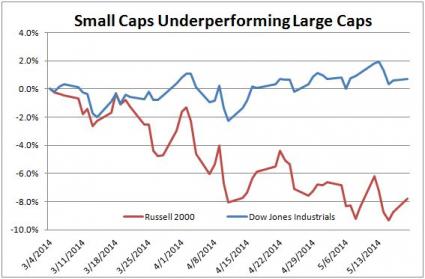

Small caps have had it a little rough this year. After surging in 2012 and 2013, the small cap Russell 2000 index has fallen more than -4% so far this year and is down over -8% from its all-time high. This is despite large cap indexes like the S&P 500 and the Dow Jones Industrial Average holding steady through most of the year and even recently hitting new all-time highs.

There are many possible explanations for this "risk-off" move by investors. Fed tapering. Geopolitical uncertainty. Global economic growth concerns.

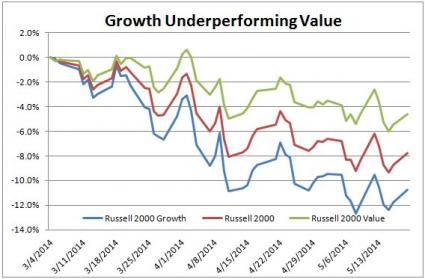

There is also the possibility that some of these stocks simply got too far ahead of their fundamentals, and now the market is reassessing their valuations. This could explain why value stocks have held up much better than their growth counterparts within the small cap space.

Focus on the Fundamentals

It looks like gains are going to be much harder to come by going forward than they were in the recent past, particularly for small cap stocks. If investors want to have success in this market environment, they need to pay close attention to the fundamentals.

Things like valuation, earnings momentum, cash flow and balance sheet strength - which were all but ignored last year - are becoming important to the market again.

With this in mind, I ran a screen in Research Wizard looking for small cap stocks with strong fundamentals, including:

- Reasonable price-to-earnings and price-to-cash flow ratios,

- Solid earnings momentum, with a Zacks Rank of 1 (Strong Buy), 2 (Buy) or 3 (Hold),

- Strong balance sheets with low debt levels and healthy liquidity ratios,

- Attractive returns on invested capital, and

- Year-to-date returns greater than the S&P 500.

4 Solid Small Caps Beating the Market

Here are 4 names from the list:

Standard Motor Products

Standard Motor Products (NYSE:SMP) manufactures and distributes replacement parts for motor vehicles in the automotive aftermarket industry with an increasing focus on the original equipment service market. It has a market cap of $959 million.

The company's "Engine Management" segment manufactures ignition and emission parts, ignition wires, battery cables, fuel system parts and sensors for vehicle systems. Its "Temperature Control" segment manufactures and remanufactures air conditioning compressors, air conditioning and heating parts, engine cooling system parts, power window accessories, and windshield washer system parts.

Standard Motor Products delivered better-than-expected first quarter results on May 1 as it turned a modest sales increase into double-digit earnings growth through expanding profit margins. Analysts revised their 2014 estimates higher after the Q1 beat, sending the stock to a Zacks Rank #2 (Buy). Based on current consensus estimates, analysts project 14% EPS growth for SMP this year and 12% growth next year.

Standard Motor Company carries virtually no long-term debt and consistently generates positive free cash flow and double-digit returns on invested capital. With shares trading at a reasonable 15x 12-month forward earnings and 10x trailing 12-month operating cash flow, there could be plenty of upside left in this stock.

Genesco

Genesco (NYSE:GCO) is a specialty retailer that sells footwear, headwear, sports apparel and accessories in more than 2,550 retail stores and leased departments through brands like Journeys and Lids. It is headquartered in Nashville, Tennessee and has a market cap of $1.8 billion.

Genesco consistently generates solid cash flow and double-digit returns on invested capital. It also has a healthy balance sheet with very little long-term debt.

Earnings momentum has been stable with Genesco beating earnings in 18 out of the last 20 quarters. Based on current consensus estimates, analysts are calling for 9% earnings per share growth this year and 13% growth next year. With shares trading at a very reasonable 11x cash flow and 13x forward earnings, this solid small capper should continue to hold up well this year.

United Insurance Holdings Corp

United Insurance Holdings Corp (NASDAQ:UIHC) is a holding company that focuses primarily on providing homeowners' insurance in Florida, South Carolina, Massachusetts, Rhode Island and North Carolina. It is headquartered in St. Petersburg, Florida and has a market cap of $348 million.

Shares of UIHC have held up well so far this year. Perhaps one reason for this is because of a huge Q1 earnings beat on April 30, thanks in part to improved loss and expense ratios. The company reported EPS of 65 cents, more than doubling the Zacks Consensus Estimate of 32 cents. This prompted analysts to revise their estimates significantly higher for both 2014 and 2015.

UIHC has a solid balance sheet with very little debt. And its $338 million investment portfolio is invested mainly in corporate and government bonds. Over the last 12 months, UIHC has generated a return on invested capital of 18.5%. The stock looks attractive at just 10x forward earnings and 10x cash flow.

Universal Electronics

Universal Electronics (NASDAQ:UEIC) develops and manufactures a broad line of pre-programmed universal remote control products, audio-video accessories, and software that are marketed to enhance home entertainment systems. Its customers include subscription broadcasters (i.e., DIRECTV (NASDAQ:DTV)), original equipment manufacturers ("OEMs"), international retailers, private labels, and companies in the computing industry. Approximately 63% of its sales came from outside the U.S. in the first quarter of 2014. It has a market cap of $645 million.

Universal Electronics delivered a big earnings beat on May 1, driven by double-digit sales growth and S,G&A expense leverage. This prompted analysts to revise their estimates significantly higher for both 2014 and 2015, sending the stock to a Zacks Rank #1 (Strong Buy). Based on current consensus estimates, analysts project 32% EPS growth this year and 11% growth next year.

Universal Electronics also has a very solid balance sheet with no long-term debt. And shares trade at less than 16x forward earnings and 15x cash flow. Looks like their is plenty of upside potential left for UEIC.

The Bottom Line

If investors want to have success in this market environment, they need to pay close attention to the fundamentals. These 4 companies each have solid fundamentals and are well positioned for additional gains in 2014.