- China Caixin Manufacturing posts slight growth

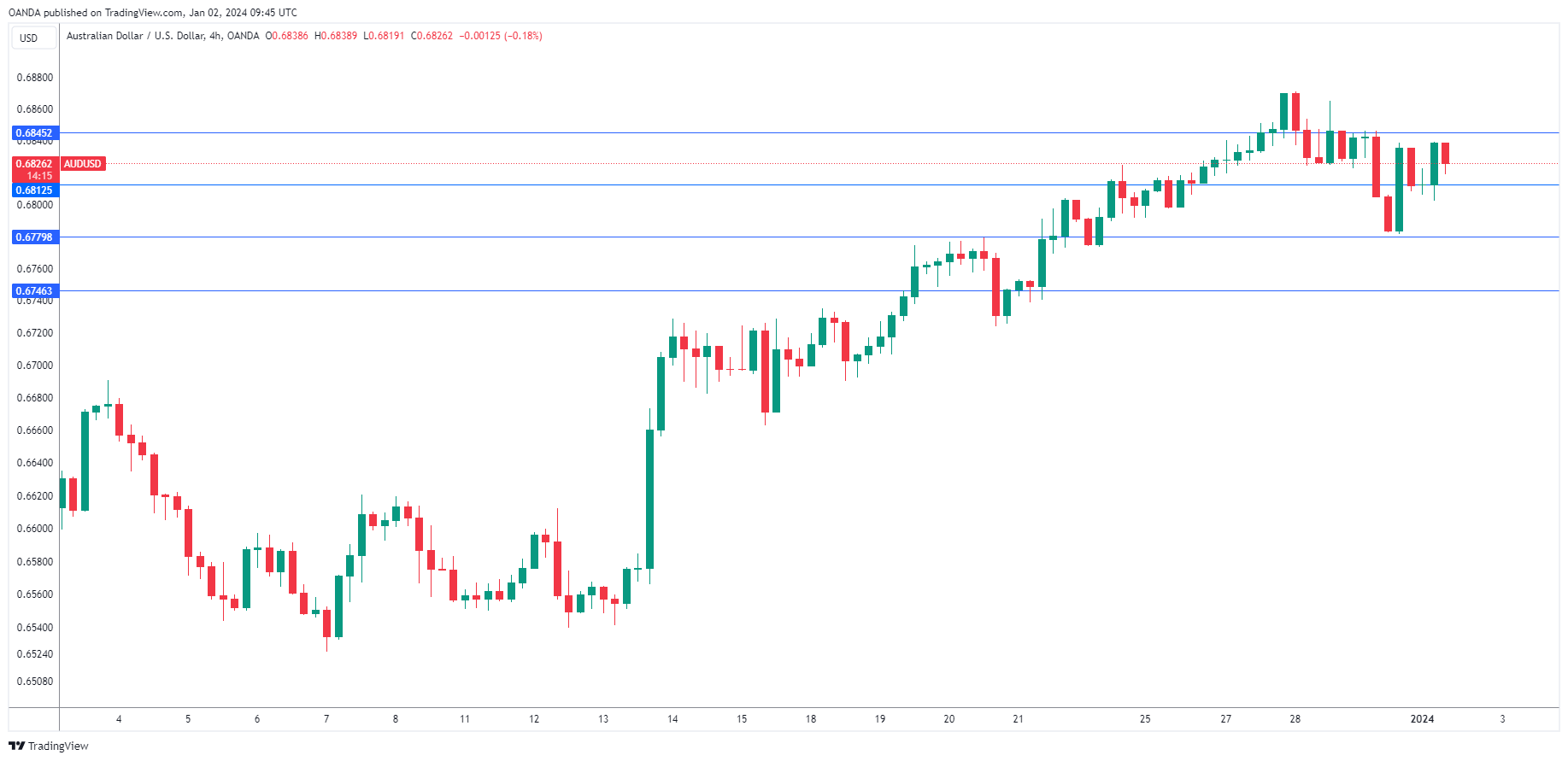

- AUD/USD is testing resistance at 0.6812. Next, there is resistance at 0.6845

- 0.6779 and 0.6746 are providing support

The Australian dollar is in positive territory on Tuesday. In the European session, AUD/USD is trading at 0.6826, up 0.22%.

The week between Christmas and New Year’s was subdued in the currency markets. Still, the Australian dollar hit a six-month high on Christmas Day, rising to 0.6871. The Aussie ended the year on a roll, gaining 3.1% in December.

China’s Caixin Manufacturing PMI ticked up to 50.8 in December, up from 50.7 in November and above the consensus of 50.4. This was the highest reading since August, but the reading points to stagnation in manufacturing. The reading was better than the official Manufacturing PMI release on Saturday of 49.0 which indicates contraction. The non-manufacturing PMI edged up to 50.4, compared to 50.2 in November. Activity in the non-manufacturing sector has been minimal over the past six months, as China remains mired in an economic slowdown as we move into 2024.

Where is RBA Headed?

The Reserve Bank of Australia meets next on February 6 and it’s anyone’s guess what the central bank has in mind for 2024. The RBA has raised interest rates just once since June and held the cash rate at 4.35% at the December meeting. It’s likely that the RBA is done with raising rates, but the timing of a rate cut is unclear. Many economists are circling September for the first rate cut, while Bank of America is predicting a rate cut only in 2025. The markets are more optimistic and have priced in a rate cut in mid-2024.

What all the views can agree on is that the inflation rate will play a critical role in determining the RBA’s rate path. Inflation has fallen to 4.9% but remains much higher than the RBA’s target band of 2-3%. Australia will release the December inflation report on January 10 and the release should be treated as a market-mover.