Ashland Global Holdings Inc. (NYSE:ASH) announced that it will raise the price of products that have industrial applications by up to 15%. These products include Advantage and Drewplus foam control agents, Aquaflow rheology modifiers, Dextrol and Strodex phosphate esters, Galactasol guar derivatives, Iron Micropowders, Philex pH neutralizers, Polyvinyl Pyrrolidone and derivatives, and Vinyl Caprolactam.

The price increase will be effective immediately or as contracts permit. Per the company, the hike was owing to continued rise in raw material and supply chain costs.

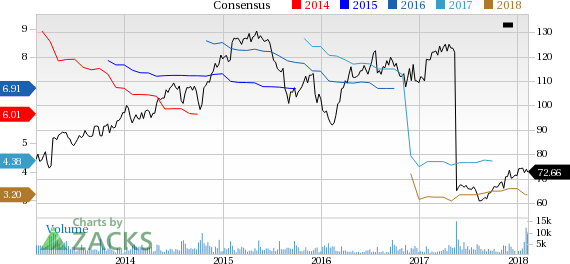

Shares of Ashland have declined 38.4% over a year, significantly underperforming the industry’s 0.4% gain.

Ashland lagged earnings and sales estimates in the first quarter of fiscal 2018 (ended Dec 31, 2017). In the quarter, the company’s adjusted earnings came in at 46 cents per share, missing the Zacks Consensus Estimate of 47 cents.

Revenues increased roughly 19.6% year over year to $842 million. The figure, however, trailed the Zacks Consensus Estimate of $860 million.

For fiscal 2018, Ashland updated its adjusted earnings outlook to a range of $2.90-$3.10 per share owing to changes in the company’s effective tax rate. Also, the company raised its effective tax rate expectation for the fiscal year as a result of the recently enacted tax reform. This, in turn, is expected to reduce fiscal 2018 adjusted earnings by roughly 30 cents per share.

For second-quarter fiscal 2018, Ashland projects adjusted earnings in the range of 80-90 cents per share compared with 70 cents in the prior-year period.

Zacks Rank & Stocks to Consider

Ashland has a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the chemical space are Methanex Corporation (NASDAQ:MEOH) , LyondellBasell Industries NV (NYSE:LYB) and Air Products and Chemicals Inc. (NYSE:APD) .

Methanex has an expected long-term earnings growth rate of 15% and a Zacks Rank #1 (Strong Buy). Its shares have rallied 19% over a year. You can see the complete list of today’s Zacks #1 Rank stocks here.

LyondellBasell has an expected long-term earnings growth rate of 9% and a Zacks Rank #2 (Buy). Its shares have gained 19.6% in a year.

Air Products has an expected long-term earnings growth rate of 14.2% and a Zacks Rank #2. Its shares were up 12.6% over a year.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Air Products and Chemicals, Inc. (APD): Free Stock Analysis Report

Ashland Global Holdings Inc. (ASH): Free Stock Analysis Report

Methanex Corporation (MEOH): Free Stock Analysis Report

LyondellBasell Industries NV (LYB): Free Stock Analysis Report

Original post

Zacks Investment Research