If you have been watching the Australian dollar move on the charts lately, it has been a little confusing and at times going against market consensus, or even the Reserve Bank of Australias (RBA) consensus for that matter. As the Australian dollar, which has been the king of the trend has lacked any sort of direction in the marketplace.

So what’s going wrong, and what can we expect from the Australian dollar in the coming week, which is going to be one of its biggest weeks this month.

The RBA statement – the all knowing neutral one. The RBA has spent a lot of time looking at the markets, and commenting on them. That is great if you’re trying to get a point across, and their point has been very clear for some time that the AUDUSD is clearly overvalued and that they would love to see it shift lower to help an economic recovery in the Australian market. The only problem is you can talk a lot, but if you don’t back it up with action it does not really work in the long run. The tone, though today was off jawboning the currency and instead putting the focus back on their current strategy of sitting and waiting in the present climate.

Trade balance data was positive coming in at -1.68b today, which was much better than expected. However, long term trends of negative trade balance data can have long ranging consequences for economies such as Australia and it’s likely the RBA will be taking notice as a result.

The unemployment rate will be the next thing to watch on the charts for the Australian dollar in terms of market movements. Over the last two years we have seen the unemployment rate lift from 5.0% to 6.0%, which is a large rise and prompted concerns over the stability of the Australian economy. Any further rise might actually have an impact on the AUD itself, and may even force it lower.

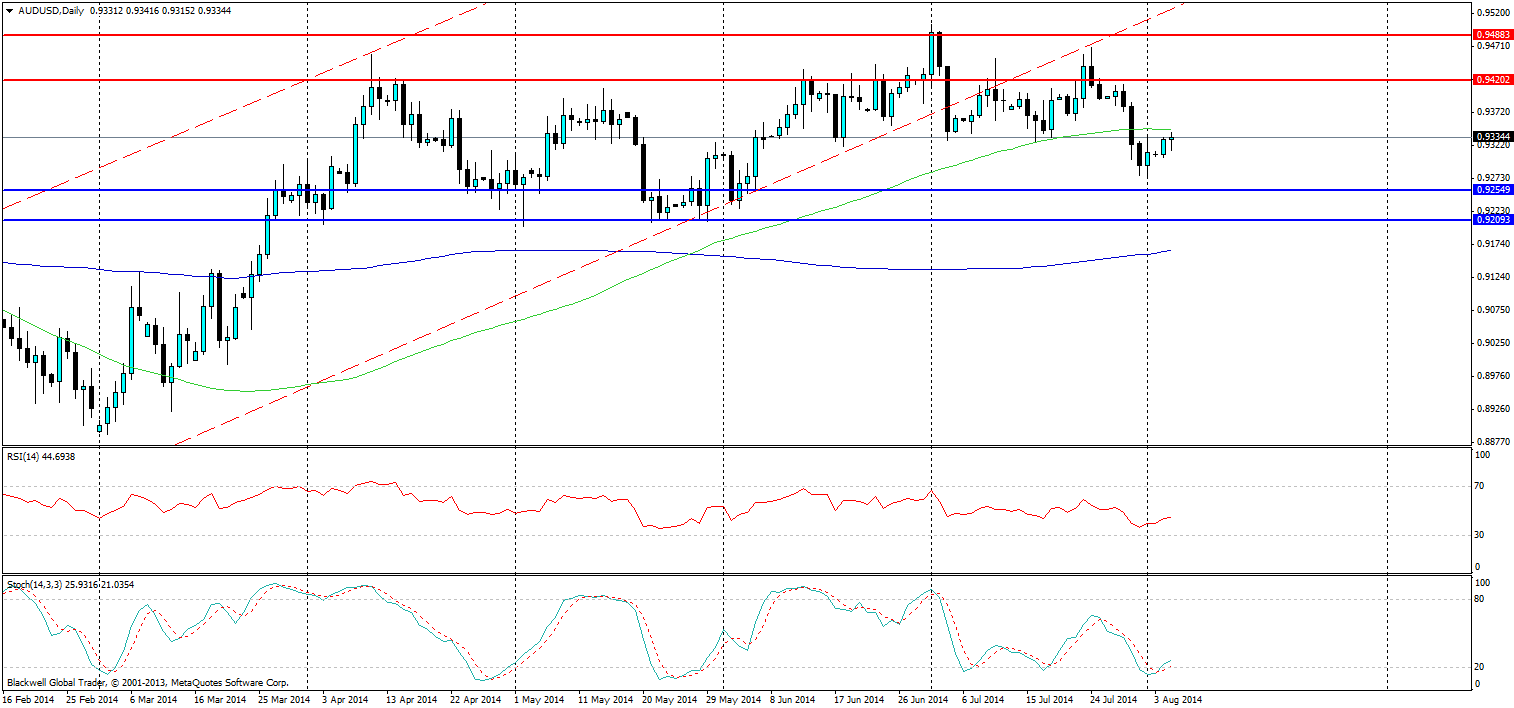

At present there are strong support and resistance levels on the AUDUSD chart, which in turn has led to the formation of a ranging pattern. This uncertainty is not surprising given the neutral stance from the RBA and many are now waiting to look for patterns to form, and after todays small movement it may take some more time for anything to appear technically.

Overall, the AUDUSD seems primed for further falls when it moves out of this ranging pattern. Current market movements have been positive for the US dollar at present, and coupled with a weaker Australian economy we should see shifts lower. The key thing though will be interest rates, if the RBA keeps interest rates flat we are likely to see buying of the AUD as carry traders look to take advantage of the situation to profit.