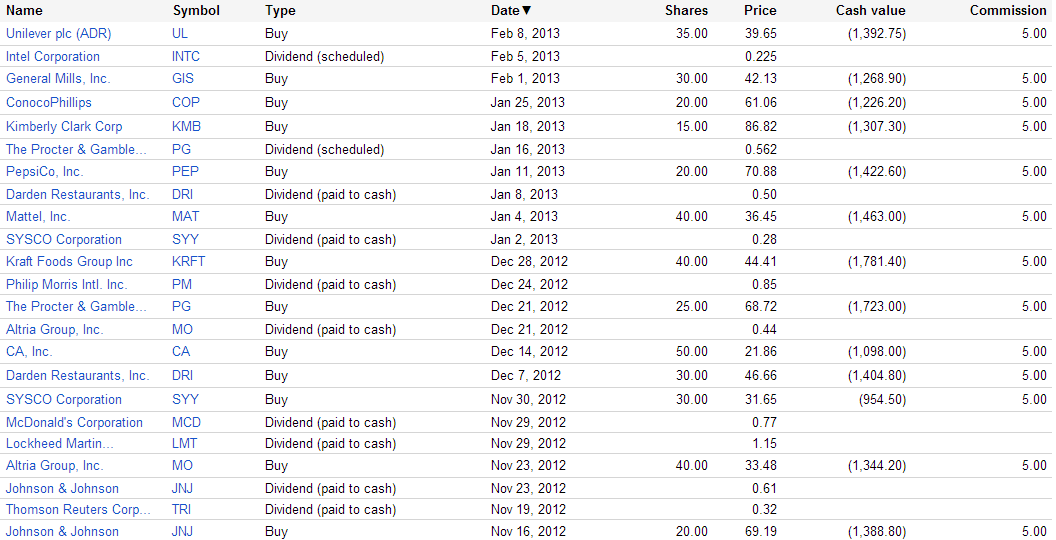

Last Friday I bought 35 Unilever (UL) shares for the Dividend Yield Passive Income Portfolio (DYPI). The full purchase amount was $1,392.75 and represents roughly 1.3 percent of the portfolio worth.

Unilever is a major diversified food company with headquarter in the United Kingdom. Unilever PLC operates as a fast-moving consumer goods company in Asia, Africa, Europe, and the Americas. It offers personal care products, including skin care and hair care products, deodorants, and oral care products.

UL has a strong market position is several markets worldwide and is one of the dominant global player in the emerging markets. 32.82 percent of sales are generated in the Americans nations, 31.83 percent in Europe and 32.33 percent in Asian/Pacific countries. With this in mind, Unilever is behind Nestlé one of the world best diversified foods and consumer goods distributor.

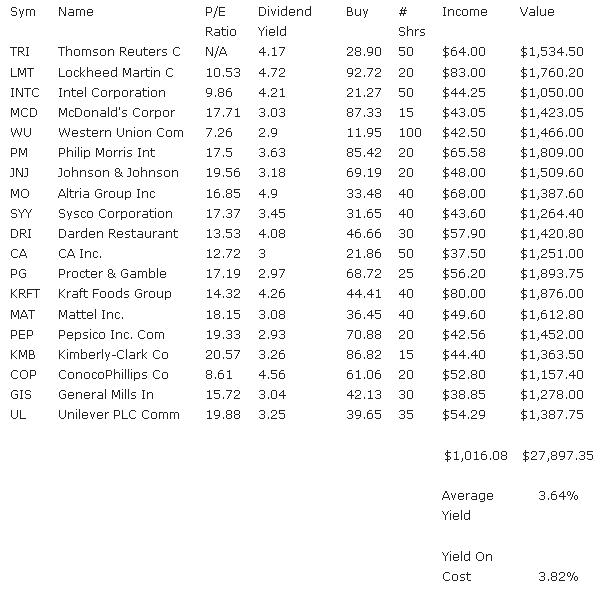

The new stake will give me additional $50 in dividends per year. The full expected portfolio dividend income is now $1,016.08. The passive income should grow to a total amount of 3k – 4k by the end of this year. This should be possible with my current cash position.

I paid $26,377.20 for all 19 stocks combined. Now, they are worth $27,581.25. Not enough, I still have $73.7k in cash for further investments and I plan to increase the current stock holdings to a total number of 50-70 shares. So I try to put every Friday one position with an attractive yield into the portfolio. I follow a buy and hold strategy and like to use the dividends for further investments. The investment horizon is long-term, 10 years or more.

This is my investment approach. If you like to make money by trading stocks and realizing a quick return, this is the wrong investment site. Dividend growth stocks will not make you rich in a short period but they can deliver you a solid return over the long-run. I talk about a performance of around 8% in average.

The DYPI portfolio was funded with 100k virtual on October 03, 2012. The aim is to show how long-term dividend growth stock investing works. I personally made huge amount of money only by buying dividend stocks, receiving dividends and selling them in order to invest the new money into more attractive stocks. This strategy resulted in a yearly double-digit return.

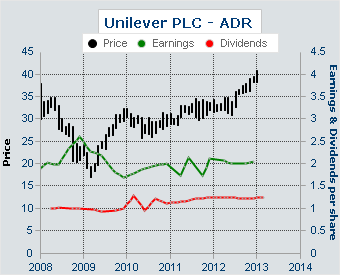

Well, Unilever is a great stock but also not really cheap. The current P/E is at 19.34 and the forward P/E is 15.80. The yield is at 3.25%, that’s ok in my view. You might think that I am betting on the foods and consumer sector and a strong gaining momentum. That’s not right. I believe that the sector has great values for long-term investors. Most of the best and safest dividend stocks come from the consumer and foods sector.

The full DYPI portfolio is up 1.34% since the funding date. The stocks alone generated a return of 4.56%. That’s a slightly underperformance but the volatility was also much lower. What do you think about Unilever? Do you own some shares of the company or do you like competitors of Unilever much more? Let me know by leaving a comment.

The income perspective:

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

A Great Foods And Consumer Stock Added To My Dividend Yield Passive

Published 02/12/2013, 03:12 AM

Updated 07/09/2023, 06:31 AM

A Great Foods And Consumer Stock Added To My Dividend Yield Passive

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.