- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Poll: U.S. Investors Believe COVID-19 Crash Will Be Worse Than 2008 But with More Opportunities

One of the various expressions which has found new meaning amid the COVID-19 pandemic is Albert Einstein’s famed quote, “In the midst of every crisis, lies great opportunity.” Among the natural human reactions to this unprecedented public health crisis is to desperately search for to a silver lining — some kind of opportunity.

Accordingly, as global financial markets continue to crash with no end in sight over coronavirus concerns, are investors seeing the glass half empty or half full? The answer is a mixture of both, according to a new survey of nearly 1,700 U.S.-based investors from Investing.com’s global financial markets platform.

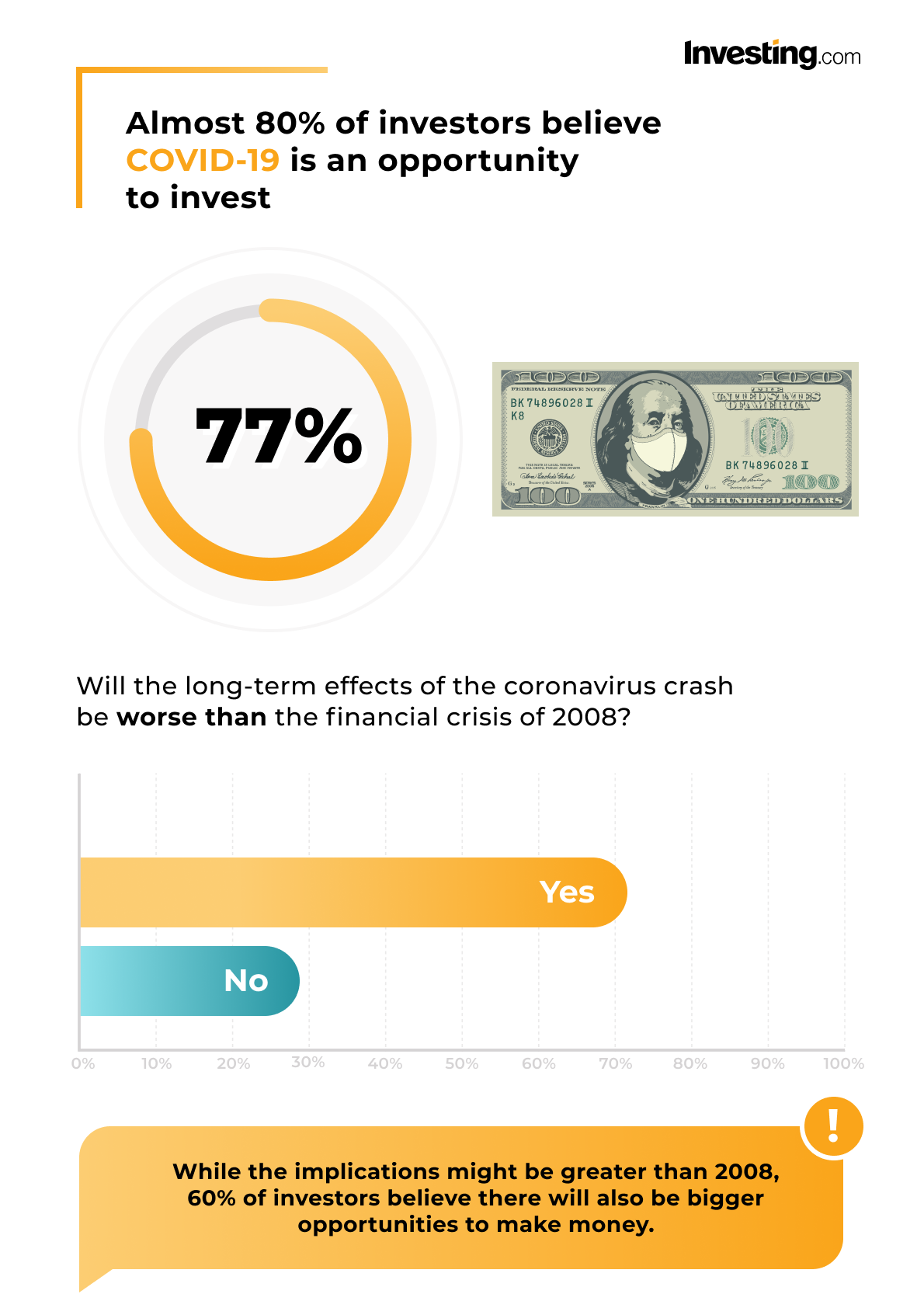

Asked if the long-term effects of the COVID-19 crash will be worse than the impact of the 2008 financial crisis, more than 70% of Investing.com users responded “yes.” But the majority of those respondents (60%) also believe it will provide an even bigger opportunity for investors.

When to invest?

Delving deeper into the nature of the current opportunity, more than three-quarters (77%) of our American users believe that now is an opportunity to invest. Additionally, almost 70% are holding onto their investments despite the turbulent times.

“The coronavirus crisis has already cost the U.S. economy 22 million jobs and counting, far dwarfing the total number of jobs lost during the 2008 financial crisis,” said Jesse Cohen, senior markets analyst at Investing.com. “With the economy likely already in a recession, investors should be prepared to take advantage of the opportunities presented by volatile trading conditions. Like the old adage says, panic when everyone is greedy, but be greedy when everyone panics,” he continued.

Exactly how bad is this?

But make no mistake — although a strong majority of Investing.com users are exercising patience rather than swiftly pulling out of the market, they are not downplaying the severity of this crisis. More than 80% of respondents believe we are headed for a global recession.

Goldman Sachs (NYSE:GS) recently cut its US economic forecast and is now expecting gross domestic product to decline by 24% in the second quarter of 2020 due to the coronavirus pandemic. US investors were slightly more optimistic with almost 60% believing it will be decline less than 20%.

Continuing on a positive note, over 55% of investors believe the economy will fully recover a year from now, with 32% believing it will do so before the end of 2020. Just 4% of investors believe the economy will never fully recover.

“The massive stimulus packages from both the Federal Reserve and Washington should be enough to cushion the economy from the worst of the Covid-19 crisis. The key to how fast and how soon we bounce back depends on how much longer the economy will remain shut,” Cohen said, referring to the restrictive measures imposed to contain the spread of the virus.

Investor priorities

As the U.S. experiences one of its biggest public health challenges in recent times worries over financial markets have people throughout the country equally worried, with over 40% of investors more concerned about their finances than their health.

It has been well-documented that older adults and people with underlying health conditions are being hit hardest by COVID-19. When looking into how age plays a factor in the priorities of investors, the data paints a clear picture with those 40 years-old and above generally more concerned about their health, while investors in their 30’s and 20’s more concerned with their financial well-being.

What does it mean for Trump?

As the pandemic has coincided with an election year, many are wondering how President Donald Trump’s handling of the crisis will affect his chances of securing a second term in office. Almost 40% of our users agree that Trump’s coronavirus response will ultimately cost him the 2020 election in November.

“Regardless of what some may think of President Trump’s handling of the Covid-19 health crisis, there is no argument that many of the decisions and policies he has taken have been motivated by getting the economy back on track as fast as possible,” Cohen said. “Love him or hate him, I think he has a good chance of being reelected all things considered.”

Republicans have a relatively high approval of Trump’s handling of the coronavirus outbreak, with a resounding 87% not foreseeing any problems for the President in this year’s election as a result. On the other hand, 73% of Democrats believe the President’s performance over the past few months will be his downfall in November.

Which companies will generate greater interest?

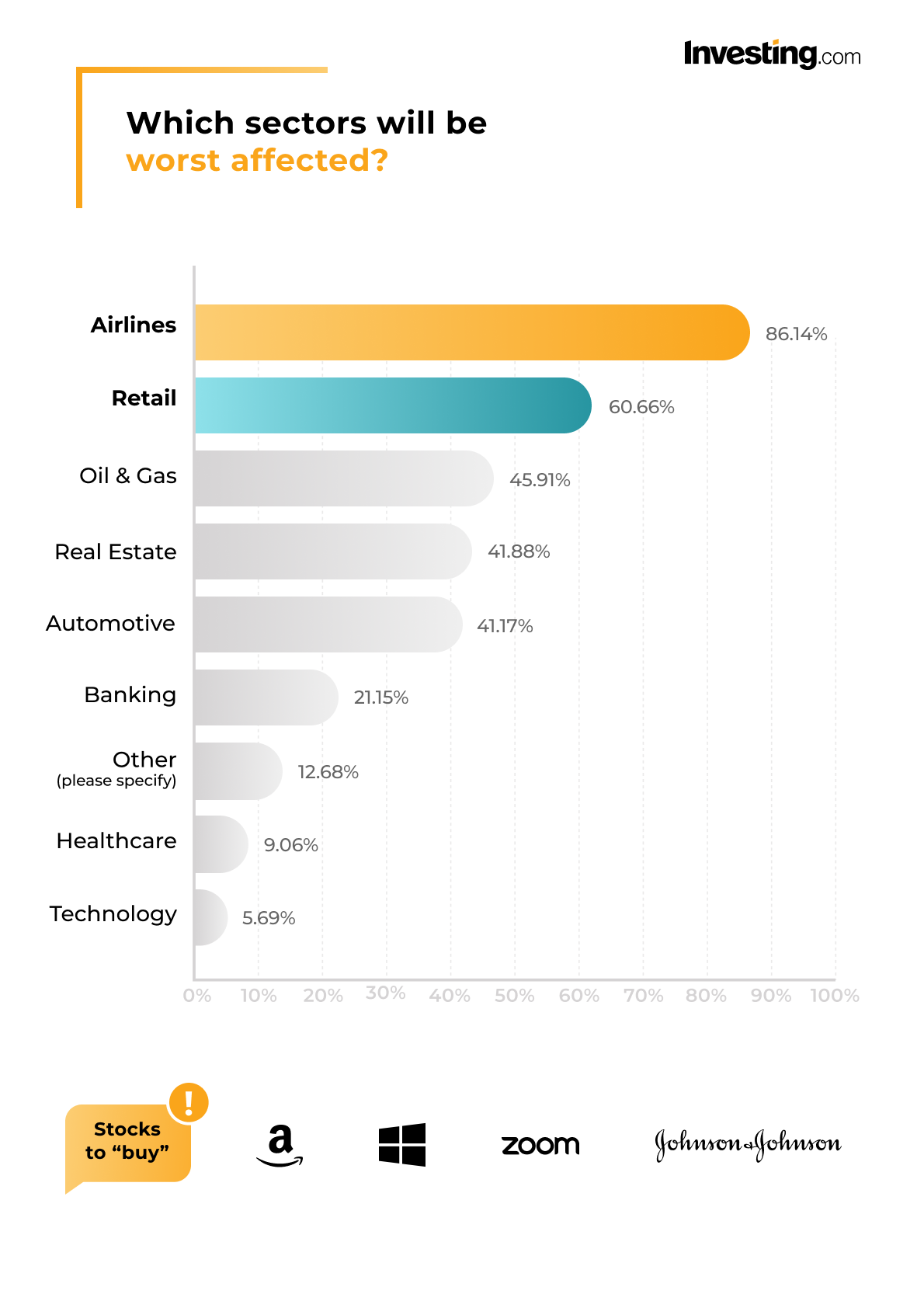

Coronavirus isn’t necessarily “bad news” for everyone, particularly for the companies whose products and services will attract unprecedented interest because they play key roles in resolving or mitigating the crisis. Asked which companies they anticipate will generate greater interest amid the crisis, Investing.com users’ most common answers were Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), Zoom and Johnson & Johnson. From a broader perspective, respondents identified the biotech, pharmaceutical, and technology sectors as the industries which stand to generate the most interest.

“Of course, the outbreak will create a number of short-term winners, primarily among companies whose products and services benefit from stay-at-home measures as well as protective-equipment manufacturers, and losers, such as travel-related stocks, including airlines, cruise operators, casinos and hotels,” Cohen said.

What is the bottom line?

The tremendous uncertainty of this moment — including in the global financial markets — creates more questions than answers. But our survey results indicate that while investors are acknowledging the severity of the coronavirus crisis, they are also behaving in a measured manner when it comes to their portfolio, mostly avoiding full pullouts from the stock market and viewing the current instability as a long-term investment opportunity. In other words, Einstein’s expression is holding true, at least for now.

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.