Auto stocks have started releasing their earnings reports for the second quarter ended Jun 30, 2017. Major auto companies, which have already released their earnings, are General Motors Company (NYSE:GM) , Ford Motor Company (NYSE:F) and PACCAR Inc. (NASDAQ:PCAR) .

Three major companies, expected to report results on Jul 28 are The Goodyear Tire & Rubber Company (NASDAQ:GT) , Tenneco Inc. (NYSE:TEN) and American Axle & Manufacturing Holdings Inc. (NYSE:AXL) .

Per the Earnings Outlook as of Jul 26, 171 members of the S&P 500 companies have already released their quarterly figures. The reported companies posted earnings and revenues beat ratios of 78.9% and 70.8%, respectively. Till Jul 26, 50% of the companies under the Auto, Tires and Trucks sector has reported earnings for the quarter ended Jun 30, 2017.

This reporting quarter, the earnings and revenue growth for auto stocks is however estimated to be in the negative territory. They are expected to register a decline of 0.4% and 4.5% in their earnings and revenues, respectively on a year-over-year basis. Though on the whole, S&P 500 companies are projected to witness a year-over-year gain of 8.7% and 4.7% in earnings and revenues, respectively.

Recent quarters have shown that the automotive companies are passing through a rough phase. High inventory levels and frequent model recalls are hitting their performance among other problems.

Also, the U.S. government’s plans of exiting the NAFTA agreement and introduction of tariffs might hurt the auto stocks.

Now, let’s take a look at how these three auto companies are placed ahead of their earnings release.

We relied on the Zacks methodology, which considers a favorable Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP, to predict chances of a beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Per our proprietary methodology, Earnings ESP shows the percentage difference between the Most Accurate estimate and the Zacks Consensus Estimate. Research shows that with this combination of rank and ESP, chances of a positive earnings surprise are as high as 70% for the stocks.

Headquartered at Lake Forest, IL, Tenneco is a leading manufacturer and supplier of emission control, ride control systems and systems for light, plus commercial and specialty vehicle applications. Currently, the company carries an Earnings ESP of +1.67% and a Zacks Rank #3. Our model conclusively predicts that the company is likely to deliver a positive earnings surprise in the second quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

Tenneco Inc. Price and EPS Surprise

The Goodyear Tire & Rubber Company is one of the world’s largest tire manufacturing companies that engages in selling tires, undertaking automotive repairs and providing other related services. Our model does not conclusively predict whether the company is likely to beat on earnings in the second quarter, as it currently has an Earnings ESP of -13.33% and a Zacks Rank #3. (Read more: Goodyear to Report Q2 Earnings: What's in the Cards?).

The Goodyear Tire & Rubber Company Price and EPS Surprise

American Axle & Manufacturing Holdings is a leading supplier of driveline and drivetrain systems, modules and components for the light vehicle market. Our model does not conclusively prove that the company is likely to surpass estimates in the reported quarter, as it currently has an Earnings ESP of -3.41% and a Zacks Rank #5. We caution against all Sell-rated stocks (#4 or 5) going into an earnings announcement.

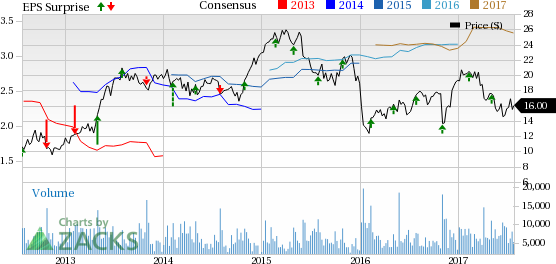

American Axle & Manufacturing Holdings, Inc. Price and EPS Surprise

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Ford Motor Company (F): Free Stock Analysis Report

PACCAR Inc. (PCAR): Free Stock Analysis Report

General Motors Company (GM): Free Stock Analysis Report

American Axle & Manufacturing Holdings, Inc. (AXL): Free Stock Analysis Report

Tenneco Inc. (TEN): Free Stock Analysis Report

The Goodyear Tire & Rubber Company (GT): Free Stock Analysis Report

Original post

Zacks Investment Research