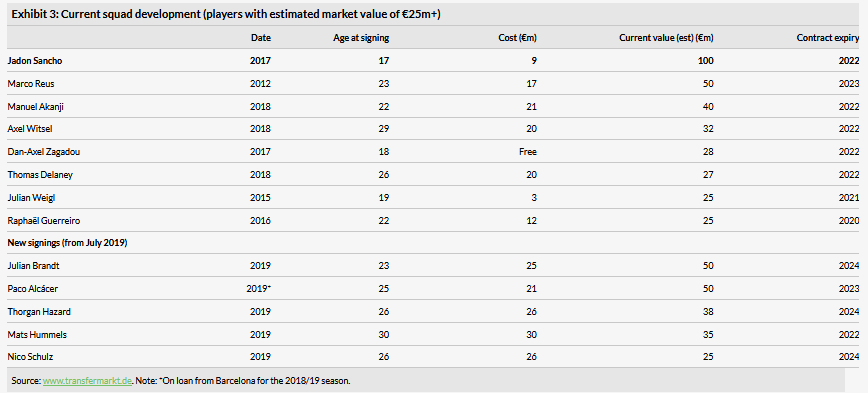

Borussia Dortmund (DE:BVB) enters the international break with mixed results. A decent season start, notably Supercup triumph vs Bayern and top of its strong Champions League group, could have been so much better but for difficulty closing out games, epitomised by four recent draws despite winning positions. This may cost Dortmund in a more competitive Bundesliga than of late (leading eight teams separated by just four points). We are nonetheless raising our current-year EBITDA forecast from €110m to €128m both to reflect change of accounting policy (€10.7m boost in FY18) and sustained buoyancy (€21m post-transfer revenue upgrade). Progress is subject as ever to surprise from Dortmund’s ability to generate substantial hidden reserves from transfers (we make no allowance for possible Sancho sale).

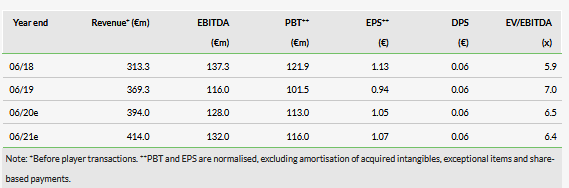

FY19: Operational revenue growth to the fore

With the previous year flattered by two bumper transfers, we highlight the 18% rise in FY19 pre-transfer revenue, driven by TV marketing income from the Champions League and exactly as we forecast. By contrast, Q4 transfers were below our expectations (€8m vs €18m) but the impact on EBITDA is unclear, given a change in accounting policy primarily for agent and brokerage commissions for contract extensions. Assuming a similar boost in FY19 to FY18’s positive €10.7m accounting revision, our unadjusted total EBITDA forecast of €105m was effectively met.

Increasing profit resilience

The absence of significant changes in media contracts and competitions suggests profit consolidation this year and indeed next, assuming Champions League qualification. Yet, as detailed on page 2, momentum, both operationally and in a lively transfer market (summer 2019 spend up 20% by the five major leagues), encourages small FY20 upgrades, change of accounting policy apart. We reiterate that transfers are the joker in the pack; it is invidious to single out Sancho, but disposal at current valuation (at €100m, the Bundesliga’s most valuable player) might alone yield the bulk of our EBITDA forecast.

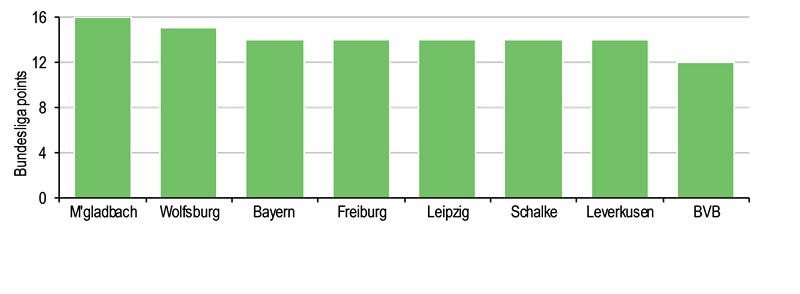

Valuation: Clear value creation

www.transfermarkt.de’s latest squad valuation (c €610m, adjusted for loans) shows BVB’s hidden reserves (over €300m surplus of market value to reported net player assets, adjusted for recent signings). While notional and at sporting cost, this underpins our forecasts in view of increased reliance on transfers. The share price is at a c 25% discount to a simple sum-of-the-parts valuation of €12.30 (from €10.75/share).

Business description

The group operates Borussia Dortmund, a leading German football club, Bundesliga runners-up in 2018/19, DFB Cup winners in 2016/17 and competing in this season’s UEFA Champions League (Round of 16 participants in 2018/19).

Revenue and profit analysis

Q419

Aside from trading, which was much as expected (pre-transfer revenue up 8% in Dortmund’s quietest quarter) and minimal player disposals, Q419 was notable for a change in accounting policy for agent and brokerage commissions for contract extensions and players acquired on free transfers. Previously included in other operating costs, these are now recognised as intangible assets and thus subject to amortisation over the remaining term of the contracts. FY18 has been duly adjusted, ie €10.7m reduction in other operating costs (see Exhibit 1), hence revision of EBITDA from €126.6m to €137.3m and €7.8m increase in amortisation, resulting in FRS3 PBT up from €31.8m to €34.7m. Importantly, the impact for FY19 of the accounting change has not been disclosed.

Minor upgrades for FY20

Despite maintained operational factors, ie competition and broadcasting, we are raising our FY20 pre-transfer revenue forecast from €383m to €394m, primarily because of assumed renewal of PUMA’s kit sponsorship contract on significantly enhanced terms (it is due to expire in 2020). Transfer income is taken to be the average of the last three years, ie €140m against our previous forecast of €130m but is of course highly volatile.

Progress to the round of 16 in the Champions League continues to be assumed. A strong performance against Barcelona and a win at Slavia Prague have put Dortmund in a good position to qualify for the knockout stage but imminent back-to-back encounters with Inter Milan, currently second in Serie A, ensure little room for error in a challenging group.

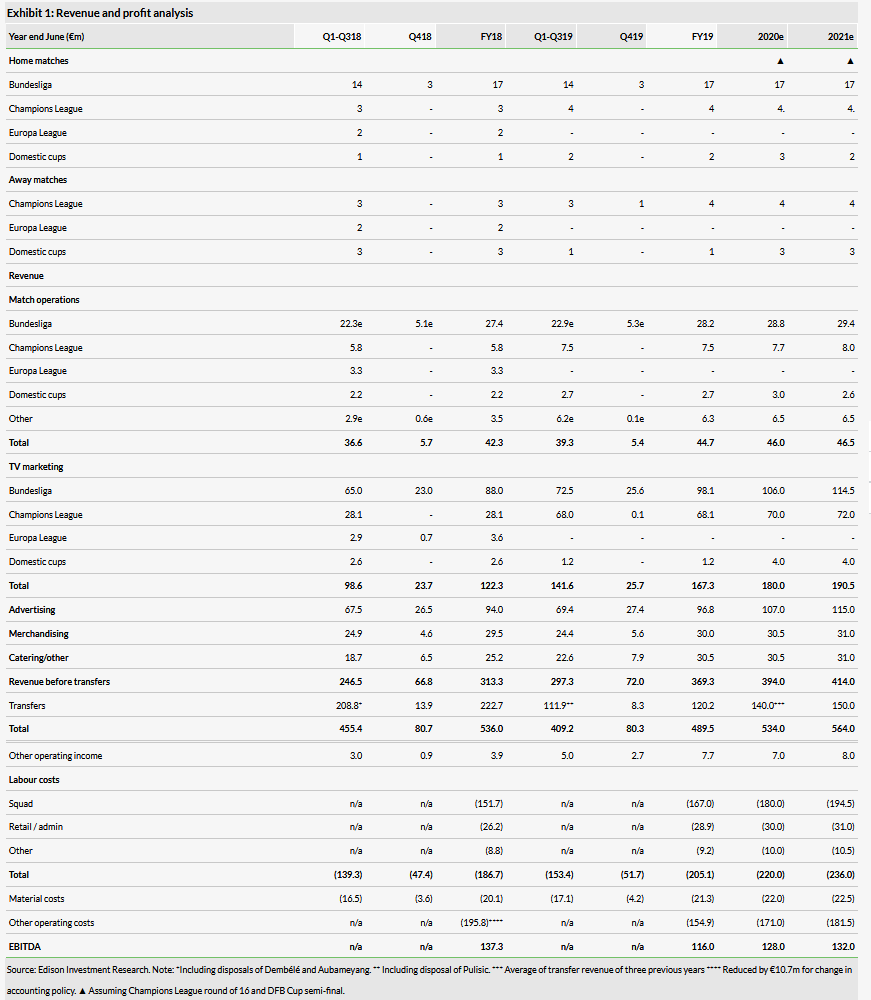

A top-four finish in the Bundesliga is also still assumed even if recent results suggest otherwise. After heading the table in the first two weeks of the season, Dortmund now stands eighth. However, despite evidently greater competition from the major clubs across the board, the disparity to Champions League qualification (top-four) is merely two points, as shown in Exhibit 2, and it is still very early days (27 games remaining). Dortmund has achieved ‘top-four,’ its premier sporting metric, in eight of the last nine seasons, indeed in 2018/19 by a convincing 21 points. As with the Champions League, resumption after the international break brings especial tests with the Revierderby at Schalke and successive games against the top three teams.

Exhibit 2: Top half of Bundesliga this season after Matchday 7

More of the same in FY21

Assuming Champions League qualification, we envisage continued modest operational progress with scope for transfer surprises. In terms of TV marketing we note a newly announced six-year US agreement between the Bundesliga and ESPN, effective August 2020 and replacing FOX, whose contract expires at the end of this season. Next year should also see agreement on the next cycle of domestic Bundesliga media rights. Increasing interest from digital platforms is expected to drive up their value.

Valuation

The share price is at c 25% discount to a simple sum-of-the-parts valuation of €12.30/share (€10.75 in our June report), based on estimated market value of players c €610m, per www.transfermarkt.de, adjusted to exclude Hakimi (on loan), brand value €481m (at May 2018 per Brand Finance) and financial position (€44m net cash at end FY19).

This squad valuation necessarily does not allow for step changes in the value of emerging talent, which Dortmund is so adept at identifying and is attracting the attention of major clubs at ever younger ages. Potential prodigies such as Leonardo Balerdi may emulate the uplift (admittedly unrealised) of estimated €91m attributable to similarly youthful Sancho or the bumper realised returns on Dembélé and Pulisic. There may also be appreciation by established talent (see Exhibit 3), notably the pre-season signing of internationals Brandt and Hazard, which has already elicited clear upgrades on approval of their Dortmund prospects. Alcácer, previously on loan, has newly seen his valuation rise by a third to €50m (€21m cost this summer), approaching the most valuable Bundesliga strikers, Lewandowski and Werner (both €65m).

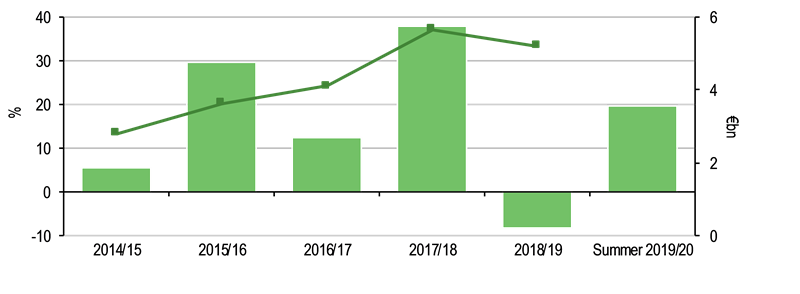

Beyond this is sustained transfer market buoyancy, shown by a near doubling in spend to over €5bn in 2018/19 by the five major European leagues over the last four years (Exhibit 4). Consolidation last season was understandable after such a heady rise (30% in 2017/18 alone), heralding a sharp resumption in growth (c 20%) in the recent summer ‘window’. This comes at a price in terms of player replacement, but Dortmund is a net seller.

Exhibit 4: Changes in player transfer market spend by five major European leagues

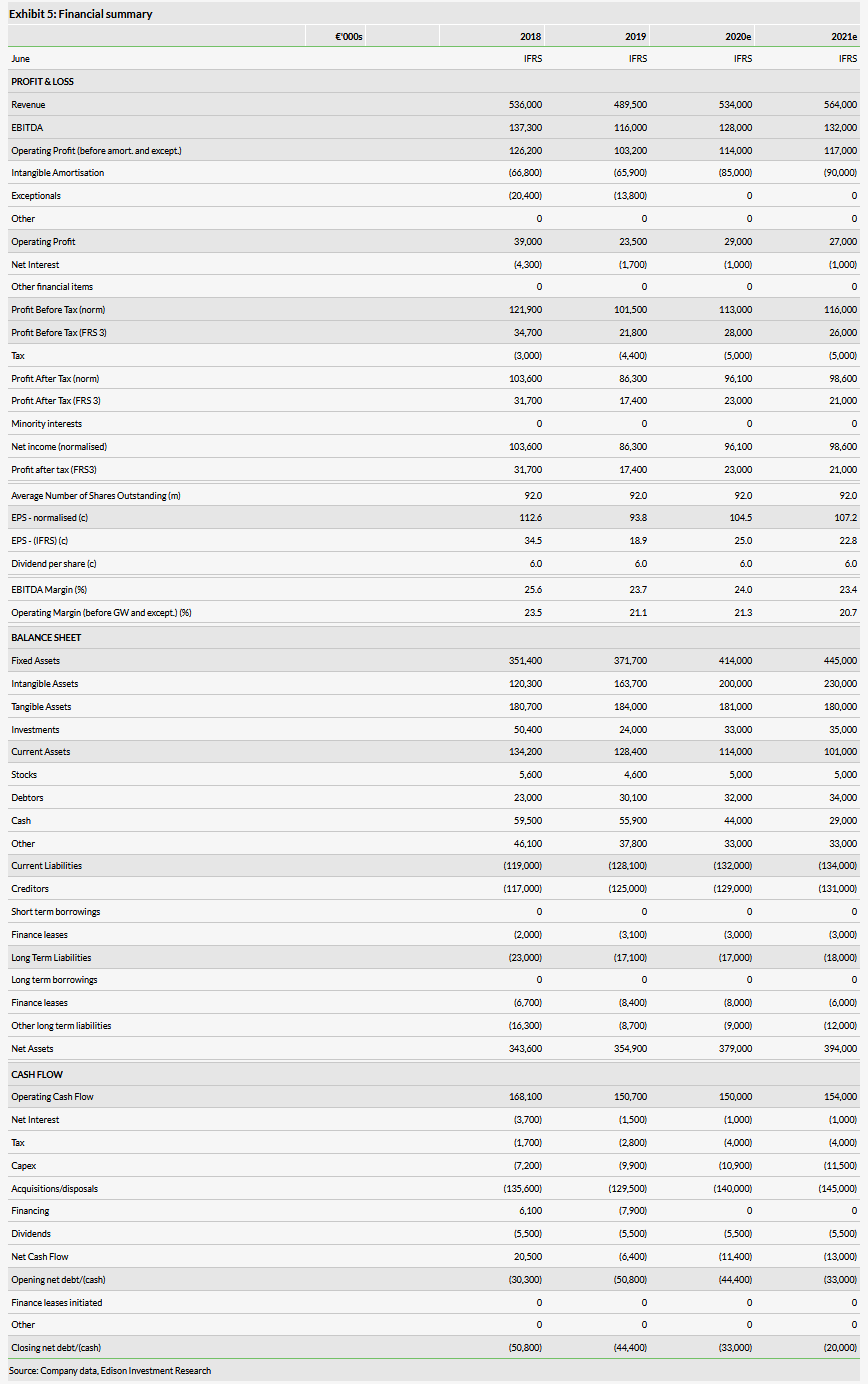

Exhibit 5: Financial summary

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI