The last job report from the US did not bring us more than a bumpy ride in the FX market last Friday. The non-farm payrolls printed well below expectations at 173k in August versus 217k median forecast. On the other hand, July’s figures were revised substantially higher, from 215k to 245k. On the bright side, unemployment rate fell to its lowest level since April 2008 while underemployment rate dipped to 10.3% from 10.4% a month earlier. Wage pressure remained subdued as average hourly earnings grew 0.3%m/m versus 0.2% in July. Overall, the report was a major disappointment as it did not provide any clue regarding the Fed’s next move and especially since it represents the last key economic indicator the Fed will have in the end before the September 16-17 FOMC meeting. Looking at USD’s price action, no clear trend as emerged. EUR/USD is roughly trading at its’ pre-NFP level around 1.1130, slightly below the 1.1155 level (Fib 61.8% on July-August rally). The dollar index moved sideways in the Asian session around 96.30.

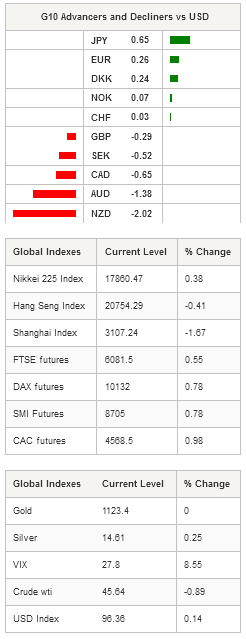

In Asia, regional equity markets are mixed this morning as traders remained cautions after Friday’s NFPs. After a 4-day holiday, Chinese mainland shares are broadly trading in negative territory, with the Shanghai Composite retreating 1.67% and the Shenzhen Composite edging higher by 0.33% as Beijing revised its 2014 GDP figure from 7.4% to 7.3%. However, the Chinese weakness is relatively contained, as Japanese stocks managed to stay in positive ground as the Nikkei gained 0.38% and the Topix 0.08%. However, Hong Kong’s Hang Seng is down 0.41%, while the highly China-sensitive Australian stocks are down 0.20%.

In the FX market, USD/JPY has been proven unable to break the strong 118.33-90 support (April-May lows) and moved therefore slightly higher in the Asian session. After having successfully validated a break of the support standing at 0.7016, AUD/USD is taking a breather above 0.69. However, we believe the Aussie’s depreciation will continue as China’s growth will remain of significant worries, with the $0.6778 level as next target.

In Europe, equity futures are in green this morning despite mixed signals from Asia. The German DAX adds 0.78%, the CAC 40 0.98%, the SMI 0.78%, the Footsie 0.55% and the Euro Stoxx 50 0.85%. In the wake of US job report, USD/CHF is moving higher this morning, lacking bearish trend.

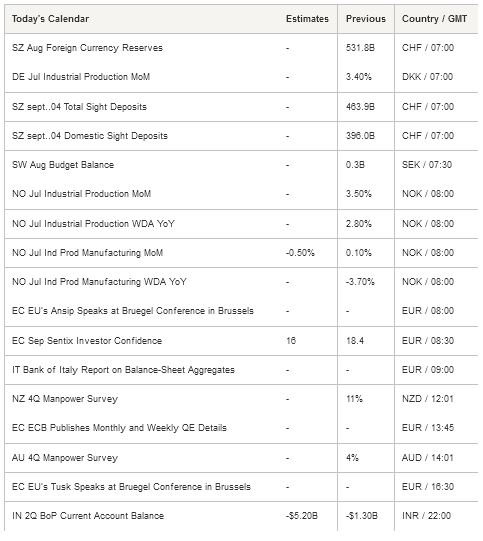

Given today’s light economic calendar and the fact that the US are closed due to labour day, we do not expect much action today. Today traders will be watching industrial production from Norway (3.5%m/m previous month), budget balance from Sweden (0.3bn in July) while the ECB will release the monthly and weekly details the quantitative easing program.

Currency Tech EUR/USD

R 2: 1.1871

R 1: 1.1714

CURRENT: 1.1150

S 1: 1.1017

S 2: 1.0809

GBP/USD

R 2: 1.5626

R 1: 1.5443

CURRENT: 1.5223

S 1: 1.5089

S 2: 1.4960

USD/JPY

R 2: 125.86

R 1: 120.40

CURRENT: 119.29

S 1: 116.18

S 2: 115.57

USD/CHF

R 2: 1.0240

R 1: 0.9903

CURRENT: 0.9730

S 1: 0.9513

S 2: 0.9259