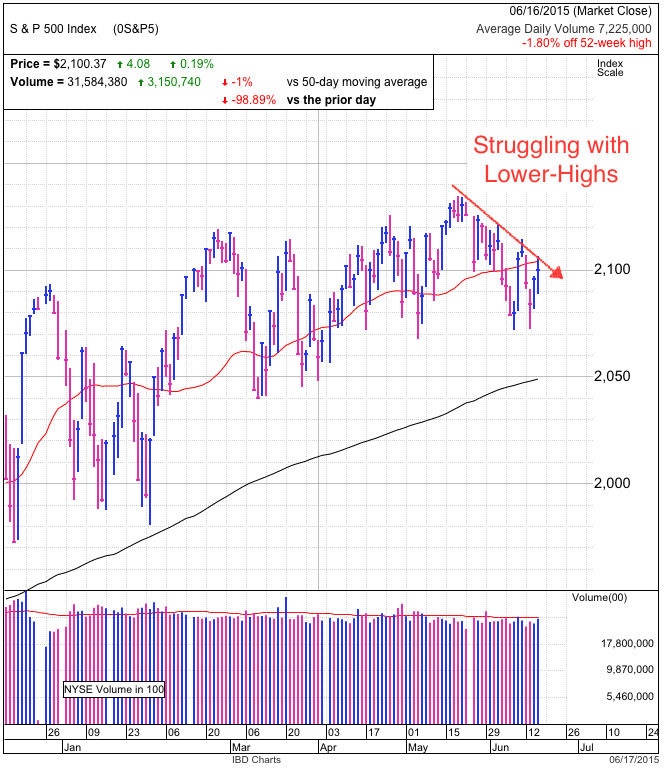

It was a volatile Fed day yesterday, with strong intraday moves in both directions, but the S&P 500 only managed to hang on to a four-point gain by the closing bell. Volume was the highest in a week, but still repressed by the typically slow summer season.

The Fed didn’t say anything that surprised us which is why we finished near where we started. It would have been foolish to expect anything else since every other Fed statement this year failed to break us out of this trading range.

The policy remains accommodative, but expect a token rate increase before the end of the year. While many speculators are afraid of rate hikes, the far bigger shock to the system was ending the Fed’s bond buying program last year. Not only did we survive that, but the market is up more than 15% from when the Taper started. Going from 0% to 0.25% in short-term interest rates is trivial in comparison to ending a trillion-dollar money printing operation.

The game of chicken in Greece continues as their politicians refuse to compromise and European leaders are reluctant to call their bluff. Some analysts claim the probability of a Grexit is now up to 50%. This is weighing on European markets, but the S&P 500 is less than 2% from its all-time highs. Similar headlines five-years ago sent shockwaves through the market, but this time the risk is far less since the financial system has had plenty of time to manage and hedge the risk posed by a Greek default. While we should expect some near-term volatility, the market holding near the highs tells us these problems in Greece are already priced in.

Individual Stocks:

AAPL – Apple (NASDAQ:AAPL) continues to underperform the broad market, closing in the red on a day where the indexes finished in the green. It seems some of the anticipation built up ahead of the Apple Watch’s release and the developer’s conference is slowly leaking out. The stock slipped under its 50dma and is more than 5% off of its 52-week highs. While there are no signs of an impending collapse, the stock might be settling into a sideways trading range.

ALGN – It was a dramatic day for Align Technology (NASDAQ:ALGN) yesterday, as some of their patents came under threat. This dropped the stock $5 from the opening highs. While I’m not in the industry, I suspect ALGN’s branding and relationships with orthodontists are more of a moat than its technical patents. Long-term this won’t be a big deal, and healthy competition is always good for business. But in the short-term, anything is possible as traders react emotionally. It is nice to see the price rebound and finish well off the lows. Three more closes above $60 and the storm will have passed, with the added benefit of scaring off the weak and emotional owners. Shakeouts like this improve the upside potential. But until then, treat this stock with extreme suspicion. There is a good chance yesterday’s afternoon rebound will fizzle in coming days and we retest that $60 support.