Chemed, Ticker: $CHE

Chemed Corp (NYSE:CHE) started to move up out of consolidation at the start of June. It quickly met resistance and pulled back. Last week that reversed and it started back higher, closing at a new all-time high Friday. The RSI is bullish and rising with the MACD positive and moving higher. Look for continuation to participate.

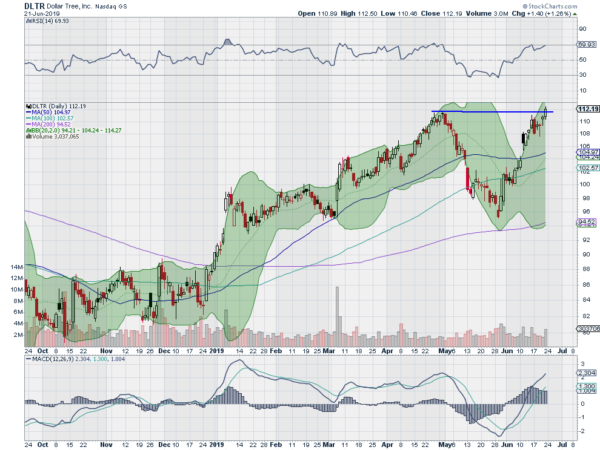

Dollar Tree, Ticker: $DLTR

Dollar Tree Inc (NASDAQ:DLTR) rose from a November low, topping out at the end of April. It pulled back to a higher low into May and found support, reversing at the end of the month. Friday it closed, pushing over the April top. The RSI is bullish and rising with the MACD positive and moving up. Look for continuation to participate.

The Hartford, Ticker: $HIG

Hartford Financial Services Group (NYSE:HIG) has been moving higher in a strong trend since a December low. It has a minor pullback 2 weeks ago and last week moved over the prior top. The RSI is bullish with the MACD rising and positive. Look for continuation to participate.

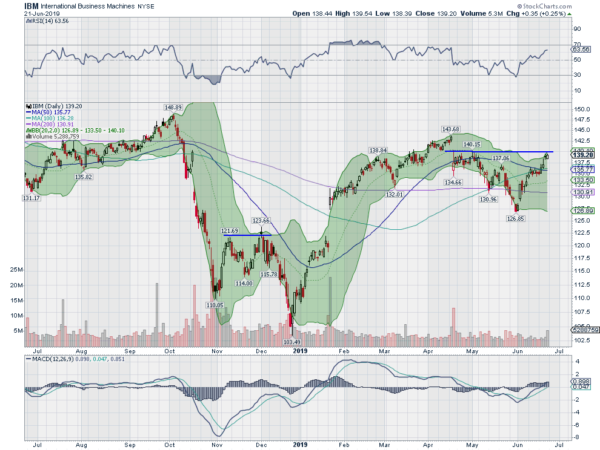

IBM, Ticker: $IBM

International Business Machines (NYSE:IBM) pulled back from a top in October, making a bottom eventually in December. From there it rose, and confirmed a double bottom with a gap up in January. It slowed as it moved over the 200 day SMA and made a top in April. The pullback from there found support at the start of June and reversed. It finished last week at resistance with the RSI rising in the bullish zone and the MACD positive and moving higher. Look for a pushover resistance to participate.

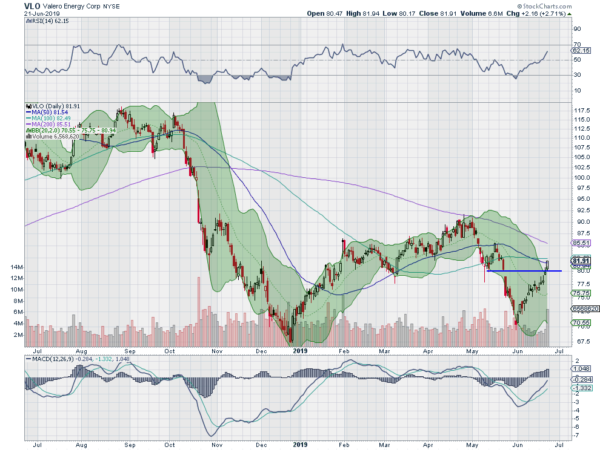

Valero, Ticker: $VLO

Valero Energy Corporation (NYSE:VLO) fell from a high in October to a low in December. A bounce recovered about half of the drop but then reversed in May. It found support at a retest of the low and is now moving back higher. Friday it moved above the prior two lows with the RSI pushing into the bullish zone and the MACD about to cross to positive. Look for continuation to participate…..

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.