The Australian dollar continues to post gains this week, and has recovered all of last week's losses. In Tuesday's trading, the AUD/USD is in the low-0.89 range. In economic news, Australian Private Sector Credit showed no change in November, posting another gain of 0.3%. In the US, today's highlight is CB Consumer Confidence. The markets are expecting an improvement in the upcoming release.

The first US release of the week did not impress, as US Pending Home Sales gained just 0.2% in November. This was well short of the forecast of 1.1%. However, the modest gain did break a string of five straight declines, so perhaps the key indicator has turned the corner on its recent downward spiral. Last week’s housing data looked much stronger, as New Home Sales beat the forecast.

Late last week, Unemployment Claims bounced back nicely following two disappointing releases. The key employment indicator fell to 338 thousand, compared to 379 thousand in the previous release. The estimate stood at 346 thousand. With the Federal Reserve poised to begin its long-awaited QE taper next month, employment releases have taken on added significance. If the US labor market continues to improve, the Fed could decide on another taper early in 2014, which would give a boost to the US dollar against its major rivals.

There was some holiday cheer from US releases last week, as manufacturing and housing numbers pointed upwards. Core Durable Goods Orders posted a strong gain of 1.2%, its best showing since April. The key manufacturing indicator had posted four consecutive declines, so the sharp gain was welcome news. Durable Goods Orders bounced back from a sharp decline in October with a gain of 3.5%, well above the estimate of 1.7%. New Homes Sales also impressed with a five-month high, climbing to 464 thousand. The estimate stood at 449 thousand.

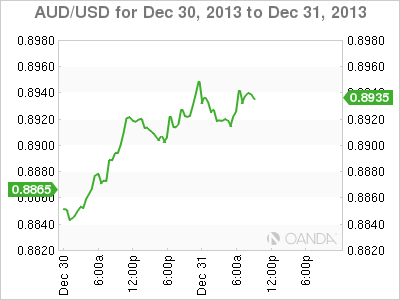

AUD/USD for Tuesday, December 31, 2013

AUD/USD Daily Chart" title="AUD/USD Daily Chart" width="400" height="300" align="bottom" border="0">

AUD/USD Daily Chart" title="AUD/USD Daily Chart" width="400" height="300" align="bottom" border="0">

AUD/USD December 31 at 13:20 GMT

AUD/USD 0.8938 H: 0.8949 L: 0.8912

AUD/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.8658 | 0.8735 | 0.8893 | 0.9000 | 0.9119 | 0.9229 |

- AUD/USD has posted slight gains in Tuesday trading. The pair lost ground in the Asian session but has since recovered.

- On the upside, the next resistance line is at the round number of 0.9000.Will the pair put pressure on this key level? This is followed by 0.9119.

- On the downside, 0.8893 has reverted to a support role as the Australian dollar has moved higher. The next support level is 0.8735.

- Current range: 0.8893 to 0.9000

Further levels in both directions:

- Below: 0.8735, 0.8658, 0.8505 and 0.8411

- Above: 0.8893, 0.9000, 0.9119, 0.9229 and 0.9305

OANDA's Open Positions Ratio

AUD/USD ratio is unchanged in Tuesday trading. This is not consistent with what we are seeing from the pair, as the Australian dollar has posted slight gains. The ratio is made up of a substantial majority of long positions, reflecting a trader bias towards the Australian dollar moving higher against the US currency.

The Australian dollar has moved higher this week, and is back above the 0.89 line. We could see some stronger activity from the pair in the North American session, as the US releases key consumer confidence data.

AUD/USD Fundamentals

- 00:30 Australian Private Sector Credit. Estimate 0.4%. Actual 0.3%.

- 14:00 US S&P/CS Composite-20 HPI. Estimate. 13.4%.

- 14:45 US Chicago PMI. Estimate. 61.3 points.

- 15:00 US CB Consumer Confidence. Estimate. 76.5 points.

*Key releases are highlighted in bold

*All release times are GMT

Disclosure: This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.