Vladimir Putin kills puppies.

Ok, that comment probably needs a little context. The president of Russia does not personally murder small dogs for sadistic pleasure. But in preparation for the winter Olympics, the Sochi city government has culled the local stray dog population by poisoning their food.

An authoritarian regime can lock political dissidents in jail and commit untold numbers of human rights abuses. But poisoning dogs by the hundreds just seems…well, for lack of better word, mean.

Sochi’s dogs are not the only ones at risk these days. 57% of Americans believe that a violent act of terrorism at the games is likely. And pity the poor residents of Sochi itself. Human Rights Watch has an entire webpage dedicated to listing out human rights abuses in the lead up to the games, including everything from forced evictions of locals, abuse of migrant workers, and intimidation of the media.

But while all of this might make Russia an unpleasant place to live, none of it necessarily makes Russia a bad investment destination, does it? After all the bad press Russia is getting, might Russian stocks be a decent contrarian investment?

Look At The Numbers

Russian stocks are definitely cheap. By Financial Times estimates, Russian stocks trade for just 5.6 times earnings. Taking a longer view, looking at the Shiller Cyclically Adjusted Price/Earnings ratio (or CAPE), you get a multiple of just 6.96 times earnings, making it the second-cheapest market in the world after Greece.

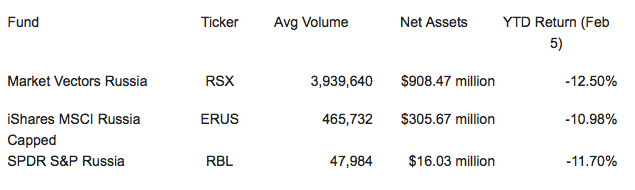

But what exactly are you buying when you buy Russian stocks? Let’s take a look under the hood at the ETFs that track the Russian market: the Market Vectors Russia ETF (RSX), the iShares MSCI Russia Capped Index (ERUS) and the SPDR S&P Russia (RBL).

A few points immediately jump off the page. The Market Vectors Russia ETF is substantially bigger and more liquid than the other options. Its assets under management are nearly three times bigger than that of the iShares MSCI Russia ETF, and its daily trading volume is more than eight times bigger. Its performance year to date is the worst of the three, yet the differences are minor.

I’m also inclined to lean toward the Market Vectors Russia ETF over the competitors because I consider the portfolio weights to be more reasonable. For example, OAO Gazprom (GAZPq)makes up nearly 21% of the iShares MSCI Russia ETF and nearly 18% of the SPDR S&P Russia ETF. But its weighting is limited to only 9% of the Market Vectors Russia ETF. RSX clearly gives the best diversification of the lot.

Should You Buy Russian Stocks?

Well, they’re cheap. But then, Russian stocks are almost always cheap. That 6.96 CAPE valuation I mentioned is only slightly lower than the 8.51 long-term average for the country. And while Russia still has a long way to go before it could be considered non-hostile to investors (let alone shareholder friendly), Russian stocks are boosting their dividends these days and making an effort to soften their images.

Ultimately though, a bet on Russia is a bet on energy prices. Energy stocks make up 40%-50% of the portfolios of each ETF, so as goes energy so goes Russia. Given that non-traditional production has made the United States the world’s largest oil producer and that new oil and gas discoveries in Argentina, Brazil and the Eastern Mediterranean, among others, promises to flood the globe with cheap energy for the foreseeable future, betting on Russian energy—which Russia has been known to use as a political weapon—it’s hard to see a catalyst here that will shake Russian stocks out of their perpetual cheapness.

Charles Lewis Sizemore, CFA, is the editor of Macro Trend Investor and chief investment officer of the investment firm Sizemore Capital Management.

This article first appeared on InvestorPlace.