Wall Street has an exciting week ahead as three big name stocks are scheduled to announce their latest quarterly earnings.

Gilead Sciences (NASDAQ: GILD):

Gilead Sciences (NASDAQ:GILD) is expected to announce its earnings report for the final quarter of 2014 on Tuesday, February 3rd after market close. The company is expected to post earnings of $2.36 a share, up from $0.52 a share the same quarter a year prior. Gilead is also expected to post $6.69 billion in revenue, marking a 114.7% increase on a year-over-year basis.

Gilead Sciences had a huge breakthrough in January 2014 when Sovaldi, its treatment for hepatitis C, became available on the market. However, in October 2014 the FDA approved Gilead’s Harvoni, an improved treatment for hepatitis C that has been proven to completely cure the disease.

Sales of both Sovaldi and Harvoni are expected to be a main focus of Gilead’s Q4 results, especially in comparison with competitor AbbVie’s (NYSE:ABBV)) hepatitis C treatment, Viekira Pak.

Back in December 2014, Gilead Sciences took a hit when healthcare provider Express Scripts (NASDAQ:ESRX) made a deal with AbbVie which gave the company exclusive distribution of Viekira Pak to its 25 million subscribers. However, in January of this year Gilead came back and made a deal with CVS Pharmacies in which CVS will exclusively offer Gilead’s hepatitis C drugs. Gilead’s Harvoni will be on CVS’s preferred drug list and accessible by customers using the Affordable Care Act, Medicaid, and parts of Medicare.

In addition, investors will also be looking for an update about what Gilead has lined up for 2015.

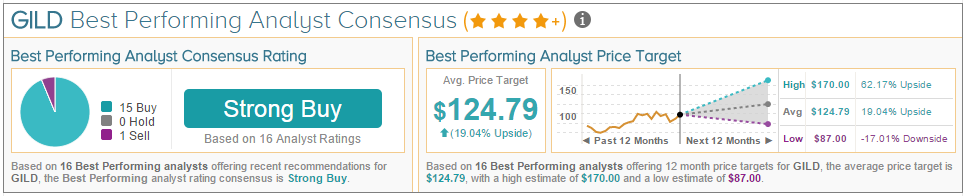

On average, the top analyst consensus for Gilead Sciences according to TipRanks is Strong Buy.

Chipotle (NYSEARCA: CMG):

Chipotle Mexican Grill Inc (NYSE:CMG) is also set to announce its fourth quarter 2014 earnings results on Tuesday, February 3rd after market close. The company is expected to post earnings of $3.77 a share, up from $2.53 a share the same quarter last year. In addition, the fast-food chain is expected to post $1.07 billion in revenue, marking a 27.2% increase year-over-year.

Chipotle has become a leader in the fast-food industry as shown with the rise in its stock over the years. Since the end of 2008, Chipotle shares have increased 11 times from $62 to $684 at the end of 2014. The company’s stock has already jumped another 4.4% so far in 2015 and even set an all-time high of $727.97 a share on January 8th.

Chipotle prides itself on using organic meats and maintaining transparency regarding its food sources. Towards the end of 2014, Chipotle’s management decided to pull carnitas from some of its stores due to a supplier not meeting the company’s pork sourcing standards despite being one of the more popular items on its menu. Investors will be looking to see how this will affect Chipotle’s sales for the quarter.

With that said, both customers and investors alike have proven to be willing to pay higher prices for Chipotle with its “better-for-you” food movement as shown with the gaining momentum of the company’s stock.

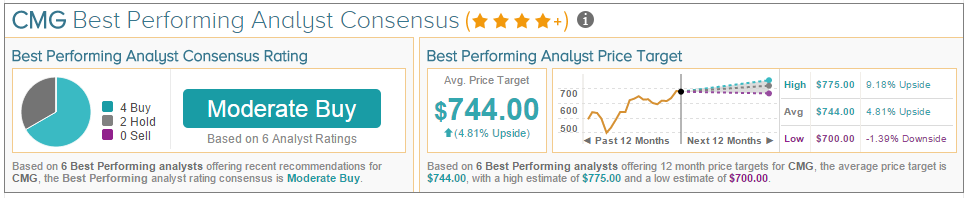

On average, the top analyst consensus for Chipotle on TipRanks is Moderate Buy.

Twitter (NYSE: TWTR):

Twitter Inc (NYSE:TWTR) is scheduled to announce its earnings results for the final quarter of 2014 on Thursday, February 5th after the market closes. The company is expected to post a loss of -$0.21 a share, up from a loss of -$1.41 a share the same quarter last year.

Twitter did not have the best year in 2014 as the company continued to report slowing growth rates. In addition, there has been increasing pressure from investors for Twitter’s current Chief Executive, Dick Costolo, to step down from his position as they have been unimpressed with his performance in the past year. Speculation rose that he would in fact be stepping down after he sold all of the shares in his family trust at the end of 2014. Dick Costolo is the latest Twitter executive to receive scrutiny over a poor performance following previous dismals of other important executives who failed to attract more users throughout the year.

In addition to Dick Costolo’s status as CEO, investors will be looking for an update on Twitter’s user growth over the Q4 quarter. The company’s user growth has failed to meet analysts’ expectations throughout 2014 and is far behind competitors like Facebook and Instragram.

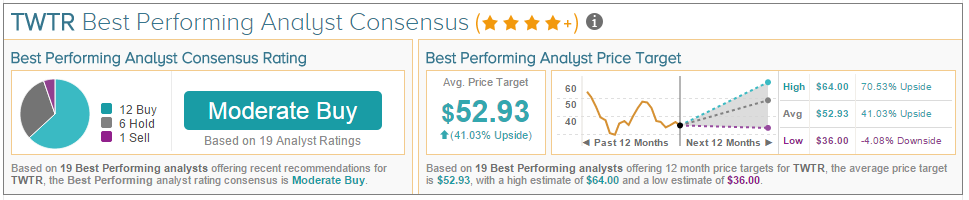

On average, the top analyst consensus for Twitter on TipRanks is Moderate Buy.

Investors will certainly be on the edge of their seats in anticipation of how these earnings reports will affect their portfolios.

Disclosure: All recommendations for GILD, CMG, and TWTR sourced from TipRanks.