Our research team has put together these charts of our ADL modeling system (Advanced Dynamic Learning), which shows a very clear upside price recovery starting to take place in late September or early October of this year. The ADL system also suggests the recovery may last through most of Q4:2020 before the markets collapse again in early 2021.

This predictive modeling system has become somewhat of a hit with our members and our followers. We continue to get requests from members for selected ADL research related to Oil, the NASDAQ, or other symbols. The idea that we can attempt to see into the future with a certain degree of accuracy would certainly appeal to any trader/investor.

These updated ADL charts show that the US stock market may stay under some downward/sideways pricing pressure until last September 2020 – prompting a Q4 “Santa Rally”, before the markets appear to find a new extreme weakness in early 2021. This suggests a brief uptick in consumer activity and economic engagement centered around the November 2020 elections and the 2020 Christmas Holiday season, then back to a more contracted economic mode in early 2021.

YM Monthly Chart

This YM Monthly chart highlights our ADL predictive modeling system’s results from a September 2019 origination point. The one thing we want to add about the ADL system and the current Covid-19 virus event is that our ADL system attempts to map historic price activity into “DNA markers” and uses those DNA markers to attempt to identify and predict future price activity. Obviously, there has been nothing like the Covid-19 virus event in recent history. Thus, the ADL predictive modeling system is attempting to apply price DNA to an event that is unprecedented in 80+ years of price history.

Our researchers believe the ADL system will be able to pick up inherent price rotations and trends that relate to existing price DNA markers, yet the scale and scope of the price moves related to the current Covid-19 event may be much larger and more volatile than the ADL predictive modeling system is capable of indicating. For example, take a look at the YM chart below and realize that price moved well beyond the ADL predictive price markers on this chart. This is not an anomaly in price, this is an extreme moment in time that the ADL predictive modeling system is incapable of modeling accurately.

Thus, as we are showing you the ADL predictive modeling results, remember that extreme volatility related to the global market event could push the price 6% to 15% further away from these predicted price levels very easily as volatility increases. Thus, a bottom shown on this chart near 24,000 with the ADL system could actually result in a price bottom near 22.460 or 20,400 (6% to 15% below the projected price level).

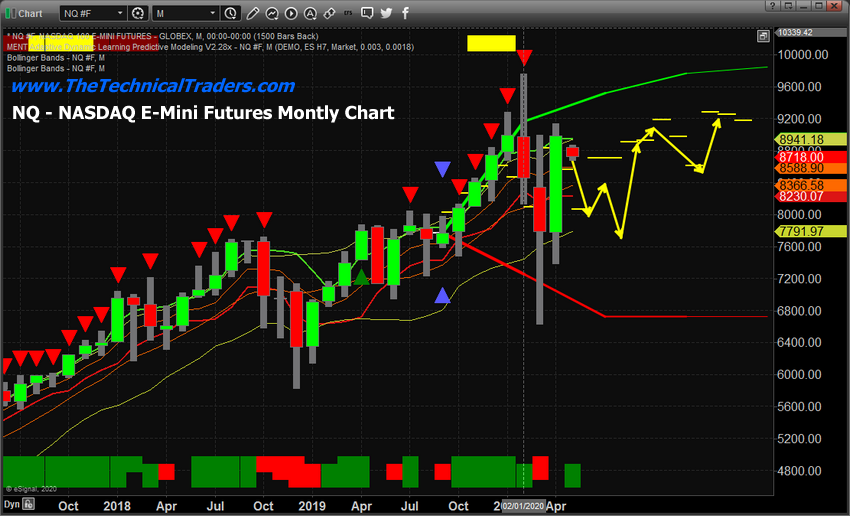

Monthly NQ Chart

This Monthly NQ chart shows that the tech-heavy NASDAQ may provide a more stable sideways market rotation over the next 6+ months than the S&P500 or the Dow Industrials. The ADL system is suggesting that the NQ will likely move lower over the next 3+ months before recovering back to the 9,000 price range in September/October 2020. Again, we see moderate weakness in price in early 2021 for a short period of time before price attempts to resettle near 9,200 in Q2:2021

This suggests the NASDAQ will continue to attract foreign investment and show more restrained price volatility than the Dow or the S&P (NYSE:SPY). Again, pay attention to the extreme volatility in the markets and how the price has extended 5% to 15%+ beyond the ADL predictive price levels. Until the volatility subsides, continue to expect this extreme price rage volatility.

Our ADL system accurately predicted the month gold started a new bull market last year which Eric Sprott (OTC:SPOXF) Eric Sprott talked about. Also, we predicted the month oil was going to crash. while price hit our downside target correctly the price went way beyond that as we all know.

Concluding Thoughts:

Overall, it appears September/October of 2020 is setting up for a moderate US stock market price recovery. Until then, it appears we have a bit of additional price rotation and volatility to contend with. The interesting take-away from all of this is that our original expectation for a price bottom near or after June or July 2020 seems very accurate.

Technical traders should wait for the price to confirm these predictions before taking any actions. This is a great market for skilled short term traders to find opportunities. But it is also very dangerous for traders to chase trends.

The next few years are going to be full of incredible opportunities for skilled traders and investors. Huge price swings, incredible revaluation events, and, eventually, an incredible upside rally will start again.

I’ve been trading since 1997 and I’ve lived through numerous market events. The one thing I teach my members is that risk is always a big part of trading and that’s why I structure all of my research and trading signals around “finding profits while reducing overall risks”. Sure, there are fast profits to be made in these wild market swings, but those types of trades are extremely risky for most people – and I don’t know of anyone that wants to risk 50 or 60% of their assets on a few wild trades.

I’m offering you the chance to learn to profit, as I do with my own money, from market trends that I hand-pick for my own trading. These are not wild, crazy trades – these are simple, effective, and slower types of trades that consistently build wealth. I issue about 4 to 8+ trades a month for my members and adjust trade allocation based on my proprietary allocation algo – the objective is to gain profits while managing overall risks.

You don’t have to spend days or weeks trying to learn my system. You don’t have to try to learn to make these decisions on your own or follow the markets 24/7 – I do that for you. All you have to do is follow my research and trading signals and start benefiting from my research and trades. My new mobile app makes it simple – download the app, sign in and everything is delivered to your phone, tablet, or desktop.

I offer membership services for active traders, long-term investors, and wealth/asset managers. Each of these services is driven by my own experience and my proprietary trading systems and modeling systems. I have a small team of dedicated researchers and developers that do nothing but research and find trading signals for my members. Our objective is to help you protect and grow your wealth.