AUD/USD: Longs In Good Shape, Eyes On Jobs Report Now

- The Australian dollar jumped on Tuesday on rising appetite for the high-yielding currencies and as the greenback edged away from a seven-month peak after recent gains.

- Reserve Bank of Australia Governor Philip Lowe noted core inflation of 1.5% was well below the target band of 2% to 3% and looked set to remain low for some time. “Achieving the quickest return of inflation back to 2.5% would be unlikely to be in the public interest if it came at the cost of a weakening of balance sheets and an unsustainable build-up of leverage in response to historically low interest rates,” Lowe told an investment conference. "Conversely, the case for moving more quickly would be strengthened in a world where the labour market was deteriorating and people were having increasing difficulty finding jobs."

- Consumer prices rose a meagre 1% in the year to June while core inflation hit a record low at 1.5%, well below the RBA's target band of 2% to 3%. Figures for the third quarter are due next week and are expected to show core inflation stayed stuck around 1.5%. Lowe said: “The experience elsewhere suggests that we do need to guard against inflation expectations falling too far, for if this were to occur it would be more difficult to achieve the inflation target.”

- Overall, Lowe said the Australian economy was performing "reasonably well" with a long slump in mining investment past its worst and growth set to benefit from a recent rise in prices for resource exports. Lowe said data on the labour market had been more mixed, with unemployment drifting lower but new jobs weighted heavily to part-time work and wages growth still weak. The next report on employment is due on Thursday and the market expects a slight rise in the jobless rate to 5.7%.

- Newly-released minutes of the RBA's October policy meeting said coming data on inflation and employment will be critical for decisions at its next meeting on November 1, opening the door to possible policy easing. However, for our economists monetary easing in Australia is still a distant possibility. The market also does not believe in a rate cut in November. Interbank futures imply only a 16% chance of a cut in the cash rate next month.

- The AUD is among the best performing major currencies this year, up more than 5% against the USD. Much of the gain is due to carry trades where investors borrow in currencies seen as safe havens such as the JPY or the EUR to invest in high-yielding assets. A recent rebound in prices of iron ore and coal - Australia's two largest exports - has also helped the Aussie.

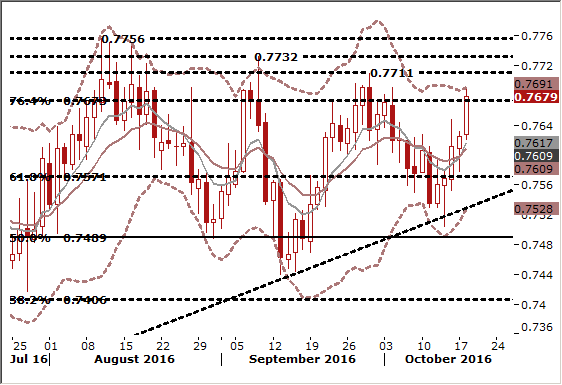

- Our long-term AUD/USD position is in good shape and relatively dovish comments from Lowe supported also our short-term outlook. Our view on the AUD/USD remains bullish. There are some strong resistance levels ahead: September 29 high at 0.7710, September 9 high at 0.7732 and August 10 high at 0.7756. We need good employment report on Thursday to break above this resistance and our forecast is slightly better than market consensus.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.