The AUD is looking a little turbulent after this morning’s Chinese announcement that manufacturing contracted for the 5th time in a row according to HSBC’s manufacturing PMI. Rightfully so, as exports to China total 78.7 billion dollars and contribute 26.2% of its total exports, according to the Australian department of Foreign affairs and trade.

Any minor contraction in China certainly has a ripple effect into the Australian economy which relies so heavily on them. But markets are fickle about it at this stage and had already priced in Chinese weakness so the movement overall was moderate at best.

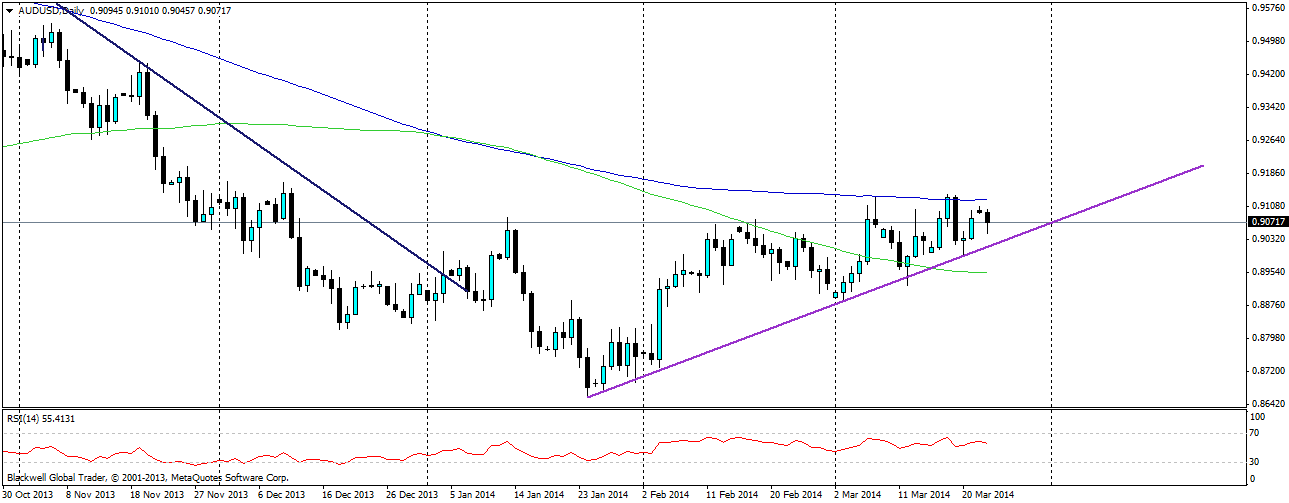

Source: Blackwell Trader

Despite the downward trend on today’s candle with the PMI results, it is important to note that the AUD is not in a steep decline at all, in fact, when we look at the charts, we can clearly see a trending market which has formed over the last month.

The week ahead is set to be a little slow for Aussie news after China PMI and the RBA speaks. Despite strong jawing being a possibility, markets have so far seen it as hollow as the RBA has yet to take action or join in the global stimulus to prop up developed economies. Any talk will most likely be shrugged off in the market and it will resume trading on the technical aspect.

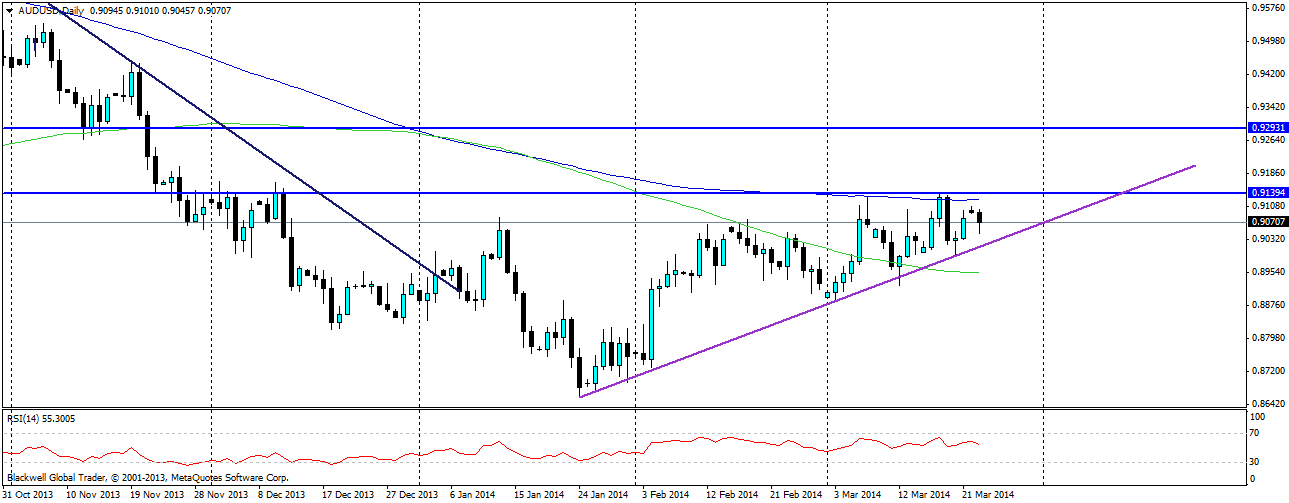

Source: Blackwell Trader

Markets will now be looking for a solid point to trade off when it comes to resistance levels and the next two serious levels can be found at 0.9139 and 0.9293. Both are likely to act as hard levels of resistance though the 0.9139 level will be the most heavily tested. This could lead to a breakdown through the trend line if the markets feel it’s too high given the current state of the Australian economy – which would not come as a surprise.

Support levels are likely to be found on the trend line in this case and in any scenario, I would be looking for stop losses at the trend line.

Despite all of this, the RSI still remains high, showcasing strong buying pressure in the trending pair as it looks to head upwards on the trend line. The slope is not steep which indicates strength, and it has been tested on numerous occasions. Certainly, it’s important to watch this one in the short to medium term especially if you’re looking to catch the trend. A small caveat would be –don’t try and time the market, especially the AUD, as it's not that black and white and fighting the trend could be a costly mistake in this case.