The mainstream media are picking up on Bitcoin's meteoric rise. In an article on CNBC, we read:

Bitcoin will likely outperform stocks and bonds the rest of this year, according to the first major Wall Street strategist to issue a report on the digital currency.

"I think bitcoin is an underowned asset with potential for huge institutional sponsorship coming," Fundstrat co-founder Tom Lee said on CNBC's "Fast Money" Wednesday.

"It has a lot of characteristics that are very similar to gold that I think will make it ultimately attractive as an alternate currency," he said. "It's a good store of value."

This is exactly the sort of article we would expect to see close to the top. It turns out that even Wall Street firms are now becoming interested in Bitcoin, a clear sign that people not necessarily interested in the field are now drawn to it. The situation could get more extreme, sure, as the extreme sentiment in the Bitcoin market is not yet a complete mania. Then again, the move has been hectic and it might be the case that most people interested in the currency are already in the market. This contrarian sign is definitely something to keep in mind.

For now, let’s focus on the charts.

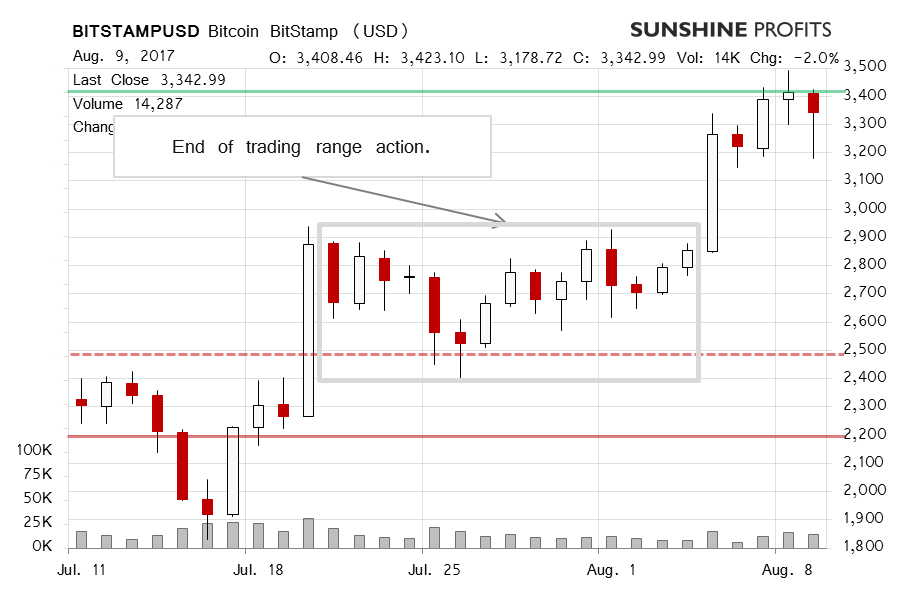

On BitStamp, we saw Bitcoin stabilize around the recent all-time high. Recall our recent comments:

The fact that we saw a move above the previous all-time high is a bullish indication. The volume was not spectacular but the appreciation was definitely visible and the currency hasn’t depreciated much since then (...). The fact that Bitcoin has been holding up is a bullish hint.

We have seen Bitcoin hold up above the recent all-time high. This is still a bullish indication. The other side of the story is the decline in volume we have seen today (this is written around 11:15a.m. ET). Actually, the action today has been up but the volume has been so weak that this is a bearish indication. The general idea is that the move up on low volume might suggest that the buying power is dying out.

The long-term picture is unchanged. In our previous alert, we wrote:

(…) Bitcoin is above the previous all-time high and this paints a very bullish picture. On the other hand, the rush of Bitcoin stories in the mainstream media is a contrarian topping suggestion. So, we have two opposing signs. Which one of them is more pertinent at the moment? Our take is that the picture now is more bullish than it was a couple of days ago and the short-term picture is bullish. At the same time, the most important piece of bullish information – the move above the previous all-time high – has not been confirmed yet. It is very close to being confirmed but not quite there in terms of daily closes. This means that while we’re not opening hypothetical long position just now, we might consider doing so in the next couple of days (…).

The situation is now pretty much the same, only the move above the all-time high is now confirmed, but the momentum has been fading. Again, we have two opposing forces right now. The fact that the move up now has been on relatively slow volume (today). All in all, we are still of the opinion that the situation is more bullish than not but the risk of a reversal now is particularly salient at the moment.