Reportedly, Alphabet’s (NASDAQ:GOOGL) Google is set to buy an e-commerce startup Pointy. The deal is subject to customary closing conditions and expected to close in the coming weeks.

Ireland-based, Pointy is a startup that sells a small device that enables retailers to know about their product inventory levels online and increase web presence.

Pointy’s e-commerce hardware automatically generates a web page that displays a store’s products and information regarding the availability of the same. The platform allows retailers to make their catalogs available on Google search results without the need to build an e-commerce site on their own. The company claims that it has more than 15,000 retail customers worldwide.

Deal Rationale

This is yet another initiative by Google to enhance search results. The deal will be beneficial for both retailers and consumers.

This will enable retailers to make their product catalogs available on Google, allowing consumers to know all details about the store’s physical stock. Consumers can easily browse inventory levels from various retailers and get information regarding the availability of any required product.

The latest move is likely to boost the momentum of Google search in various markets. Further, it will boost traffic on its search platform and fuel Google's search dominance.

In addition, the deal will help Google to bolster presence in the online advertisement world, from which it earns major part of revenues. Pointy’s platform enables stores to automatically turn their product listings into search ads. This will help Google to better target small businesses and expand advertising revenues.

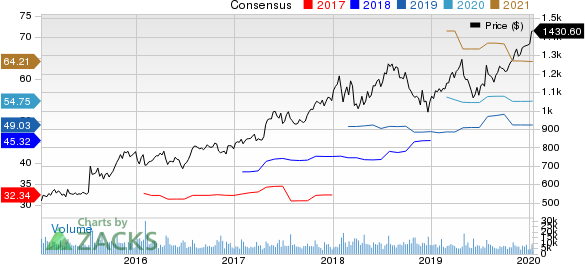

Alphabet Inc. Price and Consensus

Bottom Line

Alphabet’s division Google is leaving no stone unturned to enhance its search platform on the back of a strong expansion strategy. Google’s robust mobile search is also a positive. Its initiatives toward elimination of bad ads and introducing useful search updates are tailwinds.

In addition, it is making all efforts to protect its leading position in search, which is being threatened by Amazon (NASDAQ:AMZN) as more consumers depend on the online marketplace to search for products directly.

In this regard, last year, Google unveiled its new shopping platform for users in the United States. This service offers retailers and brands a portal that brings together ads, local targeting and transactions in one place, helping them to better compete against Amazon.

The latest deal is a testament to its efforts to maintain dominance in the digital search and advertising market.

Zacks Rank & Other Key Picks

Currently, Alphabet carries a Zacks Rank #2 (Buy). Other top-ranked stocks in the broader technology sector include MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) and Fiverr International Ltd. (NYSE:FVRR) , each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth for MACOM Technology and Fiverr is currently projected at 15% and 44.2%, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through Q3 2019, while the S&P 500 gained +39.6%, five of our strategies returned +51.8%, +57.5%, +96.9%, +119.0%, and even +158.9%.

This outperformance has not just been a recent phenomenon. From 2000 – Q3 2019, while the S&P averaged +5.6% per year, our top strategies averaged up to +54.1% per year.

See their latest picks free >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

MACOM Technology Solutions Holdings, Inc. (MTSI): Free Stock Analysis Report

Fiverr International Lt. (FVRR): Free Stock Analysis Report

Original post