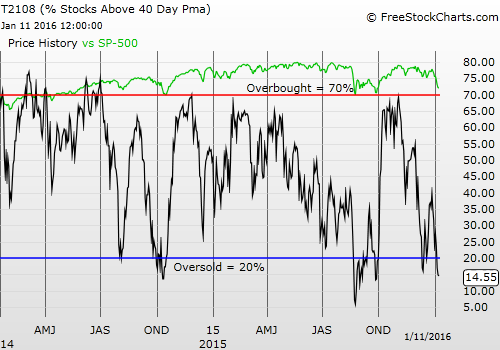

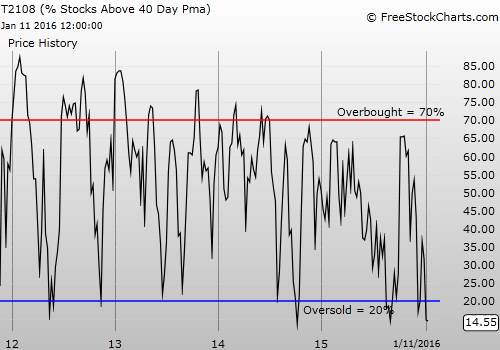

T2108 Status: 14.6% (as low as 13.1%)

T2107 Status: 17.2%

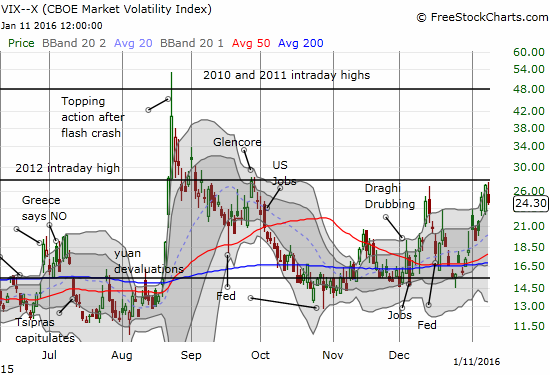

VIX Status: 24.3 (elevated but failed at resistance and faded from a high of 27.4)

General (Short-term) Trading Call: bullish with a “short leash”

Active T2108 periods: Day #3 under 20%, Day #6 under 30%, Day #22 under 40%, Day #26 below 50%, Day #41 under 60%, Day #382 under 70%

Commentary

Commodity names continue to collapse at an alarming pace, but a very subtle panic-driven bottom may have finally started (or occurred) for equity markets.

Cutting to the chase: the volatility index, the VIX barely surpassed Friday’s high when the volatility products went absolutely nuts. This contrast is important because it means buyers trying to bet on higher volatility rushed into the trade well ahead of what was actually happening in the market. The day ended with a substantial fade of the VIX and the associated long volatility products. With the VIX once again falling short of the 2012 intraday high, the trading action had all the appearances of a washout of fear. Like a panic-driven bottom for the market. It is subtle and a bit obscure without putting all the pieces together.

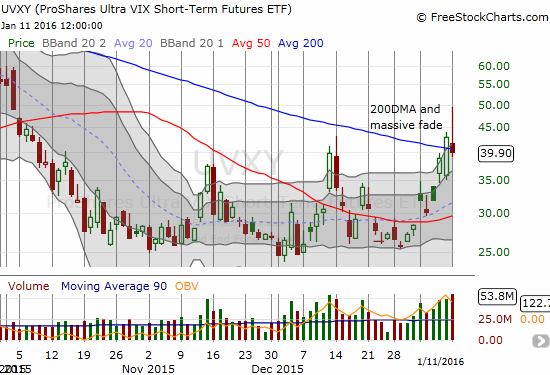

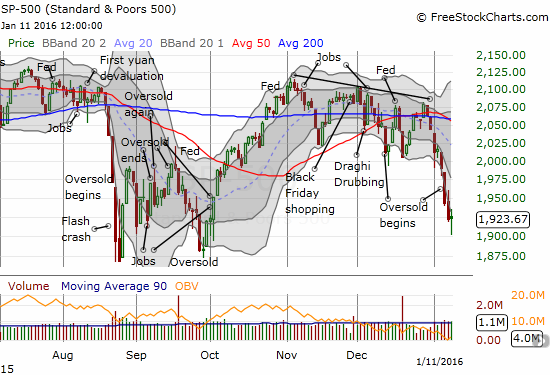

Here is a timeline…Around 1:50pm Eastern, the VIX peaked for the day at 27.4, a mere 1.4% gain over the previous day’s close. At the same time, iPath S&P 500 VIX Short-Term Futures Exp 30 Jan 2019 (N:VXX) had soared to a 7.3% gain (I trigger alerts at 7%), and ProShares Ultra VIX Short-Term Futures (N:UVXY) reached a substantial 14.9%. Around this time, the S&P 500 (N:SPY) reached its low of the day at 1901.10, a 1.1% loss (notable but not panic-worthy). Finally, T2108, the percentage of stocks trading above their 40-day moving averages (DMAs) traded down to 13.1% just marginally below the intraday low from December, 2015.

Here are some charts to tell the story…

The volatility index sharply fades after failing to break through resistance at the 2012 intraday high.

The fade on ProShares Ultra VIX Short-Term Futures (UVXY) was so vicious that it fell quickly from a strong 200DMA breakout to a collapse below 200DMA resistance. Note also that UVXY was trading WELL above the upper-Bollinger Band (BB)

Just above 1900, the S&P 500 (SPY) finally found interested buyers willing to hang around.

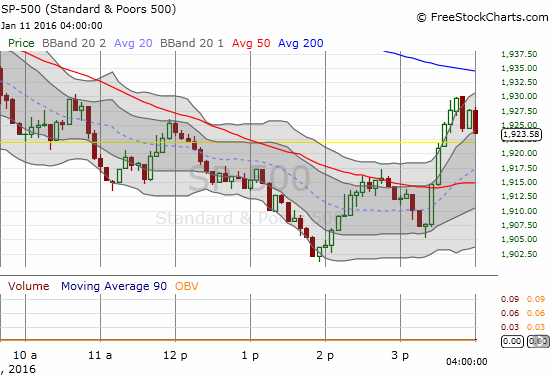

This 5-minute chart shows that the S&P 500 opened in a positive way but eventually tumbled downward. Around 1:50pm Eastern, everything changed.

In the last T2108 Update I indicated I was finally ready to get more aggressive on the bullish side of trades. As soon as N:VXX hit 7%, I purchased more shares on SVXY and placed another order at a low-ball level. I added put options on UVXY. I had no idea of course at the time that these purchases would happen at THE turning point of the day, but the odds pointed that way with VXX and UVXY so stretched above their upper-Bollinger Bands (BBs). With the put options almost doubling by the close, I decided to lock in the profits. I am still sitting on the SVXY shares and previous UVXY put options. Per my T2108 trading strategy, I am holding SVXY until at least the end of the oversold period and likely further. For example, the Federal Reserve next announces monetary policy on January 27th – given current trends, this looks like a near-perfect setup for the fade volatility trade. I also made my first purchase of shares on ProShares Ultra S&P500 (N:SSO) which I will also hold in tandem with SVXY. I did not add to my SSO call options, but I will do so if the oversold period goes even deeper.

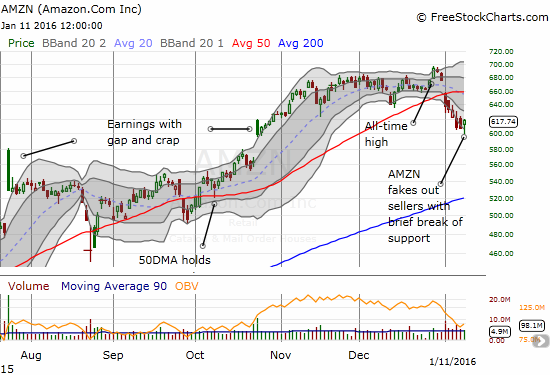

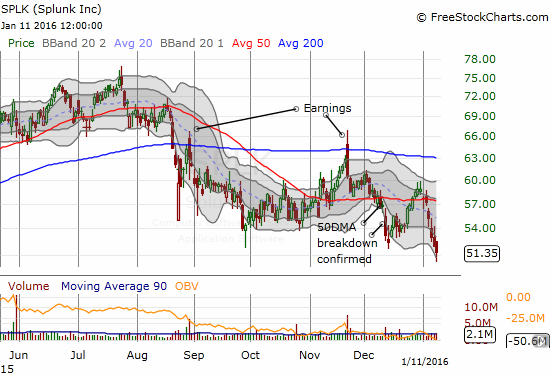

I also went to individual stocks and examined the usual suspects. I picked Amazon.com (O:AMZN) call options. AMZN fell to $600 before bouncing. I added more call options on iShares US Home Construction (N:ITB) (from a limit order set last week). I even decided to give Apple (O:AAPL) ONE more chance and snatched up a few more calls on the wilting stock. I did not have a chance to go after additional individual stocks although I did finally sell my put options on Splunk Inc (O:SPLK). I am now even more committed to seeing this oversold period through.

Amazon.com (AMZN) makes a very brief visit to $600 that temporarily breaks recent support. This is a hammer-like pattern that could mark a (short-term) bottom.

Splunk (SPLK) has yet to stabilize as it continues the dangers of ignoring sharp post-earnings fades that end the day in the red.

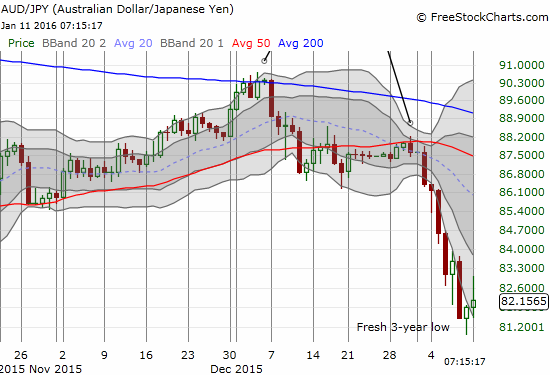

Finally, from the last T2108 Update, I claimed that the Australian dollar (N:FXA) versus the Japanese yen (N:FXY), AUD/JPY, would signal the nature of trading for the open on the S&P 500. As noted above, the index did indeed open well. The index slipped in tandem with AUD/JPY and bounced with it. The key to the final depth of this oversold period may depend on (or correlate with) the ability of AUD/JPY to hold the current bottoming pattern (anther potential hammer).

AUD/JPY is clearly trying to bottom even with the big fade on Monday.

On the bounce, I refreshed a very small short position on AUD/JPY and will build the position back up (slowly) as AUD/JPY rises. I am still very bearish over the longer haul on the Australian dollar…

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

Be careful out there!

Full disclosure: long SVXY shares, long UVXY put options, long SSO call options, long SSO shares, long AMZN call options, short AUD/JPY