AK Steel Holding Corporation (NYSE:AKS) posted net income of $33.5 million or 11 cents per share in the fourth quarter of 2018, against a net loss of $80.4 million or 26 cents in the prior-year quarter. The company entered into a de-risking pension annuity transaction in the quarter and incurred a pension settlement charge of $14.5 million.

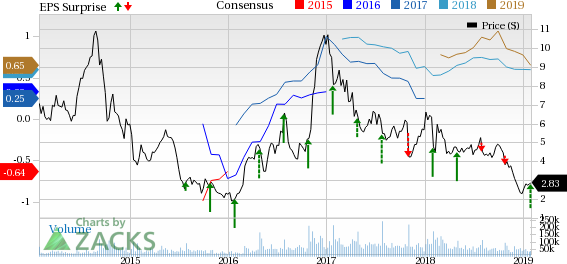

Barring one-time items, adjusted earnings per share came in at 16 cents. The figure beat the Zacks Consensus Estimate of 12 cents.

Net sales of $1,677.1 million in the quarter rose around 12.1% year over year, but missed the Zacks Consensus Estimate of $1,695.6 million.

Total operating costs in the quarter rose around 2.8% year over year to $1,590.6 million.

The company’s margins in the fourth quarter gained from higher steel selling prices and shipments, which more than offset higher costs for certain raw materials and supplies on a year-over-year basis.

2018 Highlights

For 2018, the company recorded net income of $186 million or 59 cents per share, up from $103 million or 32 cents logged in 2017. Adjusted earnings improved 25% year over year to $200.5 million or 64 cents.

Net sales rose 12.1% year over year to $6,818.2 million.

Pricing and Shipments

Flat-rolled steel shipments in the quarter were up around 3.9% year over year to 1,388,700 tons. Average selling price per ton for flat-rolled steel rose 8% to $1,106.

Financials

AK Steel exited 2018 with cash and cash equivalents of $48.6 million compared with $38 million in 2017. As of Dec 31, 2018, the company had $941.8 million available under its revolving credit facility.

The company’s long-term debt declined 5.5% year over year to $1,993.7 million.

Cash flow from operating activities was $364.7 million in the 12-months period of 2018 (ended Dec 31, 2018) compared with $198.8 million a year ago.

Guidance

AK Steel stated that starting 2019, it will only issue annual guidance and no longer provide quarterly expectations.

For 2019, it expects net income in the range of $160-$180 million or 51-57 cents per share. Adjusted EBITDA is expected between $515 million and $535 million. The company expects to generate around 50% of adjusted EBITDA during the first half of 2019. Moreover, timing of scheduled outages is likely to offset the seasonal nature of business.

The company also expects capital investments of $170-$190 million for 2019.

Price Performance

Shares of AK Steel have lost 48.5% in the past year compared with the industry’s 27.7% decline.

Zacks Rank & Key Picks

AK Steel currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the basic materials space include Ingevity Corporation (NYSE:NGVT) , Quaker Chemical Corporation (NYSE:KWR) and Israel Chemicals Ltd. (NYSE:ICL) . While Ingevity sports a Zacks Rank #1 (Strong Buy), Quaker Chemical and Israel Chemicals carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ingevity has an expected earnings growth rate of 21.5% for 2019. The company’s shares have gained 23% in the past year.

Quaker Chemical has an expected earnings growth rate of 21.1% for 2019. Its shares have moved up 27.1% in a year’s time.

Israel Chemicals has an expected earnings growth rate of 5.4% for 2019. Its shares have rallied 35.2% in a year’s time.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, wouldn't you like to know about our 10 finest buy-and-holds for the year?

From more than 4,000 companies covered by the Zacks Rank, these 10 were picked by a process that consistently beats the market. Even during 2018 while the market dropped -5.2%, our Top 10s were up well into double-digits. And during bullish 2012 – 2017, they soared far above the market's +126.3%, reaching +181.9%.

This year, the portfolio features a player that thrives on volatility, an AI comer, and a dynamic tech company that helps doctors deliver better patient outcomes at lower costs.

See Stocks Today >>

Israel Chemicals Shs (ICL): Free Stock Analysis Report

Ingevity Corporation (NGVT): Free Stock Analysis Report

Quaker Chemical Corporation (KWR): Free Stock Analysis Report

AK Steel Holding Corporation (AKS): Free Stock Analysis Report

Original post

Zacks Investment Research