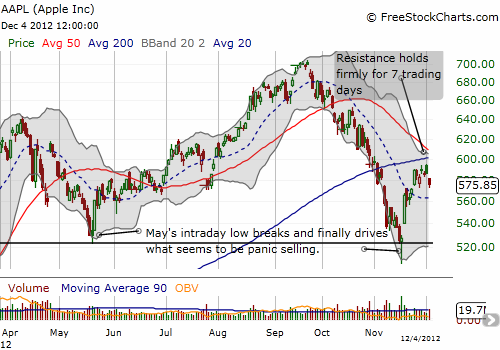

In one month, Apple (AAPL) has gone absolutely nowhere while remaining under critical resistance at the 200-day moving average (DMA). In between, AAPL printed an impressive hammer which created a bottom in the stock right above the $500 level. The hammer pattern printed what now looks like a classic washout day of selling where volume surged just as the stock broke very critical support formed by the May low.

I interpreted the stall at resistance as an opportune time to finally buy puts (put spread). I actually managed to avoid puts during most of Apple’s slide into the bottom. But I consider myself now awakened to real downside risks. In the meantime, I am holding firm to my small handful of shares.

Priceline.com (PCLN)

I have not paid enough attention to PCLN since its big earnings pop on November 2nd. If I had, I would have noticed the bullishness of the breakout above the previous downtrend line from all-time highs. I would have noticed how the subsequent pullback found support exactly at the former downtrend line. Well, I am now paying much closer attention as PCLN has broken out above its 200DMA for the second time in a month. After cratering to support from the 2012 breakout line, PCLN finally seems to be on the mend, ready to return to its stubbornly bullish ways.

Siemens Atkins (SI)

Siemens (SI) remains my favorite European stock. The euro has been creeping upward and Siemens has kept knocking on the upper bound of a three-month trading range. It is now closer than ever to a big breakout after printing a false breakdown below the 50DMA that ended in a hammer pattern puncturing through the lower-Bollinger Band. That move was a promising sign of a washout of sellers that can clear the way for an extended rally.

If the breakout does not happen this week for SI, I will have to pull in my horses and await a new buying opportunity.

Be careful out there!

Disclosure: Long AAPL shares and put spread, long SI calls.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Apple At Resistance, Priceline.com And Siemens Break Out

Published 12/05/2012, 05:54 AM

Updated 07/09/2023, 06:31 AM

Apple At Resistance, Priceline.com And Siemens Break Out

Apple (AAPL)

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.