In this commentary we’ll survey the intermediate-term to longer-term market terrain. This is especially important since we’re about to enter a new year, which the Kress cycle outlook describes as potentially dangerous from a financial market and economic perspective.

Investors have had no shortage of worries in November, including uncertainty surrounding the presidential race earlier this month, the upcoming “fiscal cliff” on Dec. 31, troubles in the Middle East and the ongoing euro-zone debt crisis. On the European front, Spain has still not asked for the European Central Bank (ECB) to purchase its bonds, while the Euro area finance ministers will not likely to make a final decision to release the Euro 31.5 billion of aid to Greece until Nov. 26.

In a bull market investors tend to ignore worries and focus on the positive news, namely expanding corporate profits. Bull markets on average tend to run about three-to-four years before becoming exhausted. The bull market, which began in March 2009, was accompanied by a major recovery in corporate profits, which was part of a feedback loop that propelled equity prices higher in the last three-plus years. Corporate profit momentum is in the process of revering now, which means investors have one less positive to consider when evaluating equities.

Bearish Conditions Ahead

From an investor psychology perspective, what does it mean when fear and worry feeds on itself and creates downside momentum? It means we’re entering a bear market, which was fated to happen at some point after the four-year cycle peaked in October. On an interim basis it was confirmed when the NYSE Composite Index (NYA) decisively broke below its 60-day moving average.

Another indication that conditions have turned bearish on an intermediate-term basis is seen in the series of internal momentum indicators known as HILMO (Hi-Lo Momentum). As the name implies, HILMO is based on the rate of change in the daily 52-week highs and lows on the NYSE. Whenever all the main components of HILMO (short-, intermediate- and longer-term) are in synch to the downside it shows that conditions have turned decisively bearish.

Equities

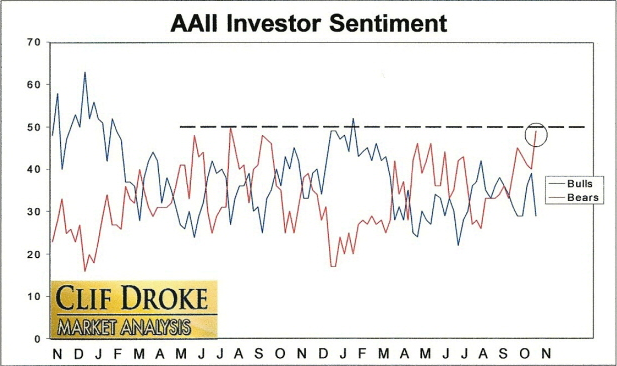

Of course this negative internal condition can, and most likely will, be reversed on a short-term basis. We’re entering a favorable timeframe for equities seasonally (December-January) and a year-end rally isn’t out of the question. The investor sentiment poll released last Thursday by the American Association of Individual Investors (AAII) showed the percentage of their members who are bullish were only 29%, while 49% were bearish. This net bearish reading is one of the highest in two years and suggests, from a contrarian standpoint, a short-term market bottom.

But what separates a normal, healthy market from the environment we’re now entering on a longer term basis is that the rallies will likely not be sustainable beyond a few weeks. The main trend for 2013, in contrast to the past year, will likely be down. This is especially true with the final “hard down” phase of the 40-year and 60-year Kress cycles upon us in 2013 and 2014.

Gold ETF

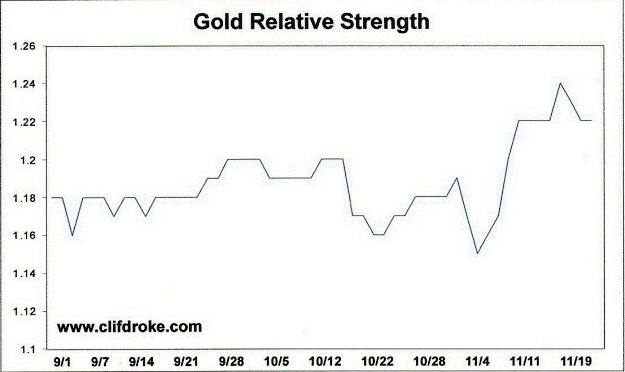

Our preferred gold ETF, the iShares Gold Trust (IAU), hasn’t yet confirmed a buy signal according to the rules of our trading discipline, but it has begun to show significant relative strength. Consider the following graph which shows the meaningful spike in the gold ETF’s relative strength in just the last few days. In most cases, a spike in the relative strength line precedes an upside move in the IAU. Accordingly we should soon have a confirmed immediate-term buy signal for the gold ETF.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

2013: A Look Ahead

Published 11/20/2012, 04:31 PM

Updated 07/09/2023, 06:31 AM

2013: A Look Ahead

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.