The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Thursday uncertain.

- ES pivot 1934.42 Holding above is bullish.

- Friday bias uncertain technically.

- Monthly outlook: bias lower.

- Single stock trader: VZ not a swing trade buy.

Last week it took five big down days before we finally got a 50% replacement. On Wednesday it only took two down days before getting the same 50% retracement . I also note that we have now finally put in a higher low for the first time in a while. And this has changed the charts so let's get right to them and see where Thursday is going.

The technicals

The Dow: Wednesday was something of a conundrum for the Dow. On Tuesday we got a big drop that gave us a bearish trigger out of a rising RTC, but on Wednesday we retraced more than 50% of Tuesday's drop. On the other hand the indicators are still rising and nearly overbought now with the stochastic completely threaded out at a high level. All of this leaves the Dow in a delicate position. In fact I don't even want to call this for Thursday.

The VIX: Last night I let the indicators get the best of me when I refused to call the VIX lower on Wednesday. But as it turns out we are actually did get a completed bearish evening star on Wednesday. And that was enough to send the indicators all oversold and the stochastic is now curving around very close to making a bullish crossover. The VIX is also near support at 26 so while it's possible there's more downside left I think it's going to be limited.

Market index futures: Tonight, all three futures are just barely higher at 12:35 AM EDT with S&P 500 up 0.03%. On Wednesday ES retraced more than 50% of Tuesday's losses to form a classic bullish piercing pattern. The indicators continue to rise though are not yet overbought. However, the stochastic is now threaded out at a high level. And the new overnight seems to be forming a gravestone doji so any further advances from here might be problematic.

ES daily pivot: Tonight the ES daily pivot rises again from 1927.00 to 1934.42. That still leaves ES above its new pivot so this indicator remains bullish..

Dollar index: Last night the dollar looked for all the world like it was going lower on Wednesday. But I didn't count on the considerable support it found at its 200 day MA. The result was a big 0.42% gain on Wednesday with a small gap-up green candle that also sent the indicators quite over bought. The stochastic like on many other charts is also threaded out here at a high level so this chart is also really too difficult for me to call tonight.

Euro: At least I had the sense not to try to call the euro last night. In the end the dark cloud cover prevailed, and the euro was unable to break up through its 200-day MA. On Wednesday if fell right back down to 1.1240 and the new overnight is continuing lower which has the indicators now oversold and the stochastic just about to form a bullish crossover. So with the euro now near recent support I think now it might stand a good chance of moving higher on Thursday.

Transportation: Then on Wednesday the Trans retraced almost all of Tuesday's losses with a tall green marubozu. That let the indicators continue rising and also threaded out the stochastic at a high level. And that leaves this chart in an indeterminate state so there's really no calling it tonight.

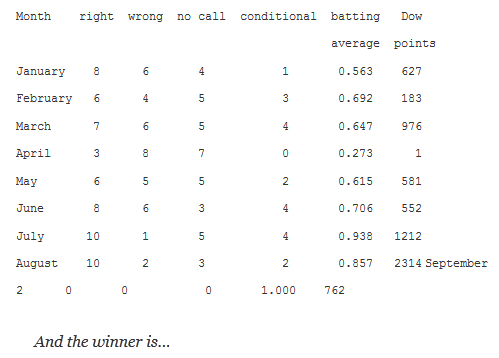

Accuracy:

The charts are playing it coy tonight. We're getting a few reversal signs in terms of the stochastic but they're not quite fully formed. And the futures aren't as much help tonight as they've been recently. The market seems to be looking for direction right now, waiting perhaps for the next shocker out of China or something. So in the absence of a clear reading I'm just going to call Thursday uncertain.

Single Stock Trader

Last night I wasn't ready to call Verizon (NYSE:VZ) higher but it did manage to gain a bit on Wednesday, swept along with the rest of the Dow. But it did it on a classic red hanging man. And the stochastic has now just completed a bearish crossover, so once again I can't call this chart higher on Thursday.