The Brookings Institute says Auto slowdown Flashes Caution Lights for Manufacturing Employment and Trump.

A switch to self-driving, trends towards electric, and a glut of used cars are all in the spotlight.

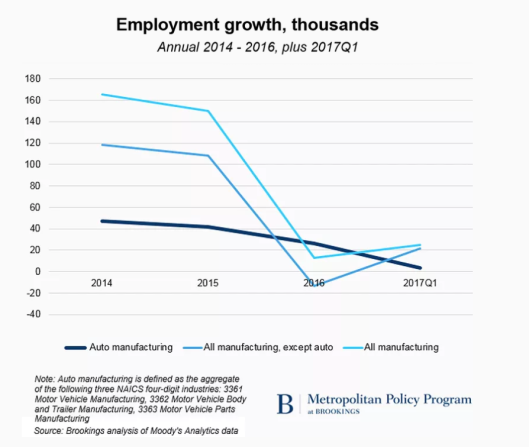

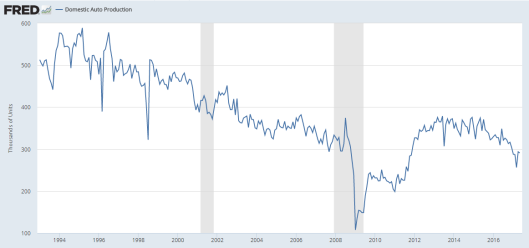

After seven years of strong growth following the 2008 economic crisis and federal bailouts of both General Motors (NYSE:GM) and Chrysler (NYSE:FCAU), auto sector output and employment growth have slowed markedly from record levels. Years of catch-up purchases by car buyers have finally plateaued. Likewise, automakers must economize to invest billions in developing the electric and self-driving cars of tomorrow.

And so the layoffs have begun. Last fall, Ford (NYSE:F) jolted the industry by revealing that its sales had peaked, while projecting a tough 2017. Then came the company’s April disclosure that it will need to slash $3 billion in costs to free up capital to invest in new technology. Soon after that came Ford’s announcement of as many as 20,000 layoffs worldwide, as well as word that GM had cut production at four U.S. assembly lines and would be laying off about 4,400 factory workers. Fiat Chrysler also laid off 1,300 workers at a Detroit assembly line.

By themselves, these announcements are not apocalyptic like the dire layoffs of 2008. Rather, the recent cuts mostly reflect the fundamentally cyclical nature of a huge consumer business. And yet, the present and future auto slow-down is a big deal because auto is critical to the manufacturing sector, which in turn looms large in regional and political narratives about whether the country is moving “in the right direction.”

Auto-related industries, after all, delivered about 40 percent of the nation’s manufacturing employment gains in the last two years, especially important given the slow growth of other production sectors in the face of a strong dollar. Focusing on just last year and the first quarter of this year, though, the data shows that auto represented fully 80 percent of U.S. manufacturing employment growth, even as auto hiring slowed significantly. Since then, the trend line has been blurry, but it’s unclear whether other industries—such as chemical manufacturing—are going to be able to pick up the slack from a likely auto-sector slowdown.

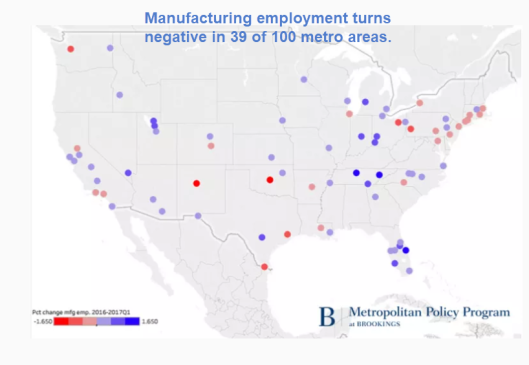

For a glimpse of what’s at stake, see here how manufacturing growth has turned negative in 39 of the nation’s 100 largest metropolitan areas in 15 months ending in March:

All those red dots suggest hazards are ahead: if layoffs accelerate in the auto sector, as they appear likely to, and no other manufacturing industries pick up the slack, scores of Midwestern and southern metropolitan areas and small towns—especially along Interstate 65 from the Great Lakes to Alabama—may have to deal with reduced help from what has been a steady source of decent employment, taxable sales, and economic momentum since the crisis. Such layoffs would be a disappointing headwind as more metropolitan areas in the industrial Midwest, for example, continue to reduce their unemployment rates—including via the interesting ways tracked by my colleagues Alan Berube and Cecile Murray.

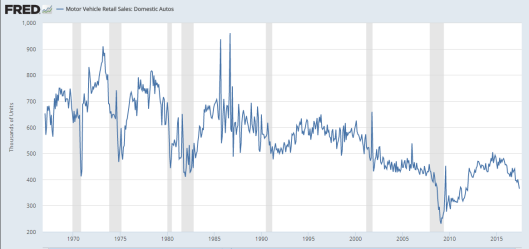

Motor Vehicle Domestic Car Sales

Domestic Auto Production

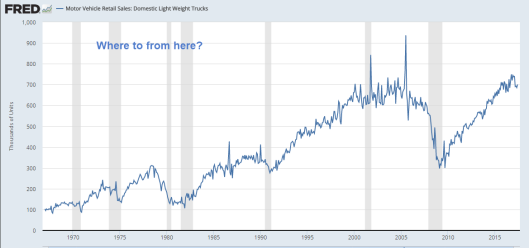

Domestic Light Truck Sales

The category of light trucks also includes SUVs. Who doesn’t have one that wants one and can afford one?

Used-Car Time Bomb

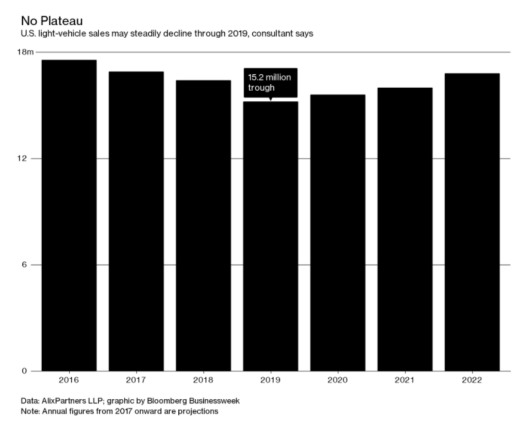

Bloomberg says Used-Car ‘Time Bomb’ Expected to Drag on U.S. Auto Sales.

It’s going to be tough to beat last year’s record U.S. sales of 17.55 million cars and trucks, according to a new study released Wednesday by AlixPartners. The consultancy expects a total of more than 1 million vehicles to come off lease last year and this year, creating a “used-car time bomb” that drags on demand for new autos. For the last 11 months, discounts on new vehicles have averaged more than 10 percent off the sticker price, a historical harbinger of automotive downturns, AlixPartners said.

Disruptive Changes Coming

- Huge disruptive changes towards self-driving vehicles are on the way.

- Those changes will not be here by 2019.

- Many of my readers doubt Ford’s announced 2020 date.

Eight Questions

- Presume Ford’s date happens. How many people want to buy a first generation self-driving vehicle?

- Presume Ford’s 2020 does not happen. How many people will wait until it does?

- Presume either way, how much more will these vehicles cost compared to used cars without self-driving features?

- Will the attitudes of millennials towards debt change in the next five years?

- Will the attitudes of millennials towards possessions like cars change in the next five years?

- Will the attitudes of millennials towards family formation (providing a need for larger cars) change in the next five years?

- Who is buying all these SUVs now? The answer is not millennials.

- Retiring boomers is one possible answer to question 7. Is it their last car perhaps?

Here’s a bonus question: Will Trump put in place steel tariffs further increasing costs of new cars?

Manufacturing Has Peaked This Cycle

Attitudes may change on a dime. So I do not have guaranteed answers to any of those questions.

Yet, many of the trends are clear and I expect them to hold.

The manufacturing picture I present is not pretty: Manufacturing has peaked for this economic cycle.