Courtesy of NASA

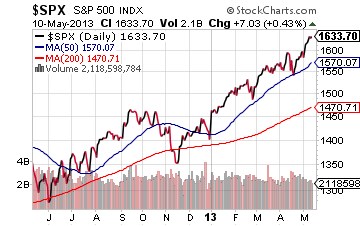

The stock market put on another record setting show with the Dow Jones Industrial Average (DIA) closing at a record high 15,118 and the S&P 500 (SPY) closing at 1633.70, another all time closing high.

For the week, the Dow Jones Industrial Average (DIA) gained 1%, the S&P 500 (SPY) climbed 1.2%, the Nasdaq Composite (QQQ) added 1.7% and the Russell 2000 (IWM) jumped 2.2%.

However, as exciting as the week’s stock market action was, the big news came after the close on Friday when Wall Street Journal reporter Jon Hilsenrath published an article detailing a new Federal Reserve strategy for unwinding its $85 billion/month in bond buying known as QE3.

This is big news, of course, because recent stock market action has been labeled “The Bernanke Rally” or “The Bernanke Put” as investors count on the Federal Reserve to support stock market prices and protect them from potential declines.

On My ETF Radar

In the chart above, we see how the S&P 500 (SPY) has begun tracking a near parabolic ascent that began in January. The S&P 500 (SPY) is now 11% above its 200 day moving average, the greatest divergence seen since March, 2000, just before the beginning of the dot-com crash. Will history repeat or only rhyme and in Yogi Berra’s famous words, are you ready for “déjà vu all over again?”

ETF News You Can Really Use

Based on the after market close Wall Street Journal article, it seems that the Fed is planning to take away the “punch bowl” of easy money, however, the timing and scope of the program is unknown.

As we all know, markets don’t like uncertainty, and this development, coming along with a steady stream of economic reports indicating a slowing global economy, is potentially significant, indeed.

The Fed finds itself in a tricky place as timing the exit will likely be difficult, at best. Leaving it in place too long could continue to stoke asset bubbles while too quick an exit could lead to significant stock market declines along with volatility in bond and commodity markets.

Here’s a quick summary of recent events:

1. Stock market levitating to record highs on a daily basis.

2. Macro economy slowing around the world with a steady stream of declining economic reports.

3. Near record margin debt, the highest level seen since 2007, just before the last market highs and subsequent meltdown associated with the 2007-2008 financial crisis. Margin debt is now north of $350 billion for March and is thought to have possibly reached record highs in April, and this is typically a bearish indicator as excessive risk taking tends to mark market tops. Also, should a sell off begin, margin calls tend to accelerate the decline as investors have to close positions and so selling can rapidly accelerate under these conditions.

4. Technical indicators put major stock markets in highly overbought conditions and so vulnerable to decline. The stock market is exhibiting signs of a “blow off top” and Friday’s news from the Fed further add to the risk of a quick reversal.

Last week saw a “another day, another record” as stock markets around the world responded to stimulus action by central banks in Japan, Europe and the United States.

In economic reports, the weekly new unemployment claims report on Thursday beat expectations and March job openings were flat from the previous report.

Next week brings a wave of fresh economic reports:

Monday: April retail sales, March business inventories

Tuesday: NFIB Small Business Index

Wednesday: Producer price index, Empire State Index, Home builders index, industrial production

Thursday: weekly unemployment claims, consumer price index, housing starts, Philadelphia Fed report

Friday: consumer sentiment, leading economic indicators

Bottom line: With new records, a levitating stock market and news from the Federal Reserve, investors will register their reactions on Monday.

Disclaimer: The content included herein is for educational and informational purposes only, and readers agree to Wall Street Sector Selector’s Disclaimer, Terms of Service, and Privacy Policy before accessing or using this or any other publication by Wall Street Sector Selector or Ridgeline Media Group, LLC.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Big News From Fed To Impact Markets

Published 05/13/2013, 02:03 AM

Updated 05/14/2017, 06:45 AM

Big News From Fed To Impact Markets

Stock market posts another record setting week, but the big news came after Friday’s close.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.