The Australian dollar has recently been on a strong bullish march following slipping sentiment in the US dollar. However, some concerning fundamental factors are impact the pair in the short term and the rally has inevitably stalled. Subsequently, the question remains as to which way for the little Aussie battler in the short term.

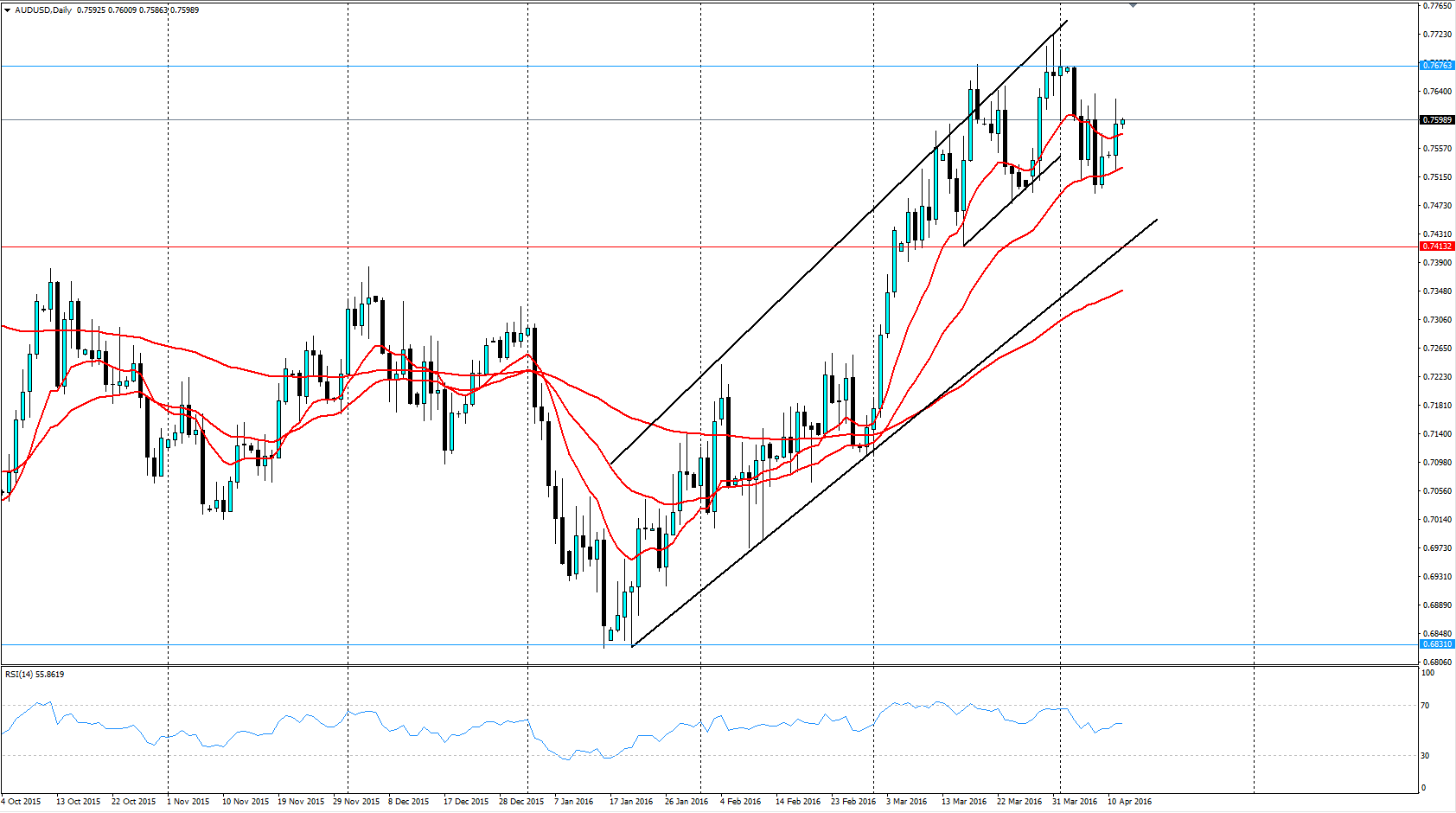

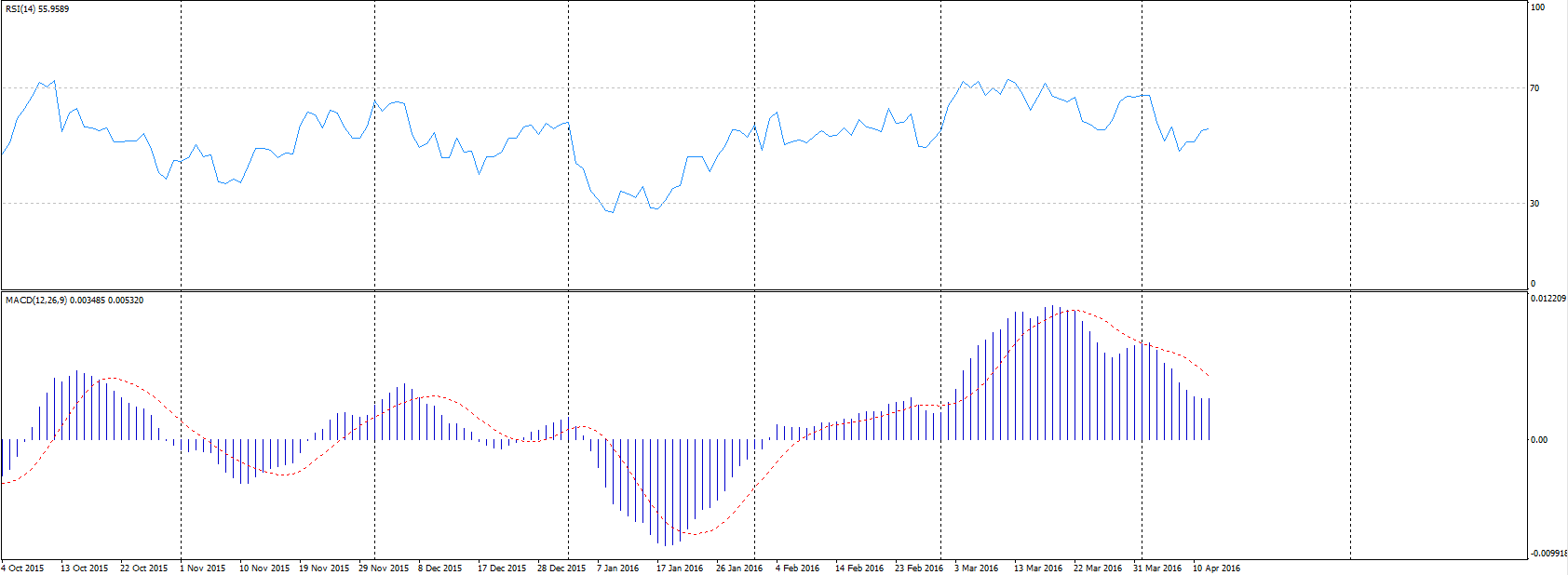

Taking a look at the Aussie dollar’s technical indicators appears to confirm an intraday neutral bias. Despite some sharp selling pressures following last week’s RBA rate decision, the pair has managed to keep the key 0.7476 support level intact. However, the pair is still facing some sharp divergence in the 4-hour MACD which could be signalling a short term top starting to form.

On the upside, the pair’s daily RSI oscillator is still within neutral territory, which means that the recent consolidation has given the indicator some room to move. However, the upside might be relatively limited with a key Fibonacci retracement level at 0.7849 likely to cap any further upside moves.

A downside move would likely face some relatively strong support from the bottom of the swing candle from late march, at 0.7476. On extension, the next relatively strong reversal zone is the 55 Day EMA which currently ranges around the 0.7402 mark. Subsequently, there is also plenty of reason to believe that a bearish move would like reverse close to the key 74 cent handle.

Ultimately, given the lack of a strong trend, the pair’s technical indicators lend themselves to wards a neutral intraday bias. However, the long term view still presents a bearish contention given that price action is still contained within a long term falling channel. Subsequently, any moves within this channel are likely to be short term corrective in nature until a confirmed break of the trend occurs.