The American scholar, William Arthur Ward, once wrote: “The pessimist complains about the wind; the optimist expects it to change; and the realist adjusts the sails.”

In today’s market, the price of a stock is influenced by more than just conventional factors. We live in an evolving world experiencing swift and transformative change. For this reason, an investor needs a more comprehensive way to analyze investment opportunities.

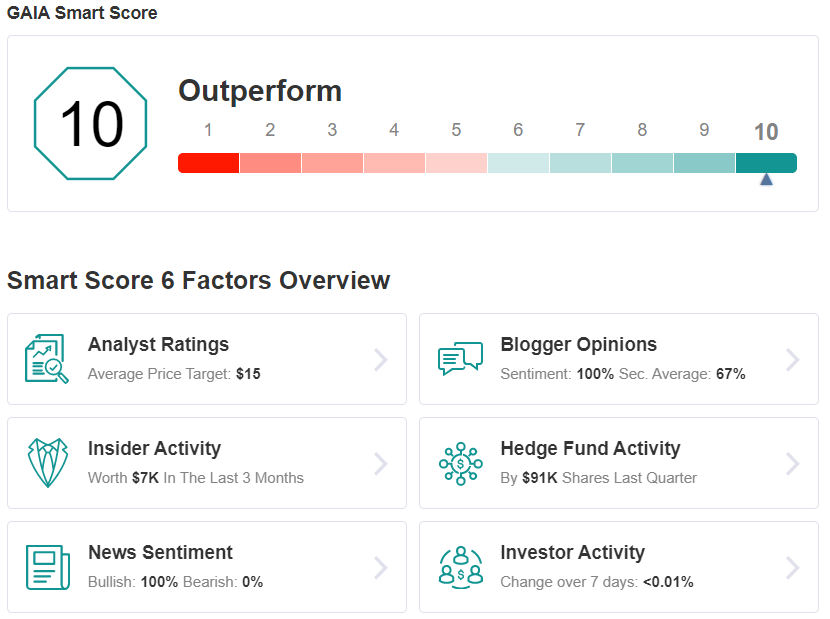

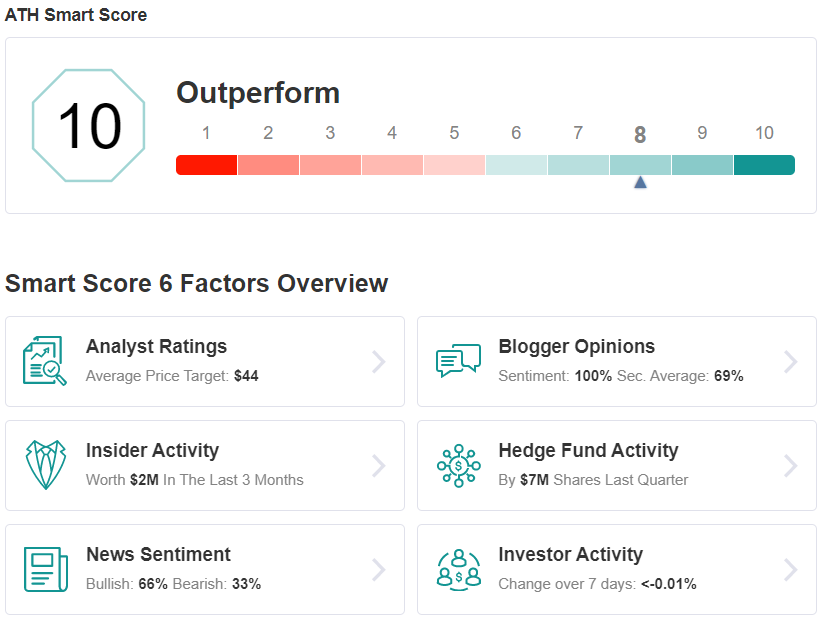

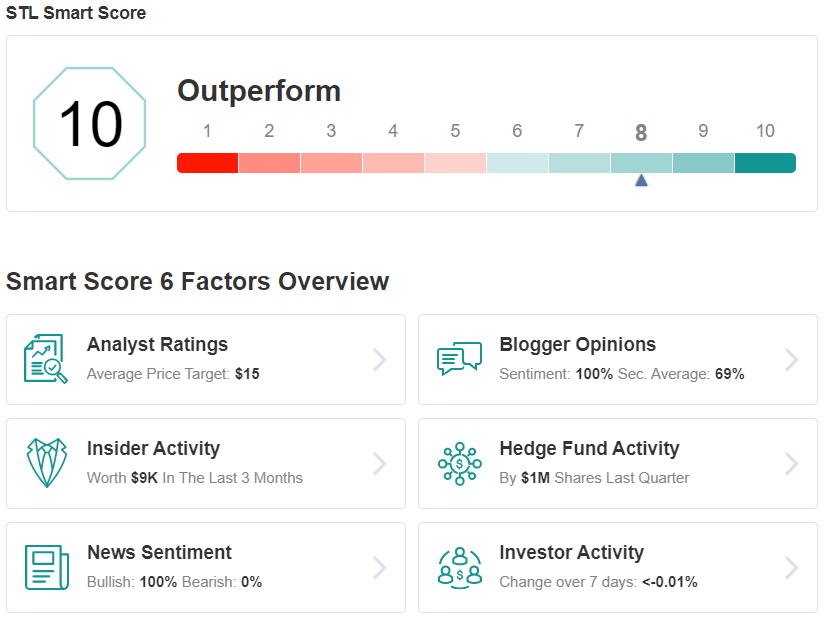

This is exactly why Investing.com offers the Investing Insights – an all-encompassing way to evaluate a stock. The Investing Insights aggregates six important factors, some of which are unfamiliar to the average investor, such as hedge fund and insider activity. Each stock is then ranked from 1 to 10, with 10 being the highest, so that an investor can keep up and make a more informed decision.

With this in mind, we used the platform to identify three stocks that have earned the “Perfect 10” Smart Score. Not to mention each offers up double-digit upside potential.

Gaia Inc. (GAIA)

To start us off we have Gaia (NASDAQ:GAIA), Inc. (formerly Gaiam), an internet media company that provides video streaming and on-demand services through a subscription. The company has a library of about 8,000 titles which focus on topics including spiritual growth, yoga and alternative healing.

Gaia experienced strong demand for its services in the first quarter of 2020 when people stayed home due to the COVID-19 pandemic. Revenue climbed 16% to $14.5 million, from $12.5 million the year before. The increase was driven by growth in paying members and average revenue per member.

The positive trend continued when management announced that despite the relaxing of stay-at-home orders, sales momentum persisted. Some investors were concerned that demand would drop-off when the economy re-opened.

Weighing in on the news, Roth Capital’s Darren Aftahi stated, “GAIA announced that it anticipated second quarter 2020 ending subscription count of ~655,000 or ~19,000 better than our estimate as the company has continued to benefit from increased engagement from the dynamics of stay at home orders through second quarter (despite the recent easing). We see this as favorable as it increases the starting subscription base for third quarter, where GAIA reiterates it expects to be earnings and free cash flow positive in July.”

To this end, the 5-star analyst rates GAYA a Buy along with a $13.00 price target. This indicates significant upside potential of 41% from current levels.

As for the rest of the Street, only one other analyst provided a recommendation on the stock over the last three months, which was also a Buy. This translates to a Moderate Buy consensus rating. The average price target is $15, which represents substantial upside potential of 62%. (See Gaia stock analysis)

Athene Holding (ATH)

Next on our list is Athene Holding (NYSE:ATH), a financial services company that sells retirement savings products such as annuities to individuals and institutions.

Athene has been able to achieve respectable operating results during the COVID-19 pandemic. In the first quarter of 2020, the company generated $3.9 billion of deposits. Although this was a decrease of 17% year-over-year, deposits actually rose 8% quarter-over-quarter.

5-star analyst James Fotheringham, of BMO Capital, provided his take on the company’s growth prospects: “We view Athene as a compelling GARP (growth at a reasonable price) opportunity. Athene shares offer above-average capital-adjusted growth (i.e., earnings plus excess capital) at a very meaningful valuation discount.”

There’s another side to Athene’s business, which is how it deploys the earnings deposits. The company invests the funds it receives from customers and attempts to realize a greater return than they promised to pay out. Given all of the recent market volatility, Athene had to mark down the fair value of its assets in the first quarter, resulting in a $1.1 billion loss compared to net income of $708 million the year before. Nevertheless, the analyst is not concerned, noting: “Investor concerns around credit risk for Athene’s invested assets, are misplaced (we think).”

Based on all of the above, Fotheringham has an Outperform (i.e. Buy) rating on the stock with a $62 price target, which suggests huge upside potential of 85%.

Looking at the rest of the analyst community, the bulls represent the majority. 5 Buys and 1 Hold add up to a Strong Buy consensus rating. The $44.80 average price target implies 34% upside potential. (See Athene stock analysis)

Sterling Bancorp (STL)

We end our list with another financial services company, Sterling Bancorp (NYSE:STL), which offers banking products and services to consumer, commercial, and municipal customers primarily in the New York metropolitan area.

Sterling’s operating performance was negatively affected by the COVID-19 pandemic. On July 22, the company reported second quarter adjusted EPS of $0.29, compared to the consensus estimate of $0.31 and the prior-year quarter result of $0.46. The poor showing was due to a $56.6 million credit loss provision, which couldn’t be offset by deposit growth of 4.6% and loan growth of 2.9%.

While the stock has significantly underperformed the broader market, plummeting 46% year-to-date, Maxim (NASDAQ:MXIM) analyst Michael Diana believes the sell-off is overdone. “STL shares are currently trading at 5.9x our 2021 EPS estimate; very undervalued, in our view,” he explained.

Diana is very bullish on the stock going forward. He noted, “Over the next four quarters, we expect, stock price appreciation of nearly 71% (to our price target) and a dividend yield of 2.4%, which should result in an estimated total return of about 73%.” To explain how he reached his price target, the Maxim analyst stated, “Our price target equates to 10.0x our 2021 EPS estimate (unchanged) and is in line with high-quality small and mid-cap banks.”

To this end, Diana rates STL a Buy rating, while his $20 price target implies a hefty upside potential of 78%.

All in all, other analysts are in agreement. The stock received 7 Buy ratings and 1 Hold in the past 3 months, which amount to a Strong Buy consensus view. The average price target is not as aggressive as Diana’s at $15.33, yet it still suggests healthy upside potential of 36%. (See STL stock analysis)

To find more ideas for stocks trading at attractive valuations, visit Investing Insights.