- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Stock in Focus, Foodies Edition: McDonald’s

Welcome to the first blog post in a 5-piece series we fondly refer to as our “Foodies” Edition.

In this delicious take on fast food stocks, we’re going to focus on the 5 major stocks in the industry. YUMMY! Here you will find some juicy facts about the company, its stock, and what our analysts think about it. But be warned - you may end up hungry by the time you’re done reading this...

History of The World’s Most Famous Burger

When people hear the name “McDonald’s" (NYSE:MCD) - the first association is almost always “America” and it’s true - McDonald’s is as American as apple pie. The story of how a small family business became the world’s largest food empire is the embodiment of the American Dream. There’s a reason this fast-food joint became a $140 billion empire (at the time of writing), with branches in over 100 countries.

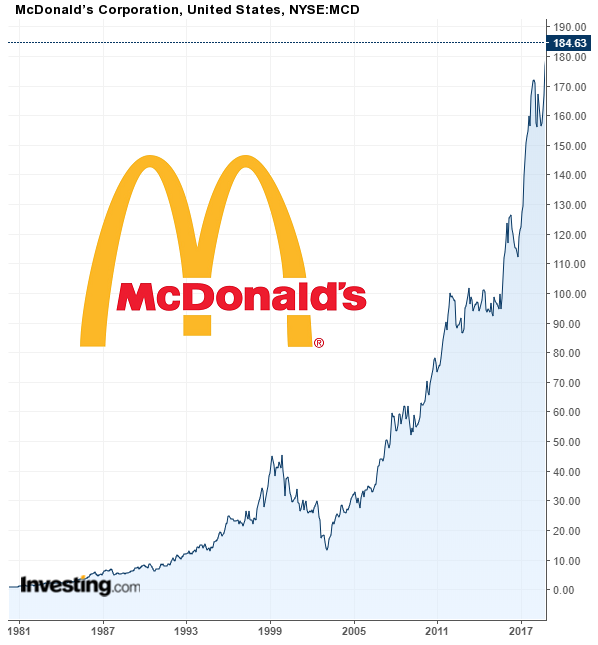

The original McDonald’s restaurant, established in 1940, was owned by the 2 McDonald brothers - Richard and Maurice McDonald. A traveling salesman named Ray Kroc saw the foot traffic the restaurant was getting thanks to their efficiency and pursued the brothers to become a co-owner and franchise the brand (in 2016 the story was dramatized in the movie The Founder). McDonald’s went public on the 21st of April, 1965. The local franchising was successful and in 1967 McDonald’s opened their first branch outside of the United States, in Canada. By the 1990’s you could find a McDonald’s in 58 other countries. If you were fortunate enough to snag 10 shares of McDonald’s on its initial public offering in 1965, the $225 you’d have spent would have meant that you now owned 7,430 shares thanks to stock splits, and at a current $183 per stock, this translates to nearly $1.36 million.

If you went and bought $1,000-worth of stock in 1970 at the then-price of $0.17 per stock, you’d have just over $1 million. That’s not bad for a company that sells hamburgers!

How McDonald’s Turned a Crash into a Meteoric Rise

Despite being such a huge organization, even the all-mighty Mickey-D had hard times, and much more recently than you’d think: At the beginning of 2000, the McDonald’s stock started to sink as the company saw its revenues dropping for several consecutive years.

Between 2000 and 2003 the company’s value dropped by more than 70% from a peak of $43.62 to $12.12 at its lowest. The continued portrayal of its food as fatty and unhealthy has pushed away many customers, culminating in 2002, when the company reported not decreased profits, but rather its first losses ever. However, McDonald’s response was nothing less than professional and on-point! They made changes to the menu, adding healthier options, adjusting existing items to catch up with changing flavor demands, and by April 2003 stock prices started climbing again, gaining more and more momentum.

McDonald’s are Localization Experts

One of the main reasons for McDonald’s international success is the ability to adjust to local markets by changing their menus and offering unique items and local spins on existing items; In Egypt, you’ll be able to find the McFalafel - deep-fried balls of ground and seasoned chickpeas. In India, there are some very-spicy options, such as the Chicken Maharaja Mac, which comes with habanero sauce. These are just a couple of examples of the uncommon menu items one can find around the world.

The McFacts

Beyond the Burger - McDonald’s as an Investment

When it comes to investing in McDonald’s, there are good reasons it can be a good decision. According to analyst Haris Anwar, investing in McDonald’s has several benefits. For starters, dividends - McDonald’s started paying dividends in 1976 and has raised its payout every year. Investors can create a steady stream of passive income, for years to come, if past performance is an indicator.

Another advantage McDonald’s has is its competitive edge, meaning very few companies in the US can beat it. For example, in 2017, McDonald’s made $91 billion in sales, more than twice that of KFC – its closest competitor.

Additionally, McDonald’s has huge upside potential. At the time of writing, most analysts have a very bullish view on the company, predicting an 11% upside in the stock value in the next year.

What are your predictions for McDonald’s? Tell us in the comments.

Disclaimer: This post should not be considered an endorsement, nor investment advice. Do your due diligence before investing in any particular asset or asset class.

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.