In my latest article I put forward two ideas: 1) That innovation in the global automotive industry pays off as shown by the performance in the stock market of the world´s most ground-breaking car makers over the last five years or so. 2) That to warrant its effectiveness, innovation should be viewed as a way of living, rather than a static phenomenon.

The first argument was based on my own tracking of the six auto giants most interested in making a transition to electric propulsion over the mentioned time span:

"In the last five years or so, Hyundai and Kia have been characterized as two of the most innovative automotive companies in the world. In a number of blogs and articles, I have advanced the idea that innovation does indeed pay off. It did so in the case of General Motors when it decided to launch the Volt right in the middle of the most severe financial crisis it had ever faced. Something similar occurred with Hyundai and Kia when they launched the Sonata hybrid and the Optima hybrid with Li-ion batteries. And, of course, Nissan (NSANY.OB) also had its share in the reputation pie when it surprised the world with its all-electric Leaf."

The second line of reasoning also resulted from my personal observation of the behavior of the mentioned car makers over the last four years or so:

"What really makes a difference between Hyundai (005380.KS) and Kia (000270.KS) and the other two car makers - and indeed Toyota (TM) and Honda (HMC) as well - is that the innovation track is not a static phenomenon but - in fact - a way of living."

By the time I was writing my piece, I had no reference of two other contributions that make - by separate - somewhat similar points.

In effect, in a paper published in 2009 by the USC Marshall School of Business, Ashid Sood and Gerard Tellis argue that "the market´s true appreciation of innovation can be estimated by assessing the total market returns to the entire innovation project". They demonstrate their contention by studying 5,481 announcements from 69 firms in 5 markets and 19 technologies over the period 1977-2006. However, their entire approach is based on expected monetary returns, failing to explain why certain kinds of innovations (e.g. green innovations) may give firms a sense of prestige and status which could in turn lead investors to increase their bets on the stock exchange market. So the main thrust of my argument here was that the market either rewards or penalizes companies depending on how innovative they are. The reasoning worked fairly well to explain why Kia and Hyundai beat up not only Nissan and GM but also Toyota and Honda in the stock exchange market during the last five years or so. As a postscript, I didn't pursue a separate assessment in relation to Kia and Hyundai because the first is a subsidiary company of the second.

Similarly, in another article published this month by the Journal of World Business but already available online in February 2012, Won Shul Shim and Richard M. Steers find that "Toyota competes both strategically and managerially by emphasizing planning and work systems to mitigate the impact of any turbulence in the external environment (stability is key), while Hyundai competes by accepting environmental uncertainty and risk as a part of normal daily operations (flexibility is key)." Thus what I call static innovation would be thought of as stable leadership, whereas dynamic innovation (in my terms) may constitute flexible leadership by the authors of that article. Nevertheless, they don´t seem to be aware of the fact that the different ways to look at innovation did indeed produced opposing results in the market place. Hence statements such as the following are completely out of context, to say the least:

"Both strategies have proven to be effective for their particular and unique environments. In the final analysis, the key issue is congruence, and both companies have achieved this goal."

"Both are successful, but each is very different. And what is the relationship between this symmetry, or lack thereof, and leadership behavior?"

"In the final analysis, Hyundai and Toyota have each discovered a way to compete successfully-albeit differently-in the same competitive environment."

"As was seen in this study, Toyota and Hyundai took somewhat different approaches here and both seemed to work, but for different reasons."

Now I would like to take up the subject to talk about the two electronic giants of the moment: Apple and Samsung. The analysis couldn't be more timing considering two important recent events: The verdict of a trial giving $1 billion in compensation to Apple (AAPL) for apparent imitation of products on the part of Samsung (005930.KS) and the launch of the iPhone5 by Apple. No doubt the comparison is also most relevant if they can be considered - nowadays - as two of the most innovative firms in the world.

This article is not about the determinants of innovation but about its consequences. Still, while innovation can explain why companies increase in value in the stock exchange market, this argument doesn't contribute to showing why some innovative companies perform relatively better than others.

In what follows I will argue that this pertains to the form or character of innovation - and to be more accurate - to the place it occupies in the business strategy of any company.

As I have indicated above, innovation should be considered as a way of living for corporations around the world. But this means at least two things.

It signifies not only that to be competitive companies need to be investing in research and development (R&D) all the time but also that they have to afford sometimes huge R&D programs, which are not likely to succeed immediately. But why should they make such investments? Well, because in today's highly competitive world you both need to be innovative and also seem like you are innovative. Here is where reputation comes into play. From a slightly different perspective, I first suggested the role of reputation in technological innovation in a blog published almost three and half years ago. A second example in this direction might be my article on Apple´s announcement about the filing of two fuel cell patent applications that could radically change the prospects for lithium demand in the coming years.

Another important aspect to innovation is that new technologies - especially in the electronics sector - have to be fun and entertaining, not boring. Following the Global Innovation Index 2012, for example, "innovation is not just about science and technology-it is about arts and culture as well." This study goes on to mention two examples of the symbiotic relationship between technological development and arts, namely the videocassette recorder (VCR) which led to new markets for movies and television, and computer animations which remained a toy for artists until the appearance of the animation film studio Pixar. Furthermore, due to internet, "more music, video, written works, and other content are published now than ever before." As a result, between 1998 and 2010 the value of the global entertainment industry grew more than 40%. In this context, according to "The Sky is Rising", a new report on the entertainment industry, Apple pioneered, for example, in: (i) convincing music labels to sell songs for 99 cents; (ii) providing convenient "1-click" shopping experiences; (iii) using music to promote the sales of its products; and (iv) introducing the iOS line of devices, one of the most popular platforms for games today, which eventually increased the number of games available to download from 6,000 in July 2008 to over 90,000 towards the end of 2011. Somewhat surprisingly, there is no mention of Samsung in this report. Does this means Samsung is lagging behind Apple by all means insofar as the entertainment industry is concerned? As I will try to demonstrate later, this may not necessarily be the case.

Let´s now analyze the two events I mentioned earlier. To begin with, assuming the appeal Samsung appears to have filed in regard to the $1 billion verdict doesn't finally make any progress and the whole issue is definitely settled in favor of Apple, we may come to the conclusion that Samsung did - in fact - not make sufficient effort to introduce a really new product into the market, preferring instead to rely to some extent on a previously existing model which happens to have been developed by Apple. Still, the verdict is consistent with the results of a recent article published by Design Studies earlier this year on a method for exploring similarities and visual references to brand in the appearance of smart phones produced by Apple and Samsung.

As shown in Figure 1, Apple built its image over the last twenty years or so but began augmenting its value in the stock exchange market only in 2005. For more than twelve years, Apple´s shares never surpassed the $50 barrier; on October 19, 2012 they closed at $610. This confirms my presumption that during a rather prolonged period of time Apple had to invest a considerable amount of money to gain sufficient reputation in the electronics industry.

Figure 1

Evolution of Apple in the stock exchange market

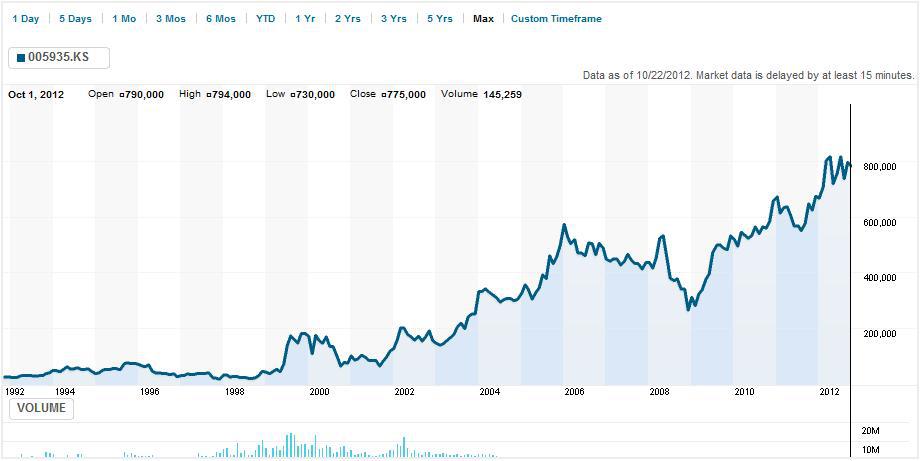

By contrast, Samsung´s evolution over the same time spam in the stock exchange market was somewhat more regular (See Figure 2). It shows first a rather short investment period (six and a half years) during which Samsung´s shares never reached the ₩40 level, and then a long period in which its shares reflected a clear upward trend despite some downturns to end up on October 22, 2012 at ₩774. Hence Samsung didn't´t seem to care much about reputation probably focusing more on earnings and profits instead. This behavior is consistent with the approach already suggested by Shim and Steers (cited above) who also refer to Apple as an example of a company that faces "continual chaos", namely a strategic model characterized by its reliance on new technologies, new entrants and new products, and to Samsung as a firm following a hybrid model of Japanese and Western systems which, by and large, seems more static and conservative. Is this the end of the story? Not quite. We need to look at the second event I referred to earlier.

Figure 2

Evolution of Samsung in the stock exchange market

More and more critical voices of the iPhone5 launched by Apple on September 24, 2012 are accumulating, many of which have stated that the device is an example of what may be considered boring technology. One part of the explanation might be that in recent years growth of Apple´s expenditures on R&D has not kept pace with growth of the world´s most valued company. Another, that Apple simply thought that its shares would continue growing no matter what. In this connection, the new maps app in iPhone5 was a real embarrassment for Apple. But, that may not be the only motive why the electronic giant should be worried: A recent report by phonebuff.com has argued that there are 50 reasons why Samsung´s galaxy s3 beats iPhone-5. As it turned out, in the last month or so the market started to penalize Apple, while Samsung appears to have initiated a new positive trend (See: Figure 3).

Figure 3

Apple and Samsung Compared

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Apple Vs. Samsung: Should Innovation Be Viewed As A Way Of Living?

Published 10/28/2012, 07:27 AM

Updated 07/09/2023, 06:31 AM

Apple Vs. Samsung: Should Innovation Be Viewed As A Way Of Living?

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.