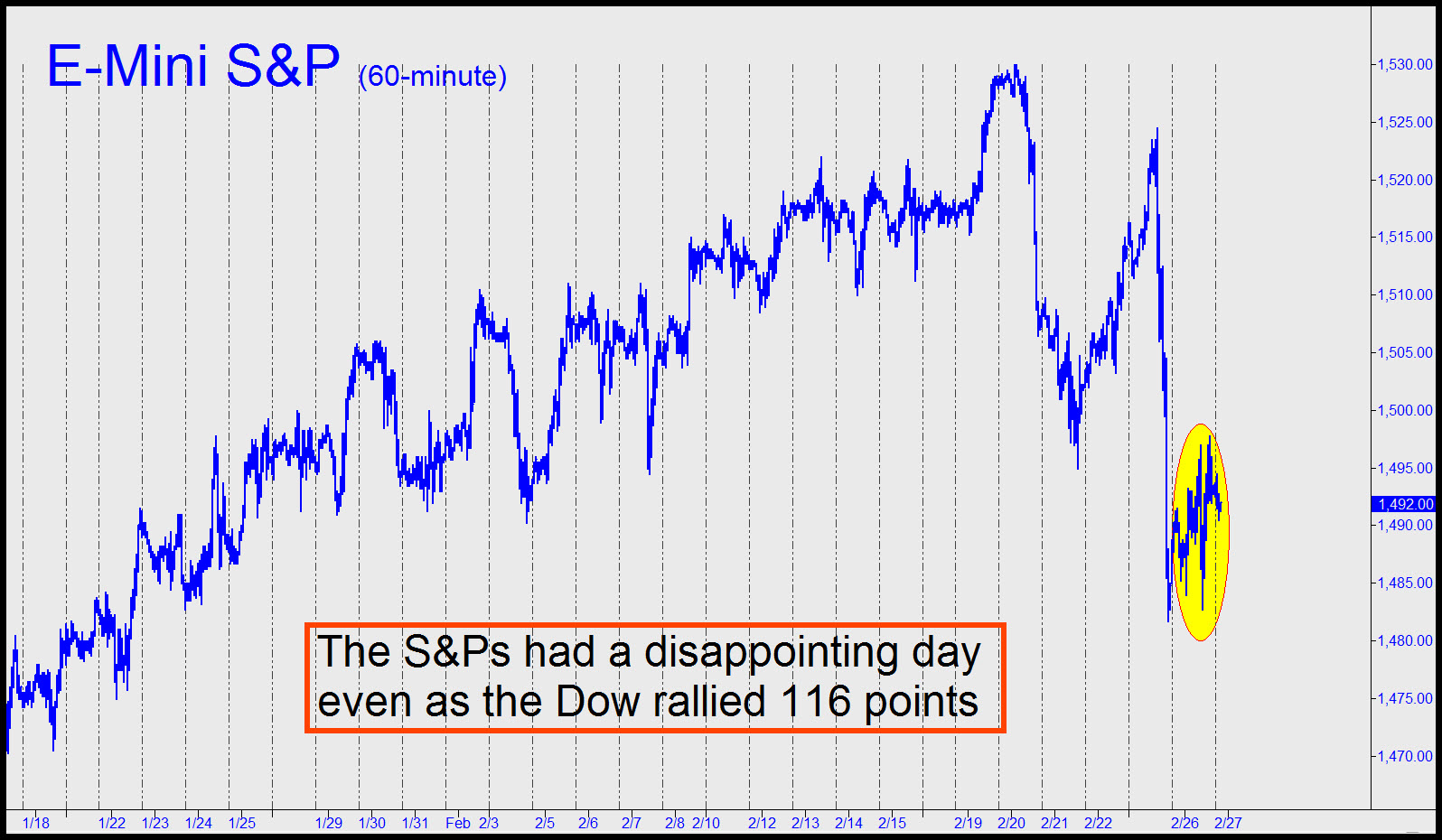

The Dow was up 116 points yesterday – all of them presumably gratuitous — recouping about half of the previous day’s losses. This was in odd contrast to an S&P 500 index that barely got off the launching pad Take a look at the 60-minute chart below if you want to see how S&P buyers spent the day head-butting their way modestly higher. Our guess is that they were outmatched by fresh supply coaxed forth by Monday’s semi-fearsome selloff. Recall that it was attributed by the news media to worries about Italy’s election results. Are the rabble about to seize power in Rome? It would seem not. Italy didn’t even rate a mention on the Google news page yesterday, unless you count a story about the Pope that had a Vatican dateline. We can only surmise that the panic over Italy’s would-be descent into anarchy that had engulfed newsrooms has not spread to the general populace, let alone to Wall Street.

So what to make of these almost daily swings of 100 to 200 points, each opposite the last? Our suspicion is that the stock market is building a broad top. By definition, that means it has been visiting pain on bulls and bears alike. We’re in the latter camp, although untouched by pain as yet. About two weeks ago, we be the “Don’t” line with the acquisition of some put calendar spreads in the Diamonds, a proxy for the Dow Industrial Average. Although we usually shun options with distant expirations, because time only works against the retail buyer of puts and calls. In this case, however, we put on the spread with the goal of “rolling” it twice by summer. Specifically, we bought the June 130-March 130 put spread for $1.50 when the Diamonds were approaching a Hidden Pivot rally target in mid-February. DIA has since fallen, making our dozen spreads an easy sale these days for $2 (“an annualized return of 800% !!!!!!” in the parlance of direct-mail marketers).

‘Rolling’ a Calendar Spread

Rather than exit the spread, though, we plan on rolling it in April, and then again in May. This implies keeping our June puts while we roll out of the Marches and into short Aprils just before March expiration. Then, before April expiration, we’ll covering the short April 130 puts while shorting the same number of Mays. Ideally, if the Diamonds continue to fall between now and June, we’ll be able to short puts in each successive months for higher and higher prices. In all likelihood, if the Diamonds were to fall just 2%-3% from current levels, we’d be able to recoup the entire cost of the June puts, giving us a cost- and risk-free play on the downside between now and June 21. What a great way that would be to celebrate the summer solstice!

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bearish? Here’s How To Keep Your Cool

Published 02/27/2013, 01:37 AM

Updated 07/09/2023, 06:31 AM

Bearish? Here’s How To Keep Your Cool

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.