By Stephanie Kelly and Leah Douglas

(Reuters) -The Biden administration said on Friday it will recognize a methodology favored by the ethanol industry in guidance to companies looking to claim tax credits for sustainable aviation fuel (SAF), a pivotal win for the politically powerful U.S. corn lobby.

But the administration will also update the methodology by March 1, which leaves some uncertainty for corn-based ethanol producers, as it could ultimately tighten requirements around SAF feedstocks.

The global aviation industry, which is expected to reap net profits of over $20 billion in 2023 and accounts for about 2% of global energy-related carbon dioxide emissions, is one of the hardest sectors to decarbonize, as the equipment is not easy to electrify. Airlines argue that incentives are needed to boost the market for SAF, which can generate 50% less greenhouse gas emissions over its lifecycle than petroleum fuel, but is typically two to three times more expensive than fossil-fuel-based jet fuel.

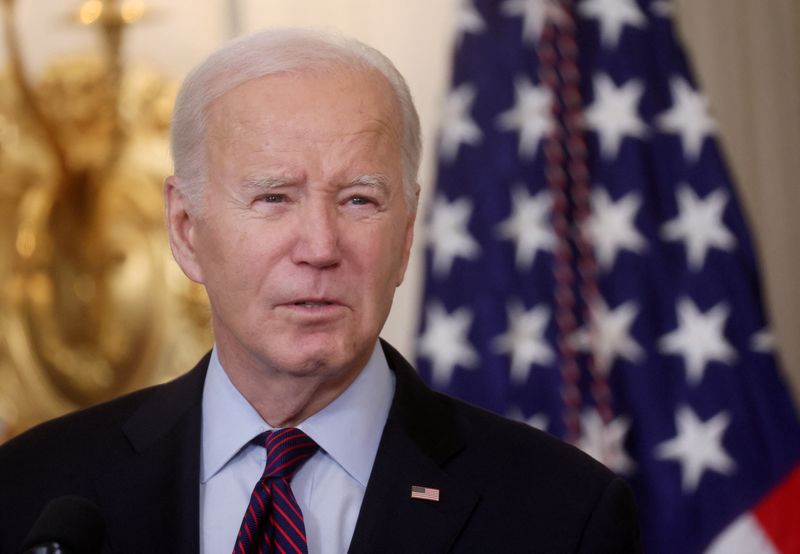

For months, the Biden administration has been divided over whether to recognize the Department of Energy's Greenhouse Gases, Regulated Emissions and Energy Use in Technologies (GREET) model. That model enables ethanol-based SAF to qualify for tax credits under the Inflation Reduction Act, President Joe Biden's signature climate law.

Ethanol producers and corn farmers in rural states such as Iowa and Illinois have been awaiting updates, as the industry sees SAF as one of the only routes to grow ethanol demand amid rising sales of electric vehicles.

Biden, a Democrat, is seeking re-election and will depend on votes from closely contested Midwestern states that are the heaviest corn producers.

The guidance was first reported by Reuters on Thursday.

While the guidance aims to reduce the price gap between SAF and traditional jet fuel, administration officials could not provide data to show the extent that the incentives would reduce price discrepancies between the fuels.

ETHANOL SEEKS ROLE IN SAF

Ethanol groups have lobbied the Biden administration fiercely to recognize the GREET model for IRA credits, battling environmentalists who want standards that elevate feedstocks like used cooking oil and animal fat instead.

Farmers, ranchers and producers have the capacity to provide feedstocks to help airlines and the transportation industry meet a potentially 36-billion-gallon market, said Agriculture Secretary Tom Vilsack on a call with reporters.

"Key to this was the Treasury recognizing and appreciating the importance of the GREET platform for providing a pathway for corn-based ethanol and [other] biobased fuels to qualify for significant tax credits that were included in the IRA," Vilsack said.

Still, the GREET model now will be updated to incorporate new data and modeling on emissions sources like land use change and livestock activity, as well as strategies producers can use to lower emissions like CCS, renewable natural gas, and climate-friendly farming practices, the Internal Revenue Service said on Friday.

The IRA currently requires SAF producers to assess emissions with a model backed by the International Civil Aviation Organization (ICAO) or a "similar methodology."

"The real question is, come March, will the GREET model be set up in a way that will effectuate the ICAO standards," said Mark Brownstein, senior vice president of energy transition at the Environmental Defense Fund.

Under the new changes, fuel produced in 2023 that meets the new GREET standards will be eligible for the credit, administration said on background during a call with reporters.

The Environmental Protection Agency and the Departments of Agriculture, Energy, and Transportation are working together on the scientific updates, an administration official told reporters on a Thursday press call.

Ethanol trade groups including the Renewable Fuels Association and Growth Energy cheered the news on Friday but said more information around the updated guidance was needed.

"New investments in SAF are highly dependent on the pending GREET modeling updates," said Growth Energy chief executive Emily Skor. "The industry needs more clarity around the proposed changes before we have certainty around market access.