NZD/USD: Short position closed

The open position for the NZD/USD has been closed on July 13 as a precaution. A profit has been made of 72 pips. The pair is still in a downtrend and had a strong pullback.

The NZD is the weakest currency, and the USD(7) is one of the strongest currencies after the GBP(8), which is at the moment the strongest currency. The pair is looking interesting again for taking positions.

AUD/CHF: Short

A position has been opened on July 7 for this pair at 0,7044. The AUD(2) is the weakest currency after the NZD(1), and the CHF has a currency score of 6 after the USD(7) and the GBP(8), which is the strongest currency at the moment. This pair was tipped last weekend for going short, and a detailed analysis about this pair can be read by clicking here.

GBP/CAD: Long

A position has been opened July 14 after close of US session on July 13. As already mentioned in my weekly strategy review of last weekend, this pair looks interesting. The pair is clearly in an uptrend and it is gaining momentum.

When trading with the CAD, I also check the Weekly crude oil chart, and this one is again picking up the downtrend after the pullback that started in February and March.

The GBP has a currency score of 8 and the CAD a score of 3. This makes the pair an interesting choice, besides the already very good technical analysis charts.

Possible positions for this week

All the pairs currently in the Top 10 look like a good opportunity, except for the EUR/AUD. When also looking at the Currency Score, all the pairs remain interesting. At the moment, the strategy has 2 positions open, which is the maximum default amount by preference. However, if a good opportunity comes around with currencies that are not yet traded in the other open pairs, it will be considered. The NZD/USD remains interesting and will be monitored in the coming week.

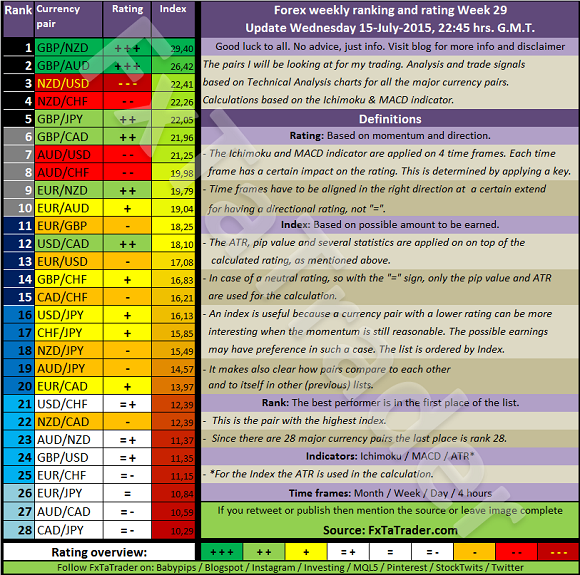

Weekly Ranking and Rating Week 29 / Update Wednesday, July 15th, 2015

Analysis based on TA charts for all the major currency pairs. Good luck to all. No advice, just info. Every week, the forex ranking rating list will be prepared in the weekend. All the relevant Time Frames will be analyzed and the ATR and Pip value will be set.

There will be 2 updates during the week on Tuesday and Wednesday. The Daily and 4 Hour chart will then be analyzed and updated.

This makes that there will be no more than 48 trading hours between each update. This is a reasonable period, when considering that the smallest time frame used is the 4 hours, meaning 12 price bars/candlesticks.

The forex ranking and rating list is meaningful data for my FxTaTrader strategy. Besides this list, I also use the Currency Score, which is also available once a week on my blog at FxTaTrader.com together with my weekly analysis on my Strategy.

DISCLAIMER: The articles are my personal opinion, not recommendations, FX trading is risky and not suitable for everyone.The content is for educational purposes only and is aimed solely for the use by ‘experienced’ traders in the FOREX market, as the contents are intended to be understood by professional users who are fully aware of the inherent risks in forex trading. The content is for 'Forex Trading Journal' purpose only. Nothing should be construed as recommendation to purchase any financial instruments.