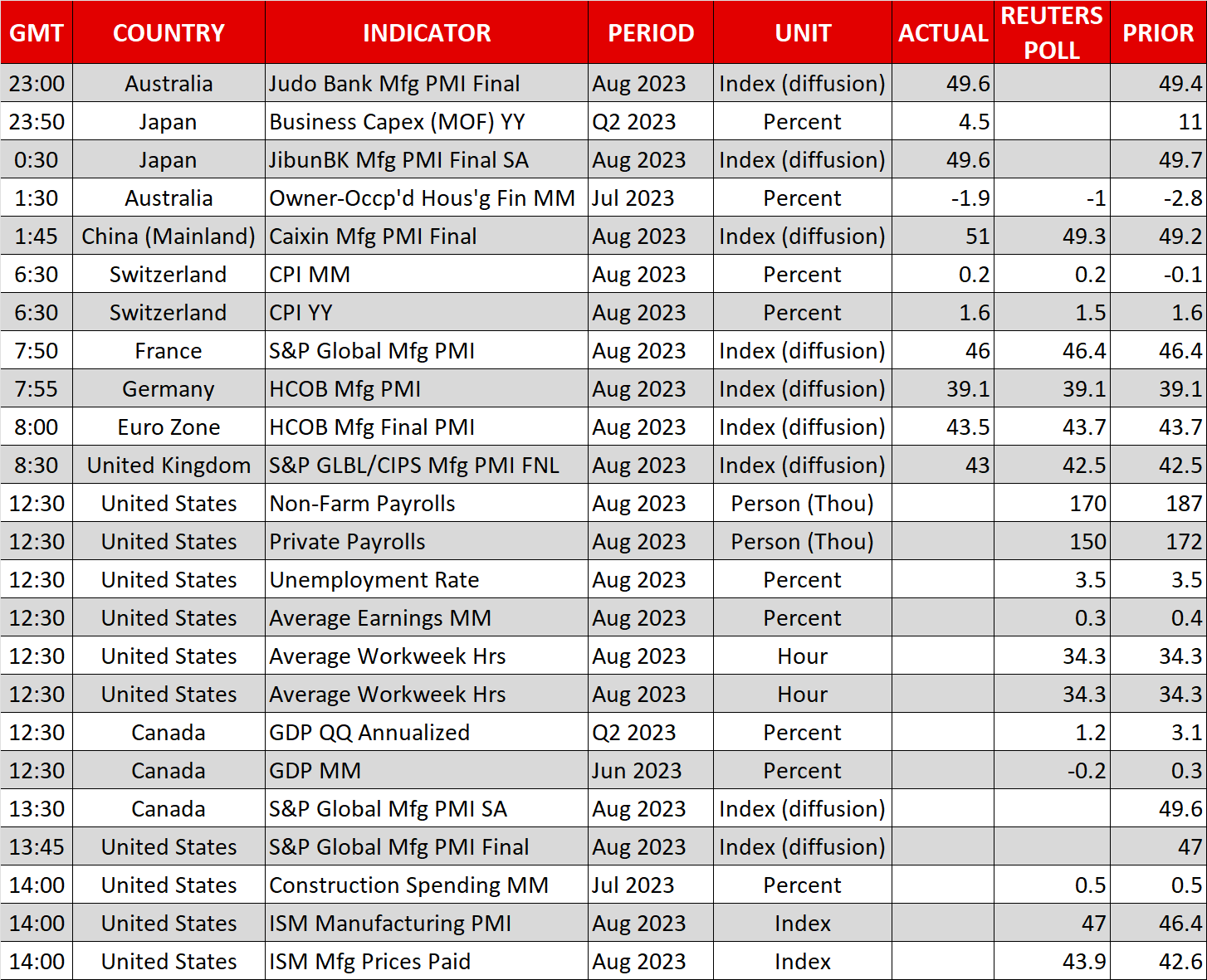

The consensus forecasts are for a net gain of 170k in nonfarm payrolls in August, down from 187k in July. Amid a summer of strikes in America, most notably, the actors strike in Hollywood, the risk is to the downside.

However, investors shouldn’t get too excited from a potentially paltry increase in jobs as the strikes are fuelling generous pay settlements that could push up wage growth over the coming months. Moreover, when the labour market is so tight, unless job losses begin to rise, consumers will remain supported. Personal spending jumped by 0.8% m/m in July, reinforcing expectations of strong GDP growth in Q3.

Dollar and stocks in cautious mood before NFP

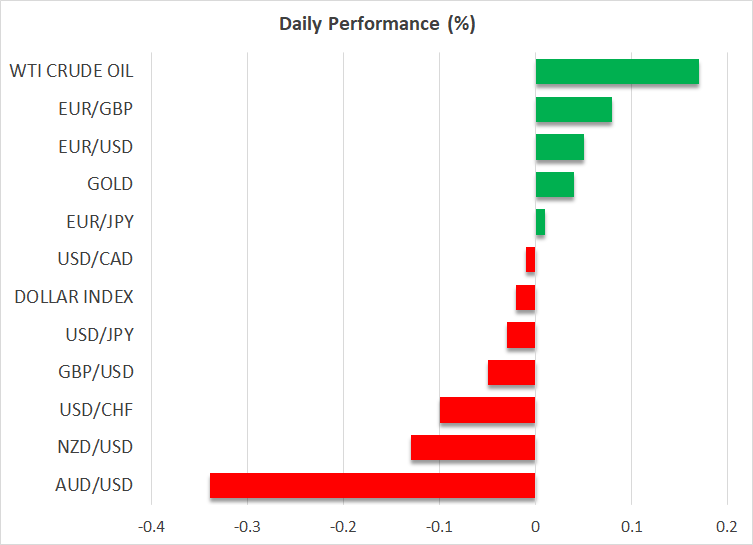

That could be one of the reasons why Wall Street turned a bit cautious yesterday and only the tech-heavy Nasdaq managed to hold onto some gains at the close. The US dollar on the other hand bounced back sharply as the euro plunged after sticky inflation data raised stagflation fears for the Eurozone.

Markets are clearly waiting for the payrolls numbers for some sort of direction and there should be plenty of that today as aside from the jobs report, the ISM manufacturing PMI for August is also due, while comments from the Cleveland Fed's Mester will be watched too.

The caution was reflected in the safe-haven yen, which was broadly firmer today despite remarks from Japan’s finance minister, Shunichi Suzuki, not hinting at any imminent FX intervention even as the greenback briefly topped 147 yen earlier in the week.

Some good news from China, but aussie slips

Most majors were steadier on Friday, although the Australian dollar stood out as being the worst performer. The aussie is headed for weekly gains so it may simply be pausing for breath. It’s also likely that investors don’t see the Reserve Bank of Australia hiking again even though there are finally some positive headlines coming out of China.

As expected, several lenders in China cut mortgage rates as well as deposit rates – the latest in a series of moves by authorities to stimulate the struggling housing market.

In addition, there was some upbeat data from the Caixin manufacturing PMI, which unexpectedly printed above 50 in August, pointing to a possible turnaround in the economy.

The combined headlines boosted regional stocks as well as metal prices, with copper futures surging by more than 1.5%, but the aussie remained deflated.

Oil and gold eye weekly gains

Oil futures also climbed to approach their August highs. There could be further gains for crude oil next week as Russia looks set to announce a new round of supply cuts, which comes at a time when the oil market is already tight from higher demand.

WTI oil was last trading slightly above $84 a barrel.

Gold headed higher too as the precious metal seeks to extend its two-week rebound amid the sharp reversal in bond yields. Gold bulls are likely to keep targeting the $1,950/oz level after failing to clear $1,949/oz on Wednesday.