Market Brief

Yesterday, the lack of progress in Greek negotiations to unlock the remaining €7.2bn of bailout funds triggered a sell-off in most equity markets. European shares were broadly lower with STOXX losing -0.41%, DAX -0.62%, IBEX 35 -0.71% and ASE -1.78%. Only the FTSE 100 managed to stay into positive territory with a modest +0.15%. US equity markets also suffered from stalled negotiations with the S&P 500 retreating -0.74%, the Dow Jones -0.98%. Even the NASDAQ, which printed an all-time record at 5,164, couldn’t resist ending red with a drop of -0.98%.

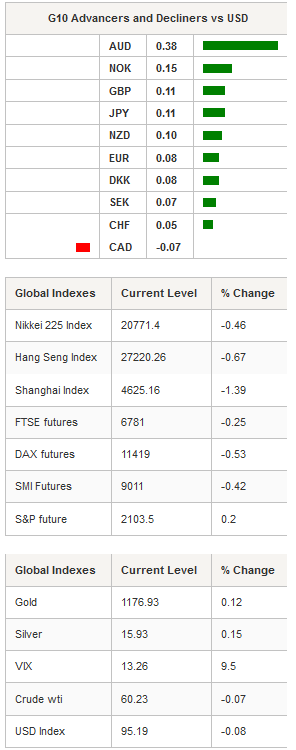

Obviously, Asian equity markets are following the downward trend this morning with almost all regional markets trading into negative territory. Chinese mainland shares suffer the most with the Shanghai Composite down -1.39% while its tech-heavy counterpart, the Shenzhen Composite, takes the biggest hit and loses -1.44%. Japan’s Nikkei 225 retreats -0.46% to 20,771 while Australian shares are down -0.95%.

In the forex market, EUR/USD was treading water yesterday and remained in the tight range between 1.1155 and 1.1235 as traders remained on the sidelines, waiting to get more clarity on Brussels’ talks. Across the channel, GBP/USD is still in correction mode and is finally affected by Greek concerns. However, it is worth mentioning that the UK’s EU membership upcoming referendum offers protection to the pound sterling against the EU’s uncertainties. EUR/GBP retreats 3.5% since June 9. A strong support stands at 0.7014 (low from March 11) while the euro will need a positive resolution to break the 0.7220 resistance to the upside.

Yesterday in the US, the third estimate of Q1 GDP came in at -0.2%q/q saar, in line with expectations. As mentioned above, EUR/USD didn’t react to the news. US sovereign yields suffered a small correction yesterday with the yield on US government 2-Year bond dropping 4bps after a 4-day winning streak, falling from 0.71% to 0.67%. The move was more contain in German yields.

In Europe, equity futures are lower this morning. The Footsie is down -0.25%, DAX -0.53%, SMI -0.42% and CAC -0.64%. EUR/CHF is trading slightly higher since yesterday at 1.047. However, in the medium-term, the euro is slowly sliding lower, down 1% since early June. USD/CHF is going nowhere in the long-term, trading range-bound between 0.9052 and 0.9463 (Fib 61.8% and 38.2% on Jan-March rally). The dollar is currently moving in the upper part of its range at 0.9338.

In Brazil, May unemployment rate is expected to rise to 6.6% from 6.4% in April while May Tax collection will be released at 1pm GMT. In the US, May Personal Income and Spending will be released today and are expected at 0.5% and 0.7% respectively while May PCE deflator should print at 0.2%y/y versus 0.1% prior read. Its core counterpart is expected stable at 1.2%y/y. Finally, we’ll get June Markit preliminary Composite and Service PMI later in the afternoon. As usual, Greek situation will remain under the spotlight.

Today's CalendarEstimatesPreviousCountry / GMT SP May PPI MoM - 0.40% EUR / 07:00 SP May PPI YoY - -1.00% EUR / 07:00 EC ECB's Nouy Speaks at European Parliament in Brussels - - EUR / 07:00 IT Bank of Italy Governor Visco Speaks at Event in Rome - - EUR / 07:00 TU Bloomberg June Turkey Economic Survey - - TRY / 07:30 SW May PPI MoM - -0.30% SEK / 07:30 SW May PPI YoY - 2.40% SEK / 07:30 BZ Jun 22 FIPE CPI - Weekly 0.51% 0.54% BRL / 08:00 EC ECB's Costa, Brazil's Tombini at Meeting of Central Banks - - EUR / 08:00 SZ SNB President Thomas Jordan Speaks in Lausanne - - CHF / 08:00 EC ECB's Smets Presents Financial Stability Report in Brussels - - EUR / 09:00 SA May PPI MoM 0.50% 0.90% ZAR / 09:30 SA May PPI YoY 3.30% 3.00% ZAR / 09:30 UK Jun CBI Reported Sales 35 51 GBP / 10:00 BZ May Unemployment Rate 6.60% 6.40% BRL / 12:00 US Fed's Tarullo Talks About Economy and Regulation in New York - - USD / 12:00 US May Personal Income 0.50% 0.40% USD / 12:30 US May Personal Spending 0.70% 0.00% USD / 12:30 US May Real Personal Spending 0.50% 0.00% USD / 12:30 US May PCE Deflator MoM 0.30% 0.00% USD / 12:30 US May PCE Deflator YoY 0.20% 0.10% USD / 12:30 US May PCE Core MoM 0.10% 0.10% USD / 12:30 US May PCE Core YoY 1.20% 1.20% USD / 12:30 US Jun 20 Initial Jobless Claims 273K 267K USD / 12:30 US Jun 13 Continuing Claims 2218K 2222K USD / 12:30 BZ May Tax Collections 93050M 109241M BRL / 13:00 US Jun P Markit US Composite PMI - 56 USD / 13:45 US Jun P Markit US Services PMI 56.5 56.2 USD / 13:45 US Jun 21 Bloomberg Consumer Comfort - 40.9 USD / 13:45 US Fed's Powell Speaks on Payment Systems in Kansas City - - USD / 13:45 BZ Bloomberg June Brazil Economic Survey - - BRL / 14:00 US Jun Kansas City Fed Manf. Activity -9 -13 USD / 15:00 BZ May Central Govt Budget Balance - 10.1B BRL / 19:30 IN May Eight Infrastructure Industries - -0.40% INR / 22:00 EC ECB Speakers at 2015 IIF Europe Summit in Frankfurt - - EUR / 22:00

Currency Tech

EURUSD

R 2: 1.1679

R 1: 1.1459

CURRENT: 1.1214

S 1: 1.1151

S 2: 1.0868

GBPUSD

R 2: 1.6525

R 1: 1.6183

CURRENT: 1.5717

S 1: 1.5681

S 2: 1.5422

USDJPY

R 2: 125.86

R 1: 124.68

CURRENT: 123.70

S 1: 122.46

S 2: 118.33

USDCHF

R 2: 0.9503

R 1: 0.9408

CURRENT: 0.9333

S 1: 0.9072

S 2: 0.8986